FTSE 100 stocks offer an average dividend yield of 3.53%. The size of the yield isn’t the only factor I look at, however. Shareholder distributions can be cut or suspended at any time, so I also like to see evidence that a company has maintained or increased payouts over a long period.

One Footsie stock that fits the bill is Diageo (LSE:DGE), which has consistently increased its dividends over the past decade.

Here’s how I’d invest in the drinks giant to target £1,200 in annual passive income.

A dividend aristocrat

Diageo is a dividend aristocrat. The company sports a 2.06% yield, which might not sound exciting, but I believe it’s one of the most reliable passive income generators in the FTSE 100 index.

As I write, Diageo shares trade for £37 each. To secure £100 in monthly passive income, I’d need 1,575 shares. In total, this would cost £58,275.

That’s a daunting sum of money. Buying all the shares at once would require deeper pockets than I have, but this is why I break up my investing goals into manageable targets.

I’m a long-term investor. My preferred strategy is to buy and hold stocks for years, ideally decades. Accordingly, I’d start with a more achievable aim of buying six shares a week for £222. To limit my trading costs when purchasing small amounts of shares, I’d use a commission-free broker like Freetrade.

If I managed to maintain this for five years, I’d eventually have 1,560 shares to my name. Reinvesting some dividends along the way would make up the shortfall with plenty of passive income to spare.

My calculations assume the share price remains constant over five years to illustrate how I’d build a second income from regular investments. This is unlikely in practice, and I expect the share price would fluctuate over the time period.

The outlook for the Diageo share price

Dividends aren’t the only reason I like Diageo. The company also has capital growth potential. It’s performed well over the past half-decade, posting a 44% share price gain.

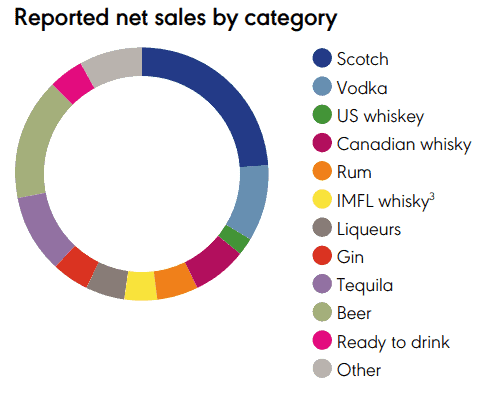

The beverage manufacturer owns a portfolio of over 200 brands that it sells in over 180 countries. Notable names include Johnnie Walker, Guinness, and Baileys.

The company’s sales are spread across categories and price points. Increasingly, it’s focusing on higher-growth opportunities including tequila, international whisky, scotch, and gin.

Diageo’s 2022 financial performance was impressive. Highlights included 18.2% growth in operating profit to £4,409m and a £281m increase in net cash from operating activities to £3,935m.

Strong cash flow is a crucial indicator of dividend sustainability. I’m optimistic the business can continue delivering stellar income returns if it remains highly cash-generative.

The price-to-earnings (P/E) ratio is currently 26.43, which makes me concerned that the shares could be expensive. However, by investing regular amounts, I hope I can avoid too great an impact from downside volatility risk in the share price.

My passive income portfolio

I’m considering buying Diageo shares this year. I’ll wait until the company’s interim results on 26 January before investing.

Provided I like the numbers, I’d buy Diageo shares in conjunction with other dividend stocks to form part of my diversified portfolio with a view to securing a regular passive income stream.