Having started the year on the front foot, easyJet (LSE:EZJ) shares soared after yesterday’s excellent Q1 trading update. As a result, the stock is now up 55% in less than a month. Even so, I still don’t think it’s too late for me to buy.

Thrusting higher

Based on current high levels of demand and strong bookings, easyJet anticipates beating the current market profit expectations for FY23.

easyJet CEO Johan Lundgren

That was enough to send the share price flying 10%. The company reported one of the best trading updates I’ve seen anywhere in the last two years, and even beat some of its initial guidance.

Should you invest £1,000 in Supermarket Income Reit Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Supermarket Income Reit Plc made the list?

| Metrics | Q1 2023 | Q1 2022 | Change |

|---|---|---|---|

| Passengers flown | 17.5m | 11.9m | 47% |

| Load factor | 87% | 77% | 10% |

| Capacity (seats flown) | 20.2m | 15.5m | 30% |

| Peak operating aircraft | 313 | 231 | 35% |

The airline impressed on the financial front too. Revenue per seat, Ancillary, and Holidays revenues all beat initial expectations. This now extends its streak of positive EBITDAR to three consecutive quarters.

| Metrics | Q1 2023 | Q1 2022 | Change |

|---|---|---|---|

| Passenger revenue | £975m | £547m | 78% |

| Ancillary revenue | £406m | £230m | 77% |

| Holidays revenue | £93m | £28m | 232% |

| Total revenue | £1.47bn | £0.81bn | 83% |

| Headline EBITDAR | £42m | -£42m | 200% |

| Profit before tax (PBT) | -£133m | -£213m | 38% |

Consequently, the board upgraded the outlook. It’s now expecting both half-year and full-year PBT to be “significantly better” than analysts’ consensus.

Not at cruising altitude yet

easyJet still has a long way to go to fulfil its potential, and that’s down to its new Holidays business. Due to growing demand for its package service, management is now anticipating a total of 1.52m customers by the end of the year, compared to the previously guided 1.43m.

Additionally, CEO Johan Lundgren reported excellent bookings momentum. Those Holidays packages are 60% booked for the summer, and there’s already a 24% increase in flight bookings for Q3 compared to pre-pandemic levels.

Moreover, the launch of 11 new routes to popular destinations like Paris, Naples, and Amsterdam should encourage higher passenger numbers. Combine that with the arrival of 75 more fuel-efficient Airbus A320/1 NEOs by the end of 2023, and I’m expecting some bottom line improvement as well.

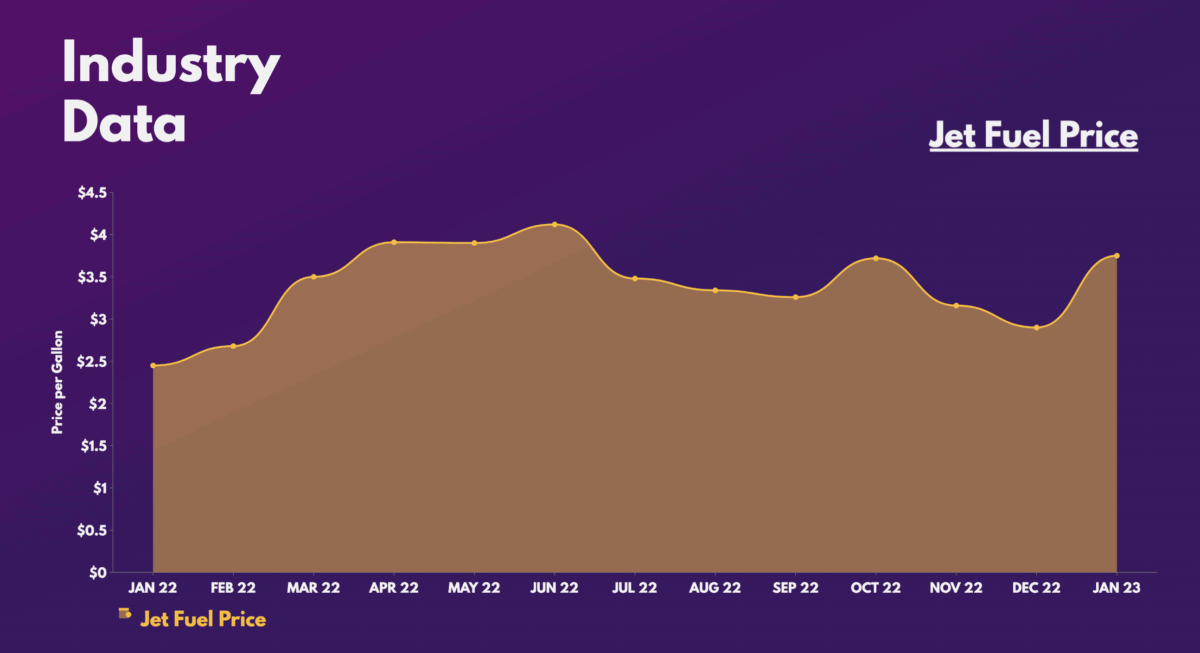

The route to cruising altitude isn’t without turbulence though. Fuel prices remain at elevated levels and are eating away at margins. In fact, fuel costs per seat rose by another 18% last quarter. In response, the group increased the amount of fuel it’s hedging, as spot prices saw a $100 increases per MT since last quarter.

