Retail and supermarket stocks had a terrible 2022. Marks and Spencer (LSE:MKS) shares weren’t spared as it was of the worst performers, declining almost 50%. Nonetheless, its latest Q3 update indicates a bright future ahead, and it’s why I’ll be looking to buy the stock.

About Marks And Spencer Group Plc

Last updated 20-12-2024, 04:30:00pm GMTTop Marks for top numbers

Marks and Spencer shares have been the FTSE 250‘s most actively traded stock in 2023 so far. This has been helped by its excellent Q3 trading update which saw the retailer post some top numbers.

| Metrics | Total sales growth | Like-for-like sales growth |

|---|---|---|

| Food sales | 10.2% | 6.3% |

| Clothing and home (C&H) sales | 8.8% | 8.6% |

| Total UK sales | 9.7% | 7.2% |

| International sales | 12.5% | N/A |

| Total sales | 9.9% | N/A |

In fact, the grocer outperformed every supermarket in terms of basket value during the Christmas period, helped by its acquisition of Gist and uptick in M&S Collection sales. Consequently, CEO Stuart Manchin cited a record market share for food, while C&H’s market share hit a seven-year high of 10%.

Building growth

As a result, management has opted to accelerate its goal to phase out older stores for newer, revamped ones by the end of FY26. The first phase of the initiative has already begun with 20 stores in the pipeline. These are expected to begin operating by the end of FY24.

The goal is to turn its current 247 stores into 180 full-line stores and over 100 food sites, with a focus on retail parks. This is a wise move due to the cheaper costs to operate them and larger basket sizes.

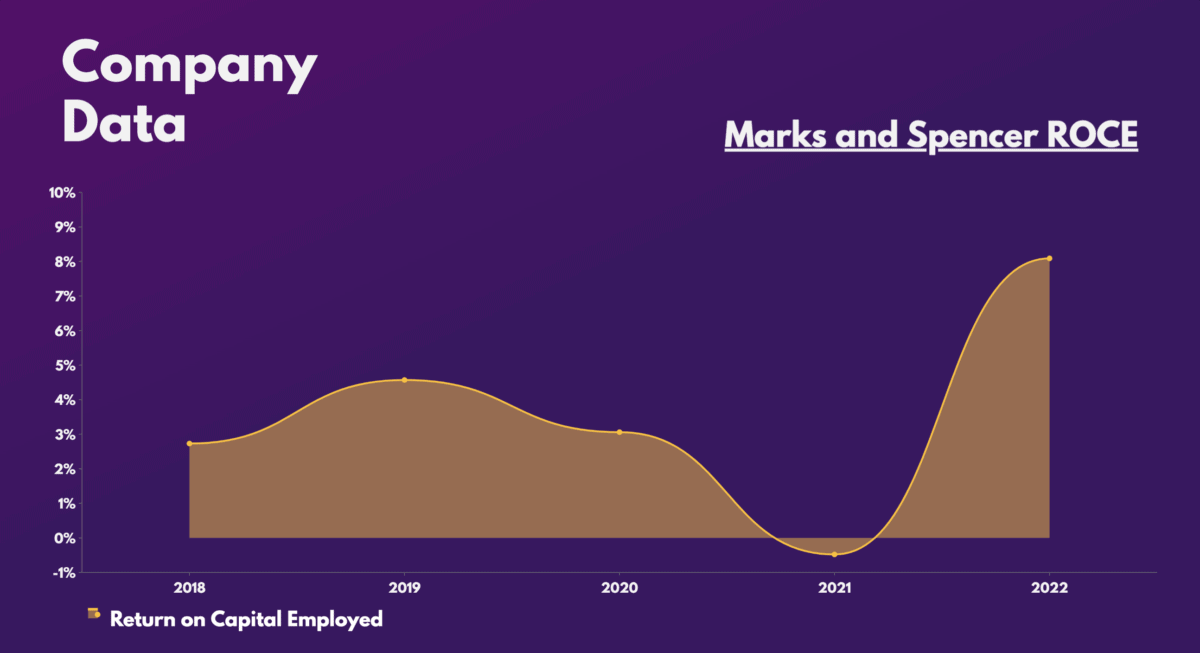

Sales at retrofitted and newer stores are comfortably outperforming older variants. And with a rather short payback period of two years, it only makes sense to do it as soon as possible. Hence, it’s no surprise to see the company’s return on capital employed improve dramatically of late.

What’s more, this move should help the group’s balance sheet. The British firm owns about 40% of its estate. As such, the move should see its lease liabilities drop by approximately £300m, with the retail giant taking over former Debenhams sites.

