The Alternative Investment Market (AIM) is a sub-market of London’s main stock exchange. The index is host to many small-cap constituents with high growth prospects. So, here are two penny stocks I’ve got on my watchlist that I think have the potential to grow my money exponentially.

1. Hotel Chocolat

After its share price dropped by as much as 75% last year, Hotel Chocolat (LSE:HOTC) shares may seem like an odd pick, especially with a recession on the cards. However, I think there are key catalysts that bears have discounted.

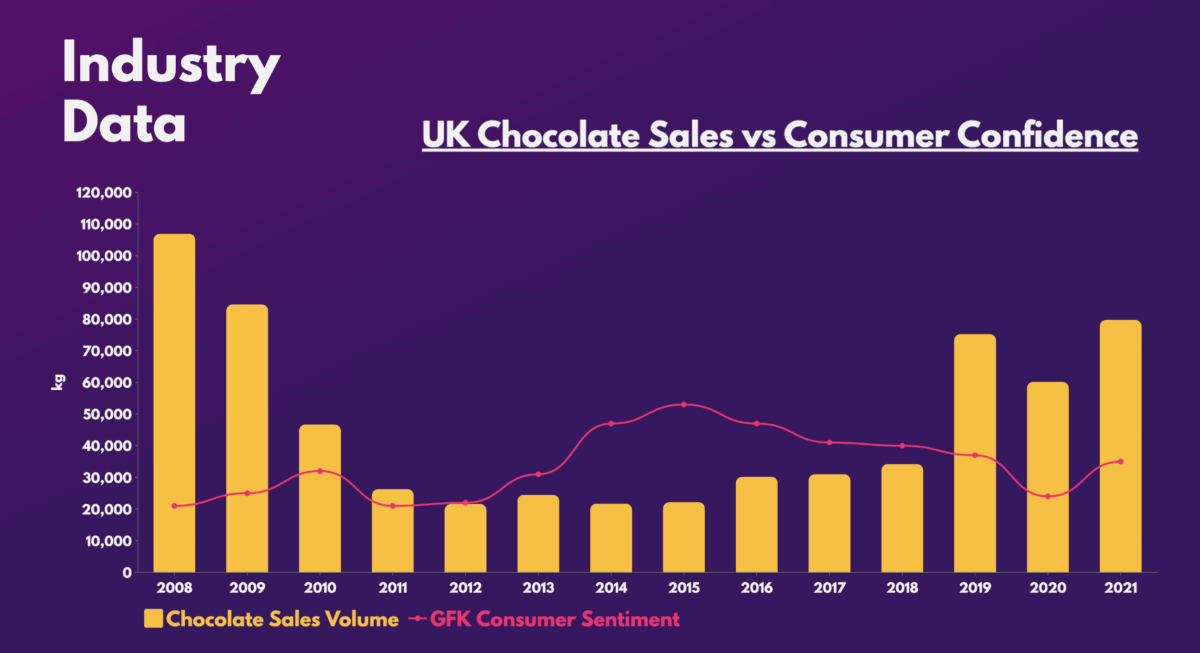

The first is consumer behaviour during a recession. It’s interesting to note that chocolate sales have somewhat of an inverse relationship with consumer confidence. This can be attributed to the lipstick effect — the behaviour of indulging in small luxuries when there’s economic uncertainty. This was evident in its latest half-year update which saw UK sales increase by 7%.

Should you invest £1,000 in Concurrent Technologies Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Concurrent Technologies Plc made the list?

Still, the company can’t shy away from its overall revenue dropping by 9% due to a weak international offering, as it’s always underperformed overseas. Even so, the penny stock is adamant on trying again in Japan. Only this time, it’s doing so with much less capital and more experience as it partners with local conglomerate Eat Creator.

More lucratively, the shares are currently trading at decent value with a great balance sheet boasting no debt. Its current valuation isn’t cheap by any means, but if the chocolatier achieves its goal of 20% EBITDA margin by FY25, starting a position now could present huge upside potential. After all, broker Leberium rates the stock a ‘buy’ with a price target of £3.00.

| Metrics | Valuation multiples | Industry average |

|---|---|---|

| Price-to-sales (P/S) ratio | 1.2 | 0.5 |

| Price-to-book (P/B) ratio | 3.0 | 1.0 |

In fact, had I bought the stock when I first recommended it in late November, I would’ve been up by 35%. Thus, I don’t want to miss out this time, and I plan to start a small position soon.

