Worries of a property market crash caused housebuilder shares like Taylor Wimpey (LSE:TW) to tumble last year. The firm’s Q4 update didn’t produce the best numbers either. Nonetheless, I’m still buying the stock for its long-term growth and potential to generate a second income.

About Taylor Wimpey Plc

Last updated 02-04-2025, 04:30:00pm BSTHolding up against headwinds

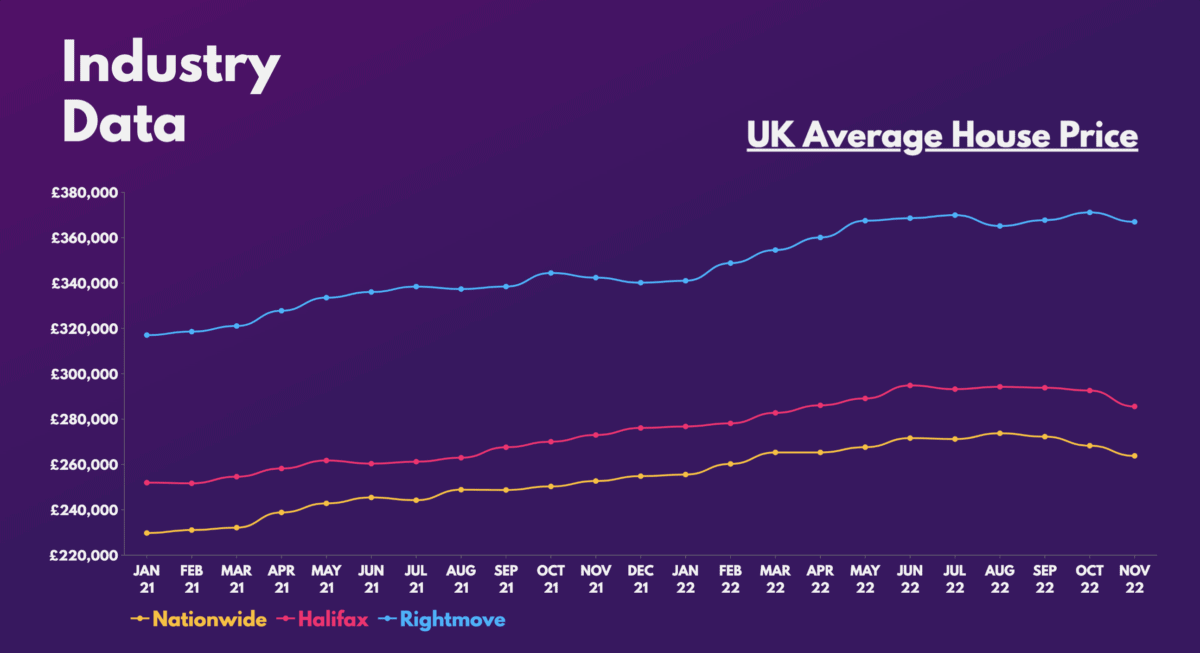

House prices are expected to decline by double-digit percentages in 2023. This doesn’t bode well for Taylor Wimpey shares. Additionally, December’s construction purchasing managers index (PMI) figures indicated a contraction with the biggest decline in new orders and purchasing activity in over two years.

Despite that, the FTSE 100 stalwart still reported a better-than-expected set of top-line figures on Friday. Although the housebuilder’s bottom-line numbers won’t be revealed until March, it’s definitely a positive to see it meet and even surpass some of its initial key performance indicators.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

| Metrics | 2022 | 2021 | Growth |

|---|---|---|---|

| Total completions | 14,154 | 14,302 | -1% |

| Net private reservation rate | 0.68 | 0.91 | -25% |

| Cancellation rate | 18% | 14% | 4% |

| Average selling price | £313k | £300k | 4% |

| Book value | £1.94bn | £2.55bn | -24% |

| Total landbank | 144k | 145k | -1% |

In fact, the firm performed relatively well against some of its other peers. This was especially the case in areas such as the net private reservation rate (sales per outlet per week).

