The past two years have been a difficult time for investors in easyJet (LSE: EZJ) shares. The pandemic’s crippling effects on the aviation industry brought downward pressure on the FTSE 250 airline stock.

The introduction of quarantines, testing requirements and outright travel bans ravaged the sector as consumer demand for international travel vanished with little notice. A meaningful recovery has been slow to materialise so far, despite an end to the era of severe restrictions.

Fortunately, I didn’t buy the company’s shares, but if I had here’s how my position would look today.

A two-year nosedive

Two years ago, the easyJet share price stood at 687p. For context, it’s notable that by January 2021 the share price had already almost halved in value compared to its pre-pandemic levels.

Today, the stock’s changing hands for 431p. That’s a 37% decrease over 24 months.

In 2021, a £1,000 lump sum investment would have bagged me 145 shares, leaving £3.85 as spare change. Today, my position would have shrunk to £624.95.

What’s more, the company axed its dividends in 2020 and hasn’t rewarded shareholders with any payouts since. Prior to the spread of Covid-19, the low-cost carrier had managed to establish a reputation as a reliable dividend stock.

This serves as a valuable lesson in the potential pitfalls of passive income investing — namely, there are few certainties in the stock market, only risks and rewards.

In short, I’d be sitting on a big loss if I’d invested in easyJet shares two years ago with no shareholder distributions to soften the blow.

A brighter outlook?

Despite its recent troubles, easyJet’s latest financial results revealed some positive momentum. The most striking figure was a record headline EBITDAR of £674m in Q4 2022. The company logged £82m in profit for the quarter too.

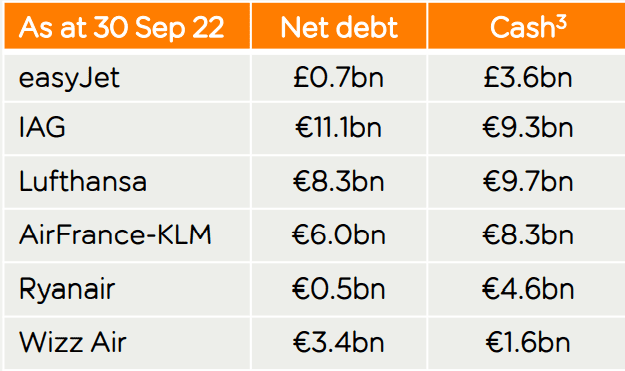

Encouragingly, the airline’s debt levels are lower than its major competitors, with the exception of Ryanair. The robust balance sheet is a key advantage the firm has over its peers. Indeed, this is a contributory factor in analysts’ expectations that dividends could return as soon as this year.

In addition, takeover rumours are circulating. Last year, the CEO of British Airways owner IAG, Luis Gallego, hinted that the FTSE 100 company is eyeing up easyJet as an acquisition target. This news comes on top of reports that WizzAir approached easyJet about a potential merger in 2022.

Either of these developments could have a positive effect on the share price. However, I’m wary that any possible M&A activity is still quite speculative at this stage.

There are also persistent risks. In line with its industry competitors, the company will have to continue grappling with turbulence in commodities markets. Although there are signs jet fuel prices are coming down from last year’s peak, I think this issue will remain a challenge for the airline in 2023.

Should I buy the shares?

Despite some remaining headwinds to growth, I think the next two years are likely to be kinder to easyJet shares than the last two have been.

At today’s share price, the stock looks like a value investment opportunity to me. If I had some spare cash, I’d invest in easyJet today.