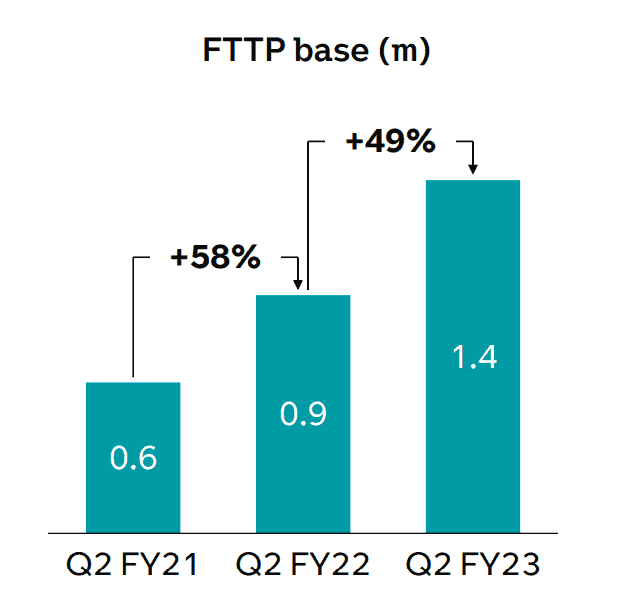

After losing nearly a third of their value, BT (LSE: BT.A) shares trail the FTSE 100 index by a significant margin over 12 months. Worries about the impact on its free cash flow generation from record capital expenditure on FTTP (fibre-to-the-premises) investments weighed on the share price in 2022.

However, there are signs BT’s fortunes could be changing. The shares have climbed nearly 12% this year. What’s more, the 6% dividend yield on offer is higher than the Footsie average. This has boosted the stock’s appeal as a passive income generator and I’m considering investing in the company as a result.

Dividends

BT has historically been a good choice for investors seeking passive income. However, its reputation was tarnished somewhat when dividends were suspended in 2020.

Should you invest £1,000 in BT right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if BT made the list?

Today, shareholder distributions are back. Crucially, dividend cover looks solid to me. At 2.6 times current revenues, I think there’s a nice margin of safety.

In addition, the firm’s aiming to generate extra cash. CEO Philip Jansen predicts the group will deliver £1.5bn of surplus cash each year by 2030.

Increased cash flows could be used to underpin the company’s commitment to raise dividend payments gradually over the coming years. Central to BT’s strategy for achieving this goal is a drive for cost savings and efficiency.

By combining its Global Services and Enterprise divisions into a new streamlined unit called BT Business, the company expects to save £100m by 2025. This should help the group meet its target to deliver £3bn in gross annualised savings over the same timeframe.

Risks

It’s not all plain sailing, however. One major risk facing BT shares is the company’s eye-watering debt pile at over £19bn. It’s worth bearing in mind that UK inflation is running in double digits. This puts pressure on the Bank of England to continue hiking the base rate throughout 2023.

Rising interest rates increase the costs of servicing debt. In this context, I’m concerned BT’s balance sheet looks vulnerable if monetary policy tightens further.

Furthermore, high capital expenditure remains a headwind for near-term cash flows. Although I view the rollout of fibre broadband to replace the UK’s copper-based internet network as a positive for the company’s long-term investment prospects, it could take a while for this to translate into upward momentum for the BT share price.

There’s also the thorny issue of increased labour costs. The company managed to reach a settlement with union bosses in late 2022 for a £1,500 pay increase offer that benefits 85% of BT Group’s workforce.

The end to the strike action was an encouraging development. However, I’m not sure the firm’s solution to finance this move by raising prices for the majority of customer contracts by 3.9% plus the current inflation rate from April will win many supporters.

I’m worried this move could ultimately lead to regulatory intervention from Ofcom in the worst case scenario.

Would I buy BT shares?

I’m certainly tempted by BT’s market-leading dividend. However, there are currently too many risks facing the company for me.

I think there are better FTSE 100 dividend stocks to buy and I won’t be adding BT shares to my portfolio today.