Earning passive income is one of my top investment priorities this year. To achieve this, I’m keen to buy high-yield dividend stocks that can provide me with a second income. In the long run, I hope the money I earn from my investments will be enough to secure financial independence.

Multiple UK shares offer attractive yields. I’ve been searching the FTSE 100 and FTSE 250 for inspiration and settled on two companies that could be good picks for my passive income portfolio in 2023.

Let’s explore each in turn.

Should you invest £1,000 in Aviva right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Aviva made the list?

Aviva

Aviva (LSE: AV.) shares currently sport a whopping 6.6% dividend yield.

The FTSE 100 insurer’s share price is down 21% over the past 12 months. At this level, I think it could be a good value investment for me.

Aviva provides wealth, retirement, and insurance solutions to 18.5m customers across the UK, Ireland, and Canada.

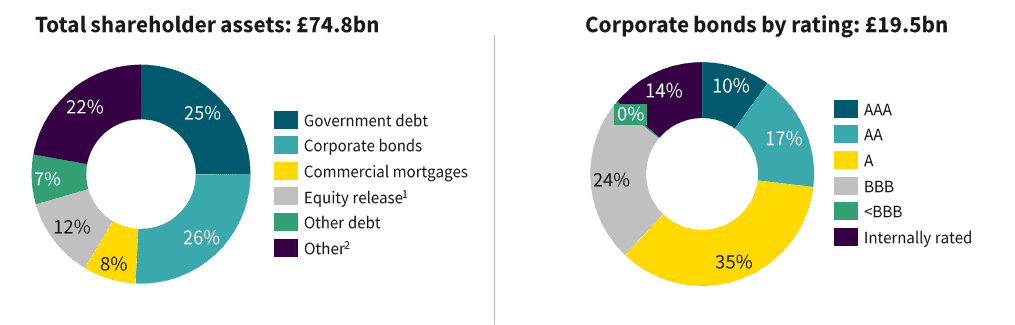

Its investment policy is relatively defensive, centred on sovereign and corporate bonds with limited exposure to stocks and emerging markets.

The firm’s solvency II ratio is 215%. This is above its 180% target. The company’s liquidity position points to a healthy balance sheet and sustainable dividends.

Indeed, the firm intends to launch a new share buyback programme in March to accompany its full-year financial results.

In my view this will add value for shareholders in a prudent manner, as the company waits for clarity on its annual performance before deploying capital.

In line with the wider insurance market, the business faces ongoing risks from high inflation. Rising prices have pushed up claims costs that could weigh on the Aviva share price.

Nonetheless, I can’t see much evidence of weakness in the latest financial results. I’d buy.

ITV

ITV (LSE: ITV) shares also have a market-leading yield at 6.5%.

The FTSE 250 broadcaster’s share price is down 35% over the past year. I think this could be another opportunity to scoop up a cheap dividend stock.

The media outfit trades for a price-to-earnings ratio of just 6.5. This looks like an attractive level for me to enter a position, with the shares seemingly priced for bad news.

The UK’s largest commercial broadcaster launched a new streaming service, ITVX, in November. It plans to invest over £800m into this project.

The financial impact remains to be seen, but I think this is an exciting development that could revive the company’s ailing fortunes.

Granted, the business faces risks from reduced advertising expenditure. A poor set of financial results could derail the positive momentum that’s lifted the ITV share price since September.

I’ll wait until the full-year results on 2 March before investing. However, barring any nasty surprises, the shares look undervalued to me at present and I’d add them to my portfolio.

My passive income portfolio

If I invested £1,000 between Aviva and ITV, my combined shareholding would produce an annual yield of more than £65.

What’s more, reinvesting the dividends within a Stocks and Shares ISA wrapper means I could benefit from a compounding effect over the long term.

By allocating some spare cash in these two dividend shares in 2023 I can make an important step on my journey towards financial independence.