The UK’s main index is now only about 50 points shy of its all-time high of 7,903. Although the general consensus is to buy low and sell high, I’m still planning to buy FTSE 100 shares as the index heads towards the 8,000 mark.

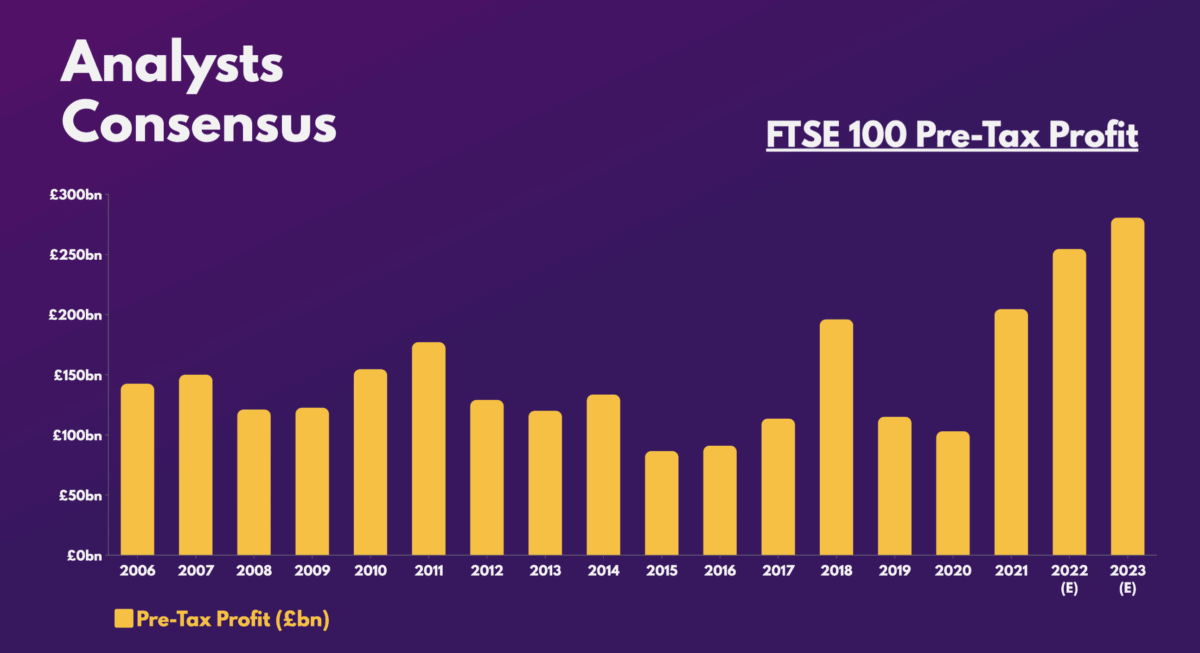

Setting new records

British equities aren’t renowned for their strong growth, but 2023 is set to be a record year for overall profits. Despite an impending recession, Britain’s top constituents generate the bulk of their profits from outside the UK. Hence, analysts are forecasting average pre-tax profits to come in at approximately £280bn. As such, it’s no surprise that the FTSE 100 is in the green since the New Year, and is closing in on its all-time high. Here’s why.

The first would be banks. With inflation still stubbornly high, the Bank of England is predicted to continue raising interest rates. Consequently, banks such as Lloyds will benefit as profits grow on rising rates. The second would be China’s reopening as it’s the world’s largest consumer of commodities. With a sizeable chunk of FTSE 100 companies producing energy and metals, the likes of Antofagasta and BP are on many investors’ watchlists as oil and metal prices are expected to continue their rebound.

Higher dividends

These main catalysts would serve to benefit shareholders’ returns in the form of dividend payments. The FTSE 100 is renowned for being one of the world’s biggest dividend generators. And with the bulk of its biggest dividend payers in the financial and commodities sectors, higher profits are most likely to translate into dividends too. Thus, analysts are anticipating ordinary dividends to hit a record high too.

