As a cautious investor, trust and knowledge are key when building my portfolio. And there is one UK share I see in particular as a foundation of growth this year and into the future – National Grid (LSE:NG).

There are two reasons for this.

Dependable dividends

Not all dividends are made equal, and when companies hand out a share of their profits each year, some generate greater income for investors than others.

Should you invest £1,000 in Morgan Advanced Materials Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Morgan Advanced Materials Plc made the list?

National Grid has been a star performer in my portfolio for years when it comes to dividends, with a yield of around 5%. This means that despite National Grid currently accounting for 9% of my total investment portfolio by value, last year it represented 14% of the dividend income generated from all my shareholdings.

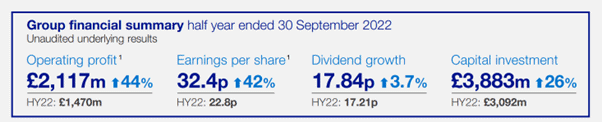

There is no guarantee that future dividends will reflect past performance. But the half-year results National Grid presented in November 2022 were highly encouraging, with operating profit up 44%, earnings per share up 42% and interim dividend growth of 3.7%.

Furthermore, the total value of dividend payments has been rising steadily for years, despite the disruption of the pandemic.

Finally, there is a clear commitment from chief executive John Pettigrew to aim to grow dividend per share in line with CPIH, the leading measure of inflation.

Put all these together and it gives me confidence that National Grid will remain a strong dividend performer in my portfolio for years.

Stable share performance

Investing in the current climate can be unpredictable, as once-promising businesses suddenly collapse in value (I am looking at you, Cazoo). But for me, National Grid represents a relative oasis of calm.

Every share price can show volatility in the short term, but over the long term National Grid tends to hover between 900p and 1,100p.

Investing at the right time remains important. But there is always the security of potentially strong dividend income to offset any reduction in share value, especially when planning to hold shares for a long period of time.

National Grid’s strength is its essential role, now and in the future, powering economies through energy infrastructure, distribution and transmission. It is a leading investor in the delivery of net zero, the transitioning to a fossil-free future in its UK and US markets, with major projects including significant investments in offshore wind that will power millions of homes.

My long-term partner

For my investment portfolio, I see National Grid as a long-term partner. Even in a post fossil-fuel world, with its investment in wind and solar, as long as the wind blows and the sun shines, National Grid should continue to generate strong revenues, leading to robust dividend and share price performance. If the encouraging signs remain, I expect its share of my portfolio to increase to make the most of its potential.