Remarkable valuation

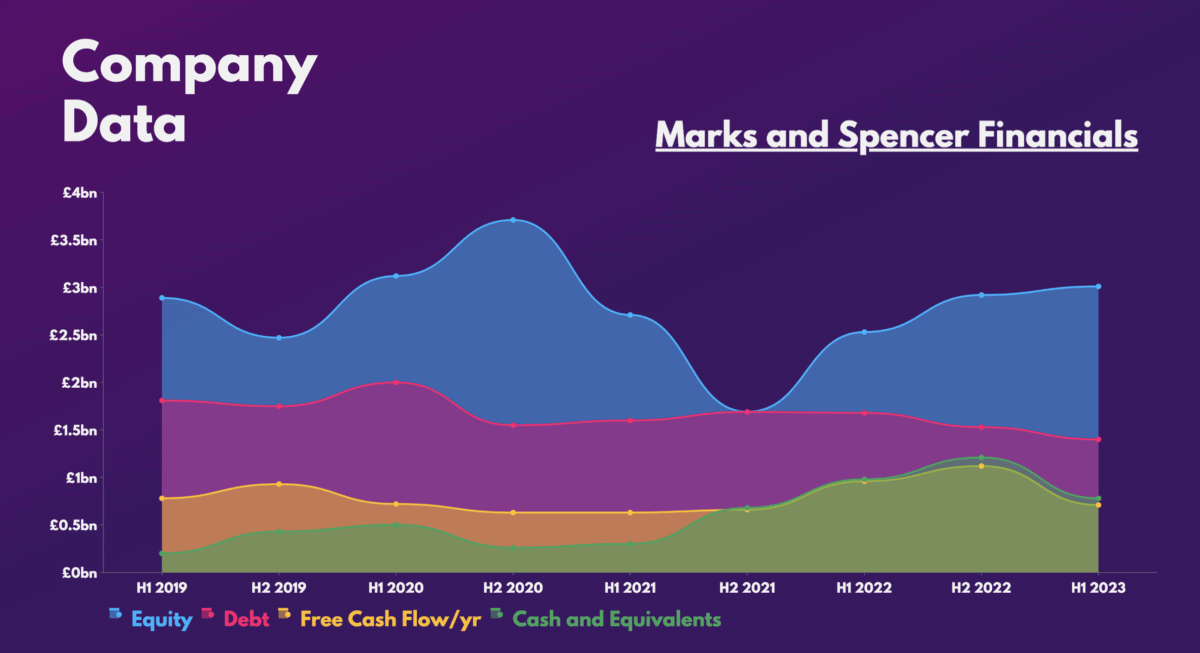

That said, it’s worth noting that Marks and Spencer doesn’t have the most pristine balance sheet. Regardless, it’s still commendable to see declining debt with improving cash flow over the years.

Provided the FTSE stalwart continues its positive momentum, a return of dividend payments may even be possible as soon as April. If this happens, I can imagine there would be plenty of excitement surrounding the shares as it would attract plenty of investors seeking passive income.

Nevertheless, I won’t be waiting until then because the stock is trading at rather cheap valuation multiples today. When compared to its historical P/E and the multiples of its supermarket peers, M&S definitely looks like a bargain despite its recent rise.

| Metrics | Marks and Spencer | Tesco | Sainsbury’s |

|---|---|---|---|

| Price-to-earnings (P/E) ratio | 9.7 | 20.0 | 10.0 |

| Price-to-sales (P/S) ratio | 0.3 | 0.3 | 0.2 |

| Price-to-book (P/B) ratio | 1.0 | 1.2 | 0.7 |

| Price-to-earnings growth (PEG) ratio | 0.1 | 0.1 | 0.1 |

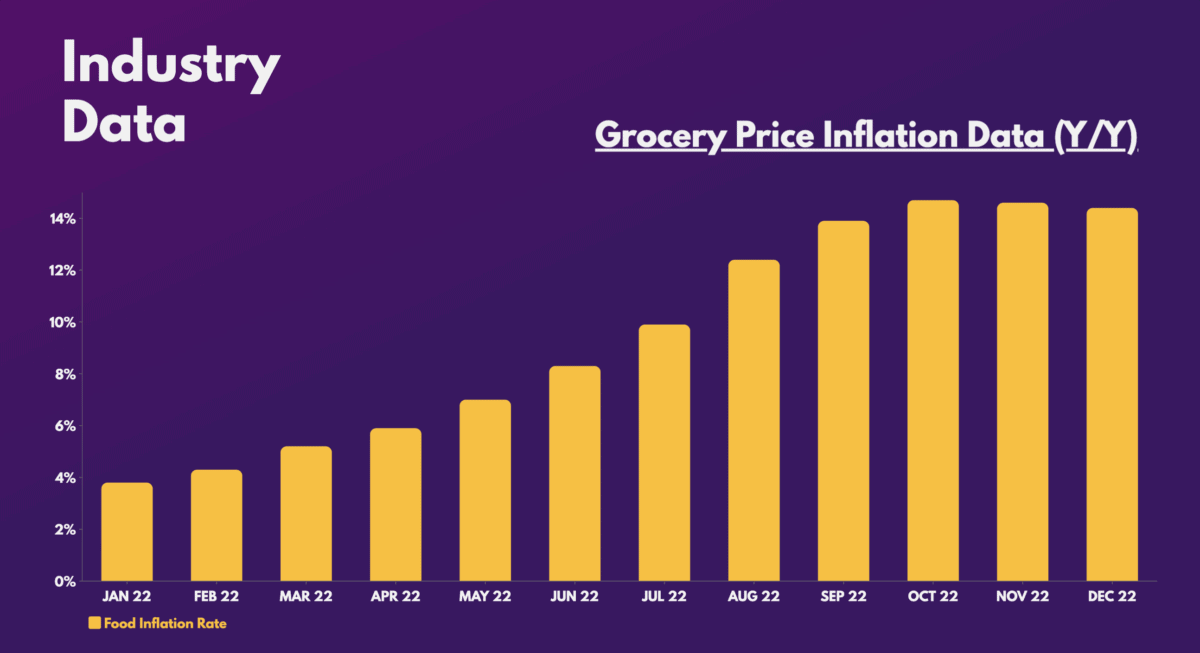

With the board reiterating its full-year guidance and grocery inflation tapering off as well, I’m expecting margins to begin expanding in the medium term.

Deutsche may rate the stock a ‘hold’ with a price target of £1.45. However, I’m more akin to agree with JP Morgan on its ‘overweight’ rating and price target of £1.55. Although this doesn’t present much of an upside from current levels, I think the long-term potential for Marks and Spencer shares hasn’t been priced in. Therefore, I’ll be looking to buy the stock once my preferred broker launches UK shares on its platform.