After all, £55.2bn worth of share repurchases were conducted in 2022 alone. Additionally, an additional £2.8bn in special dividends were paid out. As a result, analysts are now pricing in for £79.1bn worth of dividends to be paid out this year.

This comes as no surprise as the average company’s balance sheet has not been in a better position in almost a decade. Big names such as Anglo American and Glencore have strong free cash flow and dividend covers of over two times. This allows them to cover their lucrative dividend yields rather comfortably, which is why I’m enticed to invest in FTSE stocks, as it’s an opportunity for me to generative some passive income.

| Sector | Pre-tax profit growth | Dividend growth |

|---|---|---|

| Oil & Gas | 24% | 23% |

| Financials | 23% | 18% |

| Mining | 16% | 16% |

Cheap blue chips

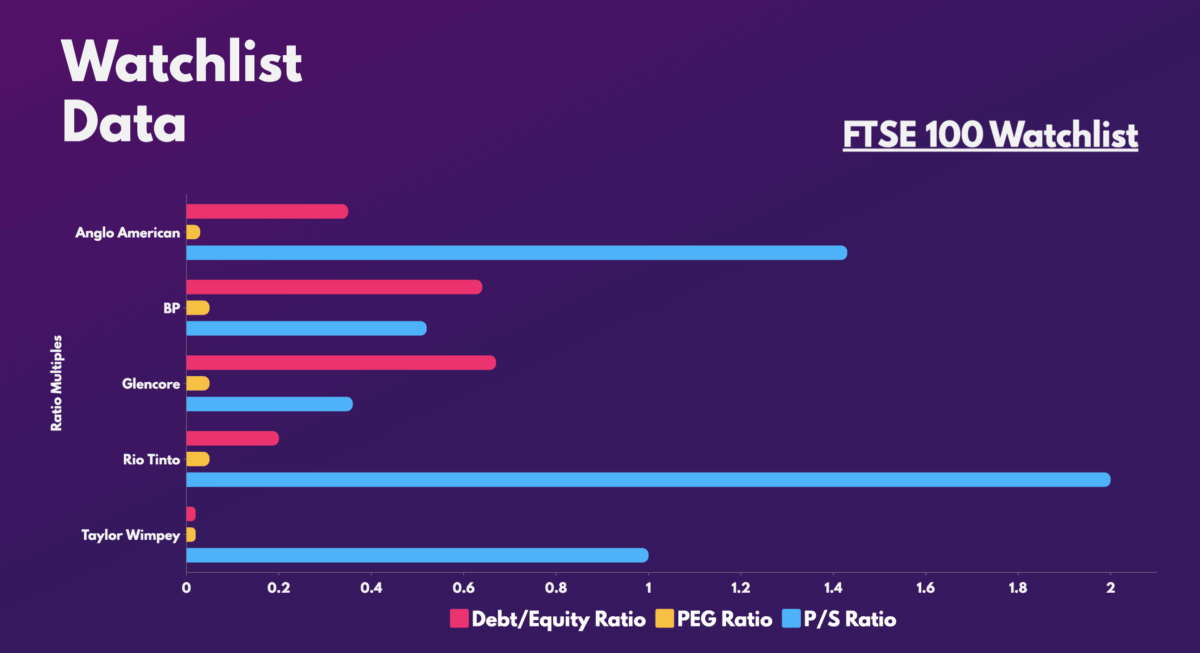

Nonetheless, the main reason why I’m buying FTSE 100 shares is because of their relatively cheap valuations. While the index hits a high, there are still a couple of big names that are trading on a bargain. Property developer Taylor Wimpey and iron ore giant Rio Tinto suffered last year as construction and industrial activity slowed down locally and internationally.

As a result, these stocks are now trading at relatively cheap price-to-earnings (P/E) ratios with high dividend yields. Moreover, they even have good dividend covers and a strong dividend policy.

So, with house prices remaining robust and iron ore prices rebounding at a rapid pace, here are several FTSE 100 shares I’m looking to buy once my preferred broker launches UK shares on its platform.