The global stock market delivered poor returns in 2022. US stocks performed particularly badly. Excluding dividends, the S&P 500 declined 19.4%, and the Nasdaq 100 fared worse, plummeting 33%. UK shares proved to be better investments. The FTSE 100 eked out a 0.9% gain, although the mid-cap FTSE 250 index struggled, falling 19.7%.

However, some bearish analysts contend we haven’t seen capitulation yet — often seen to be the final stage of bear market grief. British investor Jeremy Grantham has predicted the S&P 500 could fall 50% in a worst-case scenario.

So, how likely is a 2023 stock market crash? Here’s my take.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

The bear case

Rising interest rates, stubborn inflation, and economic slowdowns. It seems there’s no end to the list of reasons to be bearish.

American investors might point to a 10-year price-to-earnings ratio of 29.3 for the S&P 500 — this is 45% above the index’s modern-era average. Using this benchmark alone, US stocks look pricey despite substantial falls.

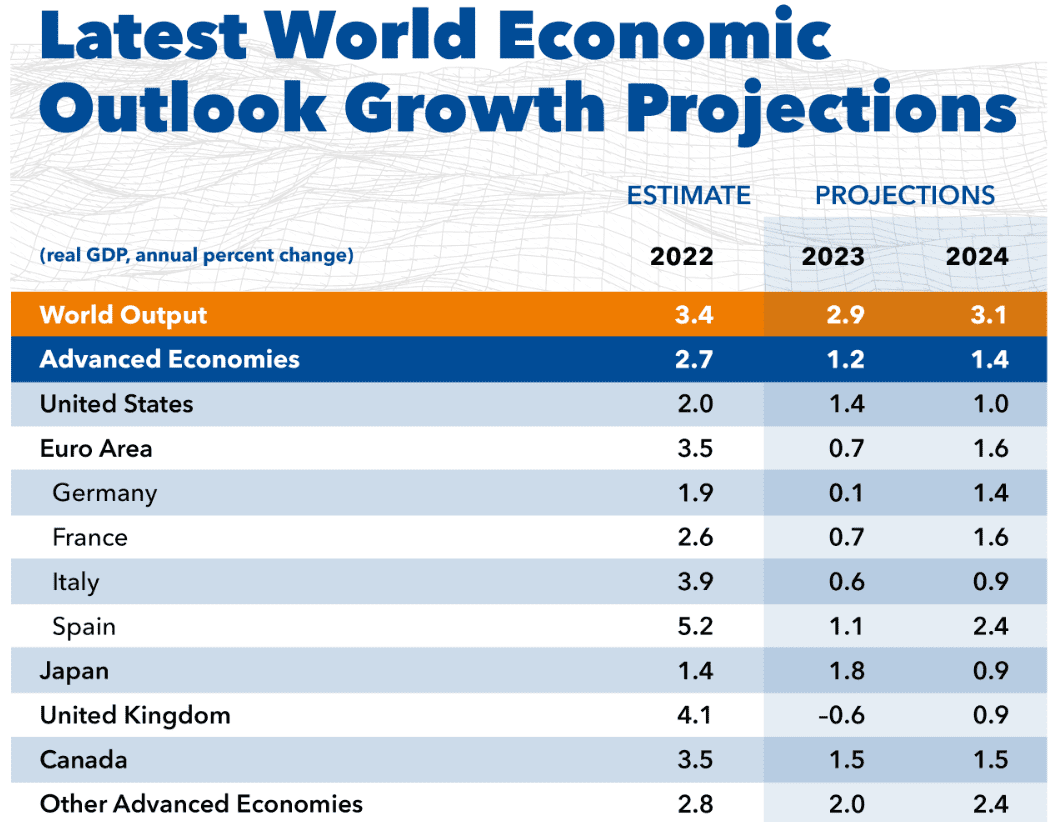

Closer to home, IMF predictions suggest a grim outlook for UK stocks. While many advanced economies received slight upgrades in their growth prospects, Britain languishes at the bottom of the IMF forecast — behind Germany and even sanctions-hit Russia. It’s the only G7 nation tipped to fall into recession this year.

The outlook for European shares is clouded by the war in Ukraine. In addition, January’s Spanish inflation data was hotter than expected. Consumer prices advanced 5.8% year-on-year, up from 5.5% the previous month. This could indicate that the ECB might need to be resolutely hawkish if similar numbers emerge across the eurozone.

The bull case

On the other hand, stocks are often forward-looking. Stock market pricing can be seen as the aggregate of investors’ opinions about how companies will perform in the future. By the time some investors are accounting for today’s economic conditions, Mr Market already has one eye on the future.

Share prices have historically enjoyed a long-term upward trend as innovation and other drivers of economic growth boost companies’ profitability. Taking one example, the AI revolution is well underway. OpenAI’s tool, ChatGPT, has attracted significant attention.

Indeed, Microsoft recently announced a $10bn investment in the start-up. Who knows what technological developments 2023 could bring, but major breakthroughs might be good news for equities.

What’s more, it’s easy to be too pessimistic about the future. Inflation rates could cool, economic growth could beat expectations, and the war in Ukraine could end sooner than anticipated. Any one of these eventualities would be a tailwind for stock market growth.

How I’m investing in the stock market this year

I expect volatility in 2023. Trying to predict a stock market crash is arguably a fool’s game, but it reminds me of the old adage: time in the market beats timing the market.

I’ll still invest in stocks this year, albeit cautiously. By diversifying my holdings across sectors and keeping enough spare cash on hand to buy any big dips, I hope I can ride out severe volatility.

Plus, I invest for the long term. I’m more concerned about where stocks will be in 2033 than 2023, so unless we’re headed for another great depression, I think the long-term outlook remains bright.