No longer budget-friendly?

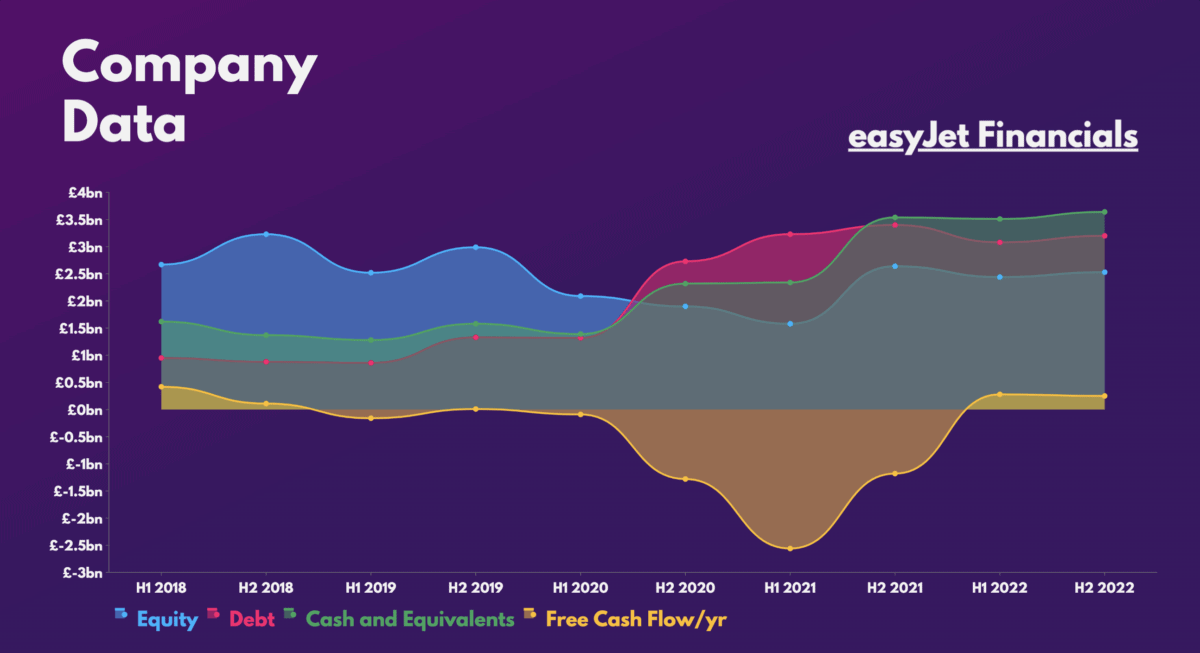

Nonetheless, I’m still a big fan of the budget airline’s balance sheet, which is one of the best in the industry. The conglomerate even reported an improvement to its financials last quarter, as net debt decreased by £0.1bn.

Having said that, are easyJet shares still cheap? Well, considering its lagging valuation multiples, one could argue that it is.

| Metrics | Valuation multiples | Industry average |

|---|---|---|

| Price-to-sales (P/S) ratio | 0.7 | 0.9 |

| Price-to-book (P/B) ratio | 1.7 | 1.8 |

| Enterprise value-to-EBITDA | 7.0 | 11.0 |

However, when considering its forward multiples, the shares start to look a little more expensive. My current model translates a conservative earnings per share (EPS) figure of £0.17 to a forward P/E of 30.3 at its current share price. This is much higher than easyJet’s long-term average P/E of 18.

| Projected metrics | 1-year forecast |

|---|---|

| Net income | £130m |

| Common shares | 758m |

| EPS | (130m 758m) = £0.17 758m) = £0.17 |

| Current share price | £5.15 |

| Forward P/E | (£5.15 0.17) = 30.3 0.17) = 30.3 |

But for FY24, assuming it achieves a consensus EPS of £0.35, the two-year forward P/E comes down to 14.7. Although not the cheapest, it’s still a buy for me, given its long-term upside. After all, brokers Liberium and Deutsche are bullish on European airlines due to a “strong pricing environment”. For those reasons, I’ll be buying more easyJet shares before they potentially get even more expensive.

| Projected metrics | 2-year forecast |

|---|---|

| EPS | £0.35 |

| Current share price | £5.15 |

| 2-year forward P/E | (£5.15 0.35) = 14.7 0.35) = 14.7 |