Over the past half-decade, the AstraZeneca (LSE: AZN) share price outperformed all FTSE 100 stocks bar one. Blistering 119% growth over five years means the biotech company’s shares trade for £111.77 each as I write — a huge gain from £50.95 in January 2018.

Even after explosive growth, I believe the Anglo-Swedish pharmaceutical giant still has plenty of upside potential today. As a shareholder, I’m hopeful this potential translates into positive movement for the share price.

Here’s my take on the business and why I’m buying more AstraZeneca shares in 2023.

Company-specific reasons

First, let’s look at AstraZeneca’s pipeline. The company has 179 projects on the go. This includes 13 new molecular entities in its late-stage pipeline and two recent approvals. In my view, the business has one of the most promising portfolios of any pharma company globally.

Although Covid vaccines made the firm a household name, its strength runs far deeper. AstraZeneca’s medicines cover an array of healthcare issues from oncology to cardiovascular disease and respiratory illnesses.

The company’s also expanding. It recently took advantage of a crash in the CinCor Pharma share price to snap up the blood pressure biotech outfit. The deal will be worth $1.8bn if Cincor can secure regulatory approval for its baxdrostat product for patients with treatment-resistant hypertension.

The drug can potentially be combined with AstraZeneca’s Farxiga medication to address cardiorenal disease, which could contribute significantly to the firm’s revenue. The merger agreement’s expected to conclude in first quarter of 2023, if all conditions are met.

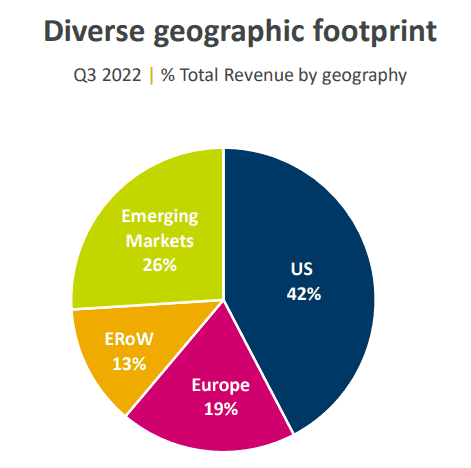

Beyond a strong pipeline and ambitious expansion plans, another reason I like AstraZeneca is the geographic diversification it offers. With truly global sources of revenue, the company’s not overly exposed to any single global region in my view.

Macroeconomic trends

There are also macroeconomic factors that make the pharmaceutical industry an attractive play for me at present. No firm is immune to the scourge of high inflation, but pharma companies have high levels of discretionary spending and considerable pricing power.

What’s more, the industry’s relatively non-cyclical. Whether the economy’s performing well or in a downturn, demand for medicines remains fairly constant. As possible recessions loom, I’m keen to boost my exposure to the sector to hedge against potential falls in the value of my other investments.

Risks

Admittedly, there are risks that could derail the stock’s positive trajectory. The business has a high price-to-earnings (P/E) ratio over 105, which suggests it’s expensive using traditional valuation metrics.

There’s also the concern that some candidate drugs might fail to secure regulatory approval. This could weigh on expected earnings growth and hurt the AstraZeneca share price in the process.

It’s a tricky balancing act. If there aren’t enough new approvals to replace patent expiries in the coming years, the promising outlook for the business could change.

Why I’m buying more AstraZeneca shares

Despite concerns over a high P/E ratio, I believe a premier pipeline warrants a premium valuation. AstraZeneca’s at the forefront of ground-breaking advances in the medical field. I think the company’s well positioned to continue its outperformance among FTSE 100 shares.

A promising combination of micro and macro factors make me bullish on AstraZeneca. I’ll be buying more this week.