According to broker AJ Bell, dividend payments for FTSE 100 shares are expected to hit an all-time high this year. With that in mind, I’ve been buying these two miners with high growth and yields to generate me a healthy amount of passive income.

1. Glencore

With a decent dividend yield of 3.9%, the first share on my list is Glencore (LSE:GLEN). Jefferies thinks that coal-mining stocks are undervalued. This is especially the case given elevated coal prices. Gas prices have been declining due to warmer temperatures in Europe this season. However, due to a combination of factors, such as a colder Asian winter, the region’s heavy reliance on coal, and China’s reopening, prices are forecast to continue to remain strong in the coming months.

Therefore, it’s no surprise to see Deutsche recommend Glencore shares for its dividends and growth prospects. Aside from generating the bulk of its revenue from coal, the commodity giant is also the world’s largest producer of base metals. Given its portfolio of metals such as copper, zinc and nickel, the company has a bright future ahead. Those metals are crucial to producing batteries for the electric vehicle revolution.

Should you invest £1,000 in Unilever right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Unilever made the list?

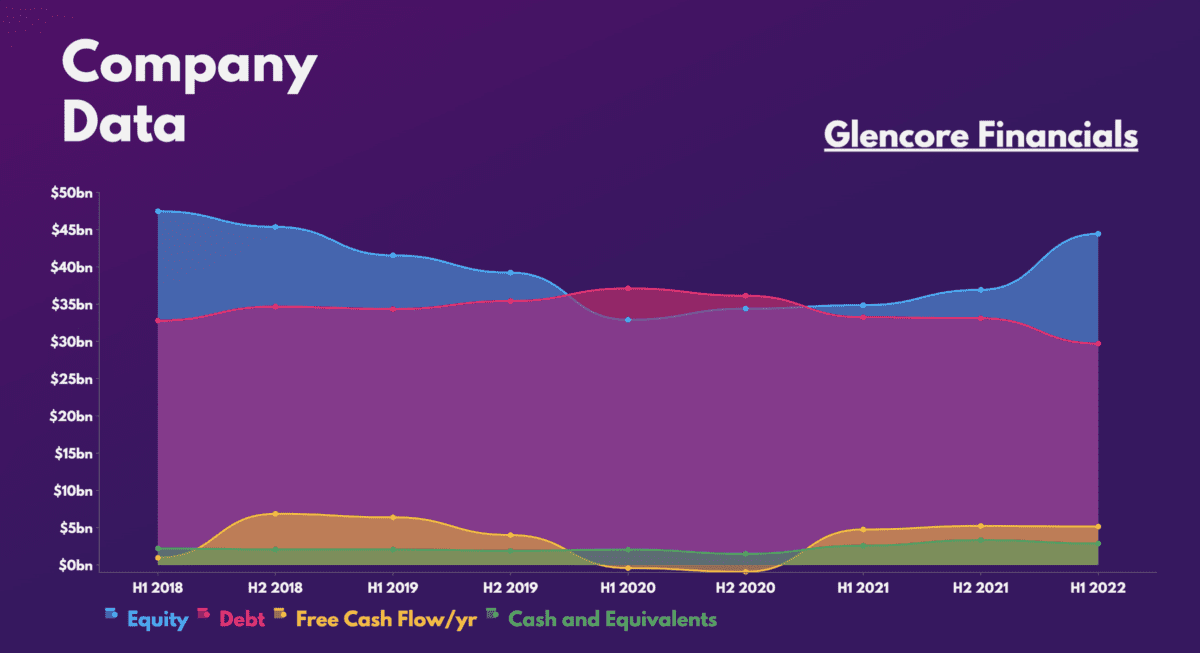

Additionally, it’s got the backing of several other investment banks. The likes of UBS, Citi and JP Morgan have ‘buy’ ratings on the stock too, with the latter two labelling it one of their top picks for 2023. Combined with a strong balance sheet, excellent growth prospects for its bottom line, and dividends, such optimisim for its shares is certainly understandable.

Pair the above with rather cheap valuation multiples, and it’s easy to see why Glencore is a top pick for my portfolio as well.

