I’m always on the lookout for new FTSE 100 stocks to add to my passive income portfolio. However, often I find it can be just as beneficial to expand my position in some of my existing stock market holdings instead.

For instance, one dividend aristocrat that I own has seen its share price tumble 10% in the last six months. I think this could be a good opportunity for me to scoop up cheap shares in one of my favourite highly cash-generative businesses.

The stock I’m talking about is British American Tobacco (LSE: BATS).

A passive income heavyweight

British American Tobacco shares are among the highest-yielding investments available in the FTSE 100 index. Currently, the stock rewards shareholders with a yield just above 6.9%.

The tobacco manufacturer has a 120-year history. It owns brands such as Camel, Lucky Strike, and Dunhill within its product range. Importantly, the business has significant pricing power in times of high inflation.

Given the high taxes imposed on tobacco by many governments around the world, the price of cigarettes is less sensitive to rising input costs than many other manufactured goods. I believe the stock acts as a useful inflation hedge in my portfolio, as well as a handy passive income generator.

British American Tobacco expects operating cash conversion will be ahead of its 90% target for FY22. This bodes well for the dividend, in my view.

What’s more, dividend coverage of 1.78 looks solid to me. The business also faces pressure from competition to maintain its stellar dividend record. Footsie bedfellow Imperial Brands yields a near-identical 6.85%.

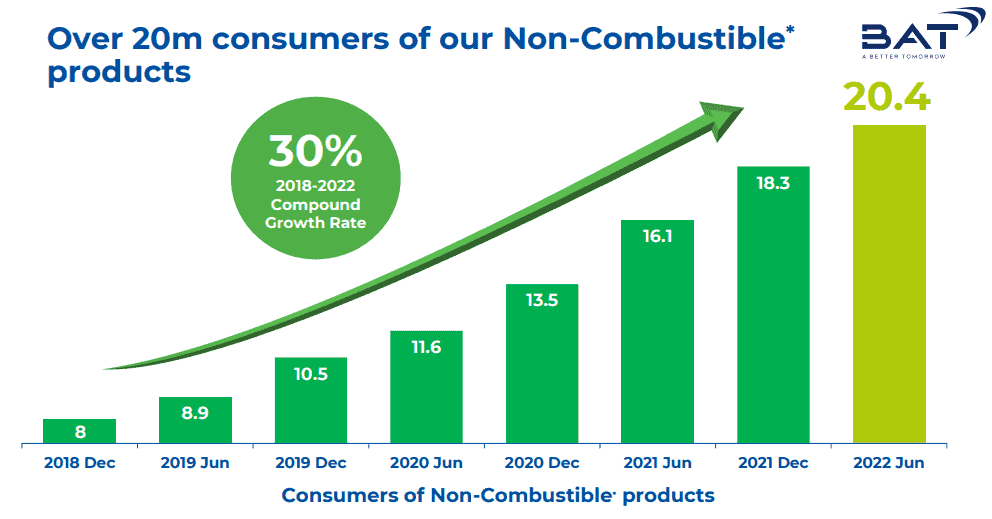

Despite the long-predicted demise of the tobacco industry, the company continues to defy the gloomier forecasts. By expanding its non-combustible product offering, it’s making efforts to confront potentially existential threats to the business model from government intervention.

Non-combustible products now account for 15% of the firm’s revenue after rapid compound annual growth over recent years. Increased demand for the company’s vapour, tobacco heating and oral nicotine products has contributed significantly to the group’s expectation that revenue will rise between 2% and 4% in full-year 2022.

Risks

As I mentioned, in my view the biggest threat to British American Tobacco’s business is the prospect of stringent government regulations. After all, reducing smoking is a key public health goal for many countries.

For instance, New Zealand recently passed legislation that ensures anyone born after 2008 won’t be able to buy cigarettes or tobacco products.

Closer to home, Shadow Health Secretary Wes Streeting confirmed the Labour Party would consider similar measures if it wins the next election. Whether non-combustible product sales could sufficiently replace traditional tobacco sales in such a scenario remains to be seen.

Why I’m buying more shares

Tobacco companies aren’t for everyone. Many investors will have moral concerns about investing in the industry.

But in the context of strict regulations, I’m comfortable investing in British American Tobacco. The company has served me very well as a highly reliable dividend stock.

I’ll be buying more shares in the FTSE 100 tobacco giant to boost my passive income further in 2023.