2. Concurrent Technologies

Like many other tech-related companies in 2022, shares in Concurrent Technologies (LSE:CNC) suffered a downturn. Thankfully though, its drop wasn’t as drastic as many, due to its client base (aerospace, defence, and telecoms), which is more insulated from economic downturns.

In its latest trading update, the company mentioned that it expects its revenue for 2022 to beat consensus (£16m) by 10%, with pre-tax profits coming in as expected (£0.1m). And with the semiconductor industry seemingly at a bottom, a rebound could be on the cards, with Concurrent standing to benefit.

The firm ended last year with its highest ever order backlog as order intake rose by more than 25%. As such, the board is expecting to see significant revenue growth in 2023 as it plans to increase its production capacity.

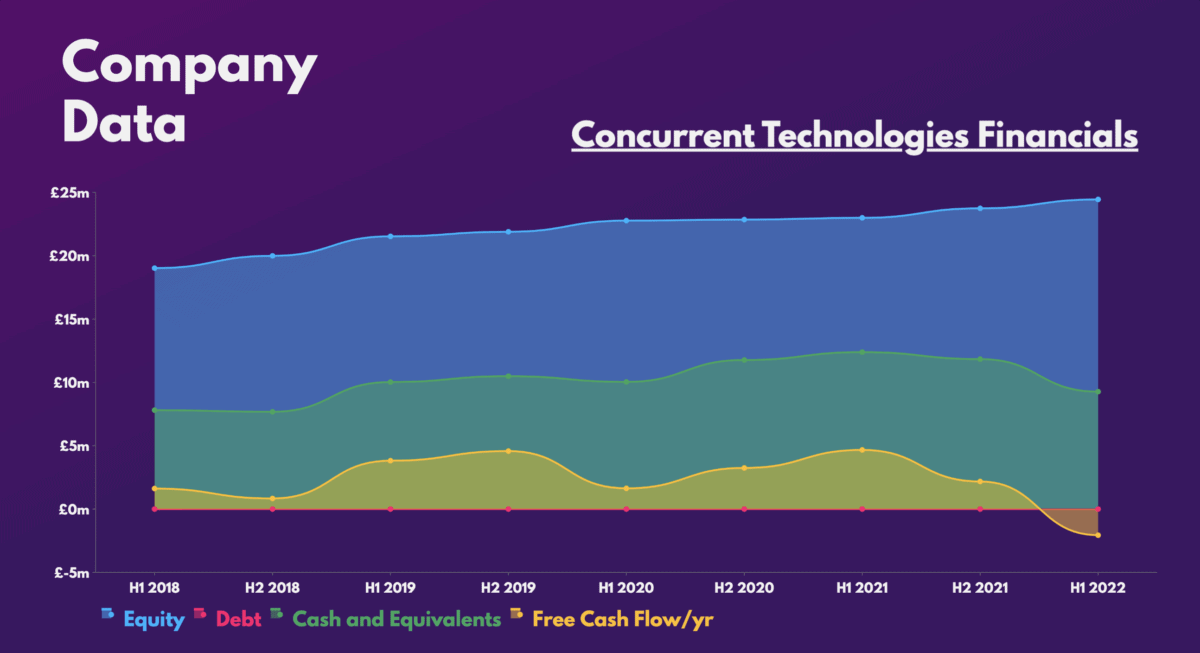

Nonetheless, Concurrent’s investments in components, R&D, and improving its systems to mitigate supply shortages in 2022 saw its free cash flow tumble. As a result, its 3.4% dividend yield isn’t going to be paid out in the near future as the AIM stalwart looks to claw back its capital. But with a flawless balance sheet, it’s certainly got the right foundation to propel its free cash flow back up.

The penny stock isn’t exactly the cheapest based on its current multiples, which is something I’m cautious of. That being said, its long-term growth still entices me to start a small position given its upside potential.

| Metrics | Valuation multiples | Industry average |

|---|---|---|

| Price-to-earnings (P/E) ratio | 30.0 | 33.9 |

| Price-to-sales (P/S) ratio | 3.0 | 1.1 |

| Price-to-book (P/B) ratio | 2.3 | 1.1 |

| Forward pice-to-earnings (P/E) ratio | 40.9 | 25.3 |