| Metrics | Valuation multiples | Industry average |

|---|---|---|

| Price-to-earnings (P/E) ratio | 6.0 | 7.1 |

| Price-to-sales (P/S) ratio | 0.4 | 1.6 |

| Price-to-book (P/B) ratio | 2.0 | 1.2 |

| Forward price-to-earnings (P/E) ratio | 5.1 | 7.1 |

2. Rio Tinto

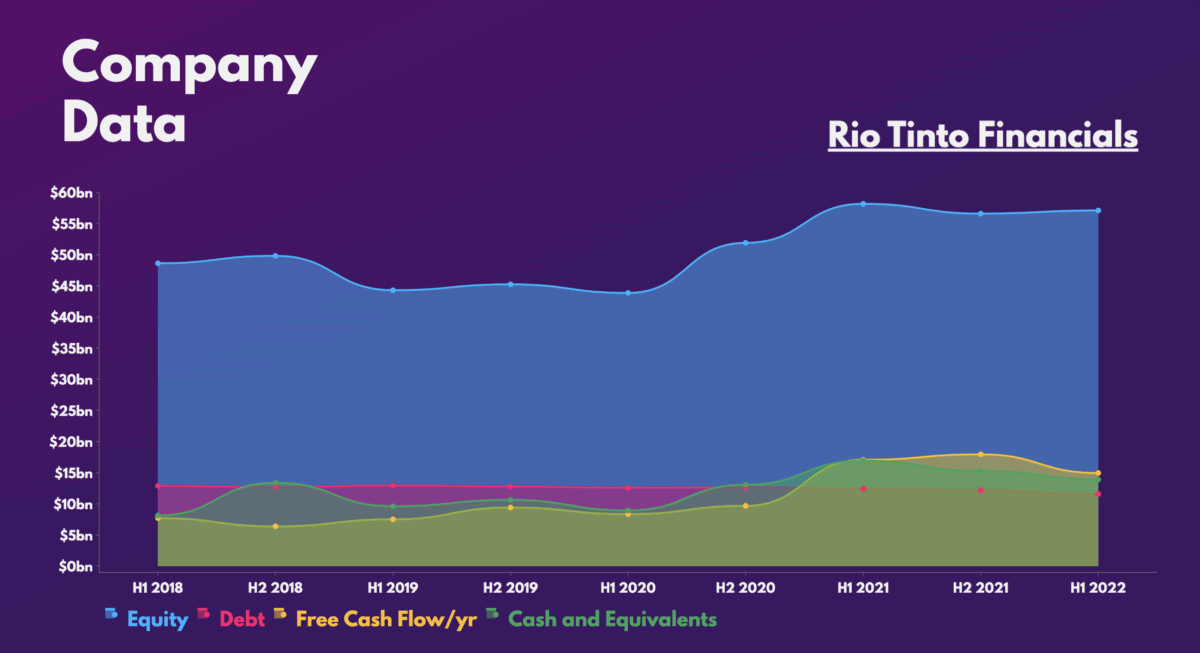

Another monster dividend share on my portfolio is iron ore giant, Rio Tinto (LSE:RIO). Despite a volatile 2022, I advocated for buying its shares in early December due to its strong fundamentals. Since then, iron ore prices have continued to rebound strongly. Nonetheless, there are downside risks to consider, mainly a recession in Europe and the US. Even so, analysts think that a potential downturn has already been priced in.

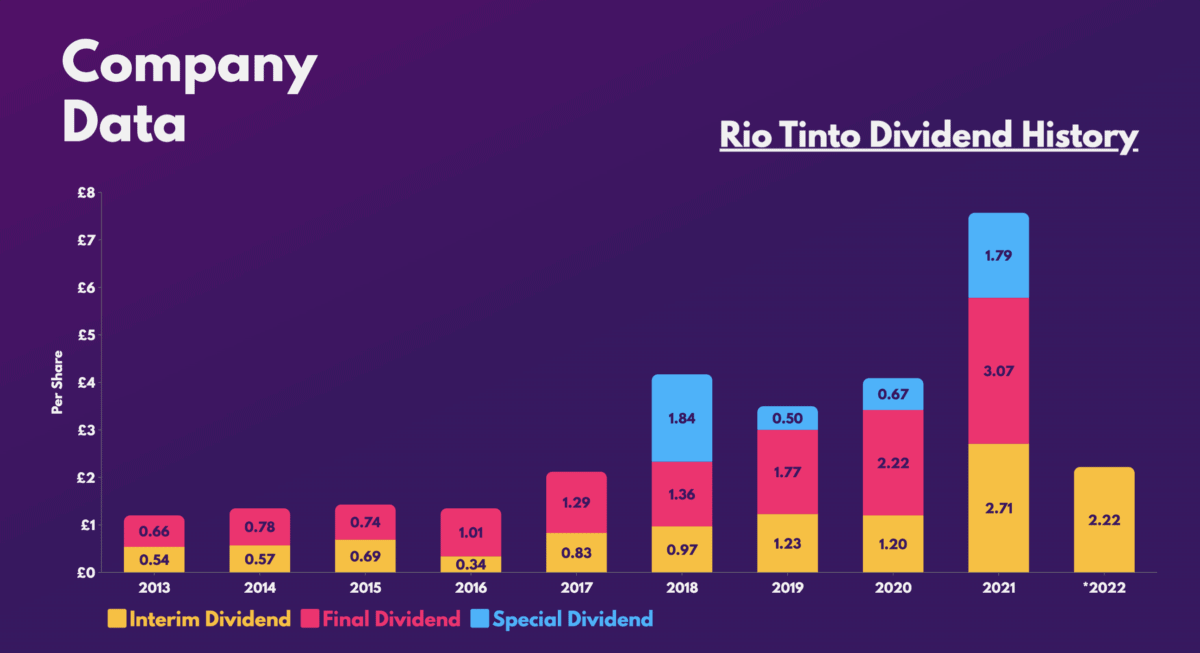

Moving onto its bullish thesis though, there are plenty of reasons to invest. The most lucrative one is its status as a dividend aristocrat. Rio shares have a strong history of paying large and growing dividends.

To complement this, China’s abandonment of its zero-Covid policy should allow industrial and construction activity to resume with fewer hiccups. Moreover, economic stimulus is widely anticipated to provide support to metal prices. This should bring in higher income which usually translates into bigger dividends.

Also, other metals on Rio’s portfolio such as copper and lithium will be beneficial for its long-term growth as they’re critical building blocks for green technology. After all, the mining titan shared its significant copper capabilities in its latest trading update. This has left the likes of Berenberg and UBS questioning whether their initial bearishness on the stock was right all along.

Nevertheless, its current valuation multiples don’t look particularly cheap. Thus, I won’t be buying more shares at this moment. Instead, I’ll be holding onto my original position for passive income, and may buy more if Rio’s share price comes down.

| Metrics | Valuation multiples | Industry average |

|---|---|---|

| Price-to-earnings (P/E) ratio | 7.2 | 7.1 |

| Price-to-sales (P/S) ratio | 2.1 | 1.6 |

| Price-to-book (P/B) ratio | 2.5 | 1.2 |

| Forward price-to-earnings (P/E) ratio | 10.1 | 7.1 |