| Housebuilders | Net private reservation rate |

|---|---|

| Taylor Wimpey | 0.68 |

| Barratt | 0.44 |

| Persimmon | 0.69 |

Solid foundations

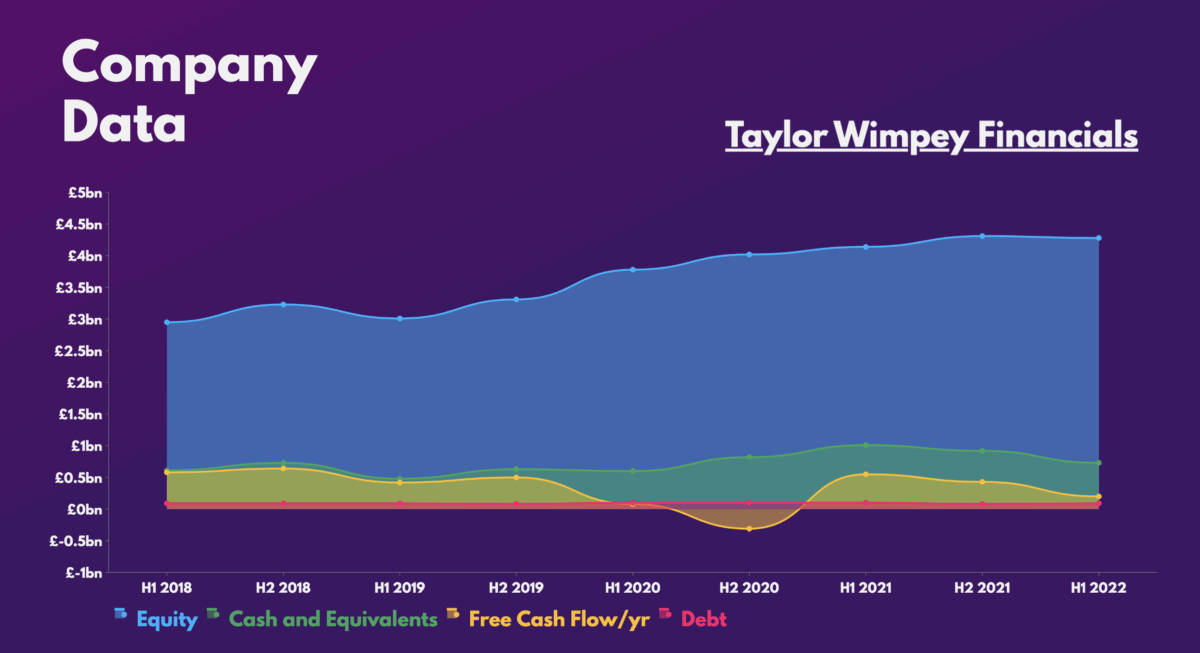

The company ended 2022 with net cash coming in above expectations, and even saw its operating margin expand. With a debt-to-equity ratio of 2% and excellent dividend cover of 2.1 times, it certainly sets up a solid foundation for an investment in Taylor Wimpey shares.

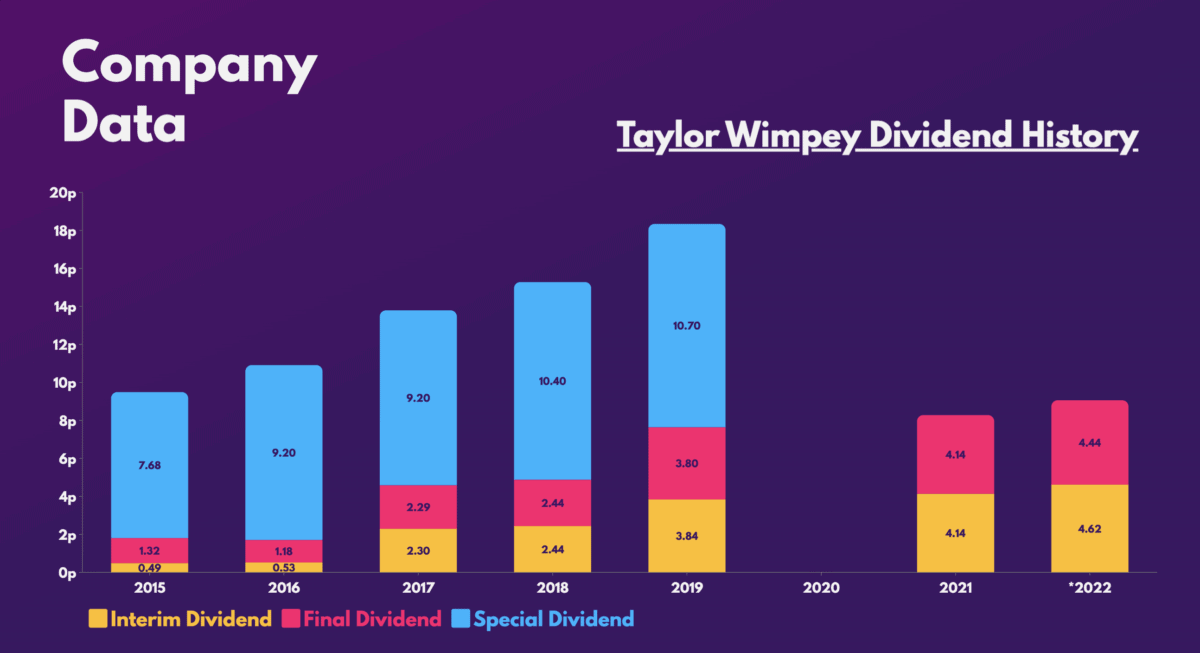

This is good news for its earnings and also its dividends. Taylor Wimpey has a reputable history of growing and steady dividends. And unlike its peer Persimmon, management is yet to indicate any rebasing of its high payouts. Nevertheless, a prolonged period of lower house prices and sub-par free cash flow could force the board’s hand.

However, it’s worth noting that even in such an instance, the developer has a secure dividend policy. The constructor aims to pay a dividend worth at least 7.5% of its net assets, or at least £250m annually. Buying Taylor Wimpey shares today would still give me a minimum dividend yield of 6.1%, even in the group’s worst-case scenario.

Building back bigger

Having said that, there are a number of things to be optimistic about. For one, house prices shouldn’t fall as badly as initially anticipated due to housing supply constraints. Moreover, Taylor Wimpey has a healthy exposure to second-time buyers (40%). This should allow it to hedge against the decline in its first-time buyer base (35%) due to affordability concerns. And there are another £20m of cost savings to come with build cost inflation levelling out. Meanwhile, mortgage rates are declining as well.

All these should serve as gradual tailwinds over the next couple of years. And although house prices are forecast to continue declining in the short term, buyer intention remains robust, according to CEO Jennie Daly. With construction activity normally being the first sector to benefit when an economy rebounds, Taylor Wimpey shares are in a prime position to capitalise on this, provided its buyer intention remains strong.

It’s no surprise to me that the likes of Jefferies and Liberum rate Taylor Wimpey shares a ‘buy’, with the latter even suggesting a 25% upside this year. So, given its decent valuation multiples and strong dividend yield, I’ll be buying the stock once my preferred broker launches UK shares on its platform.

| Metrics | Valuation multiples | Industry average |

|---|---|---|

| Price-to-earnings (P/E) ratio | 7.2 | 10.7 |

| Price-to-sales (P/S) ratio | 1.0 | 0.8 |

| Price-to-book (P/B) ratio | 1.0 | 0.9 |