The International Consolidated Airlines Group (LSE:IAG) share price looks ultra cheap. It’s so cheap, in fact, that a case could be made that it’s the FTSE 100’s best low-cost dividend share.

The British Airways owner has soared 35% in value since the start of 2023. This has been driven by loosened Covid-19 rules in China that could reignite the country’s travel industry.

Yet despite this rise, IAG’s shares still carry a rock-bottom valuation. City analysts think the aviation giant’s earnings will soar 177% this year. That results in a price-to-earnings growth (PEG) ratio of just 0.1.

Any reading below one indicates that a stock is trading below value.

Dividend growth

You may be asking why IAG’s being discussed in a piece about dividend shares. The company hasn’t dished out cash rewards to its shareholders since 2018.

What’s more, companies with high debts like this are usually anathema to income investors. Net debts at IAG have fallen sharply as its planes have returned to the skies. These dropped by €609m during the nine months to September. But it still had a whopping €11.1bn worth of debt as of four months ago.

Despite this, brokers think the business will resurrect its dividend policy this year and raise payouts strongly as earnings rebound.

Payouts of around 1.9 euro cents and 3.6 cents per share are forecast for 2023 and 2024 respectively. These projections yield 1% and 1.8%.

However…

Okay, these dividends aren’t the biggest. But they could be the first step on the path to strong and sustained growth over the next decade.

And what’s more, these projections are covered between 7.5 times and 8.3 times by anticipated earnings. This provides an extremely wide margin of safety.

However, IAG still faces big obstacles that could scupper these bright dividend growth forecasts. And I’m not just talking about its colossal debts.

BIG risks

As IAG’s share price surge illustrates, the scrapping of mandatory quarantine for arrivals in China could turbocharge profits over the short term. The Asian country was the world’s largest outbound travel market before the pandemic.

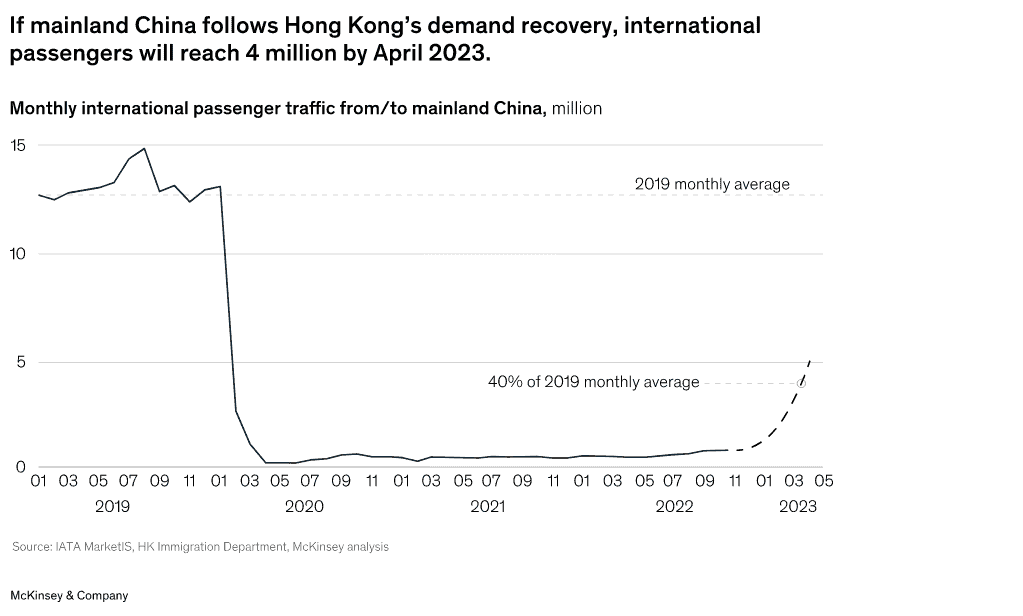

And as the graph from McKinsey & Company below shows, forecasters believe passenger numbers could soar if they rise at the same pace as in Hong Kong. Quarantine rules there were dropped in September.

However, hopes of a sustained recovery in the airline industry are still plagued with danger. A sharp uptick of Covid-19 cases in China could result in fresh quarantine rules. And ticket sales in other regions could lump as the global economy splutters.

Derren Nathan, head of equity research at Hargreaves Lansdown, has suggested that “as the cost-of-living crisis intensifies in many key markets, holidays are set to drop off the essentials list and so we are cautious about next year.”

Profits at IAG could also be threatened by rising costs. The short-term outlook for oil prices remains highly unpredictable as the Ukraine war continues. Airlines are also battling against a tight labour market and wage costs could keep climbing as well.

The IAG share price is cheap on paper. But its high debts and uncertain revenues outlook mean I’d still rather buy other UK dividend shares.