The Scottish Mortgage Investment Trust (LSE:SMT) share price has risen 3% in 2023. Yet signs are emerging that UK share investors are becoming increasingly bearish about the tech stock.

According to Hargreaves Lansdown, the trust — which focuses on US and Chinese tech shares — is the fifth most sold stock across its platform in the past seven days. The FTSE 100 share accounted for 1.42% of all sell orders over the week.

Should you invest £1,000 in Safestore Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Safestore Plc made the list?

Are Scottish Mortgage shares about to sink? And as a long-term investor, should I consider building a position in the business?

Job cuts keep coming

Scottish Mortgages’s Top 10 Holdings (as of 31 December, 2022)

| Company | What it does | % of Scottish Mortgage’s Total Holdings |

| Moderna | Makes pharmaceuticals including vaccines | 10.6 |

| ASML | Produces semiconductor manufacturing equipment | 6.7 |

| Illumina | Develops systems for genome sequencing | 4.1 |

| Space Exploration Technologies | Manufactures and launches spacecraft | 3.6 |

| Northvolt | Makes lithium-ion batteries | 3.6 |

| Meituan | Operates a Chinese online shopping platform | 3.5 |

| Tesla | Manufactures electric vehicles (EVs) | 3.2 |

| Mercadolibre | Operates e-commerce and payment systems | 3.1 |

| Kering | Owns a variety of luxury brands | 2.8 |

| Tencent | Provides a variety of digital services | 2.5 |

| Pinduoduo | Operates internet shopping platforms | 2.5 |

Source: Scottish Mortgage Investment Trust

The outlook for the global economy has got brighter in recent weeks. Typically, this would boost demand for growth shares like tech stocks. So why are investors selling Scottish Mortgage Investment Trust shares?

The answer is job cuts. A huge number of job losses, in fact, as the boost technology companies enjoyed during the pandemic fizzles out and consumers cut spending.

Amazon started 2023 by announcing 18,000 role reductions in early January. Then last week, Google owner Alphabet and software giant Microsoft declared they were cutting 12,000 and 10,000 roles respectively.

And yesterday, music streaming platform Spotify said it was axing 6% of its global workforce.

Pricey picks

Job cuts like these help to protect profits during good times. This is why the above shares rose in value following their streamlining announcements.

The trouble however is that many US tech stocks continue to trade on elevated multiples. And many in the market (including those Hargreaves Lansdown customers selling Scottish Mortgage shares) don’t believe these businesses now warrant such high valuations as the global economy cools.

This suggests to me that Scottish Mortgage Investment Trust’s share price could extend its recent fall.

Growth potential

That’s not to say the FTSE 100 trust doesn’t have massive investment potential over the long term.

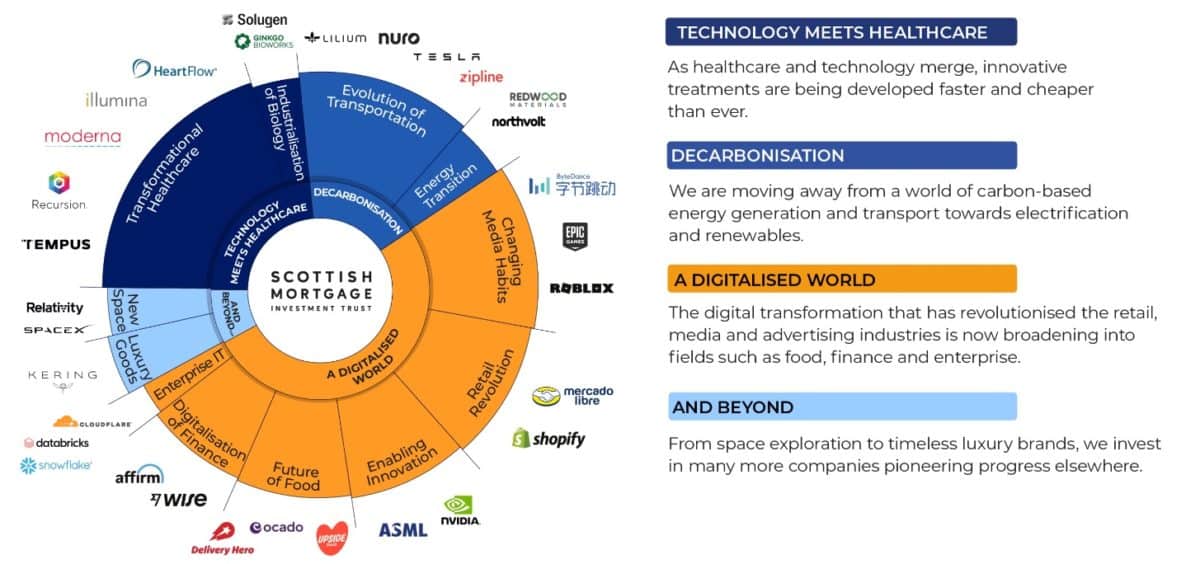

As the graphic shows, Scottish Mortgage shares provide exposure to multiple growth industries and trends for the next decade and beyond. What’s more, many of the businesses it’s invested in have strong track records of innovation and creating market-leading products and services.

However, I still have a problem with the vast premiums many of those stocks in its portfolio command. Earnings forecasts for some of those companies have long looked juicy. And that’s before the prospect of a global recession came into view.

As a result, I think the shares could struggle to deliver robust capital appreciation. On balance, I’d rather buy other FTSE 100 shares today.