Aside from its pandemic lows, Rolls-Royce (LSE:RR) shares haven’t dropped to such levels since 2005. The stock may be 75% off its all-time high, but it’s risen by 150% over the past two years. So, here’s why I’m buying the shares at these unprecedented prices to potentially triple my money.

Flying prospects

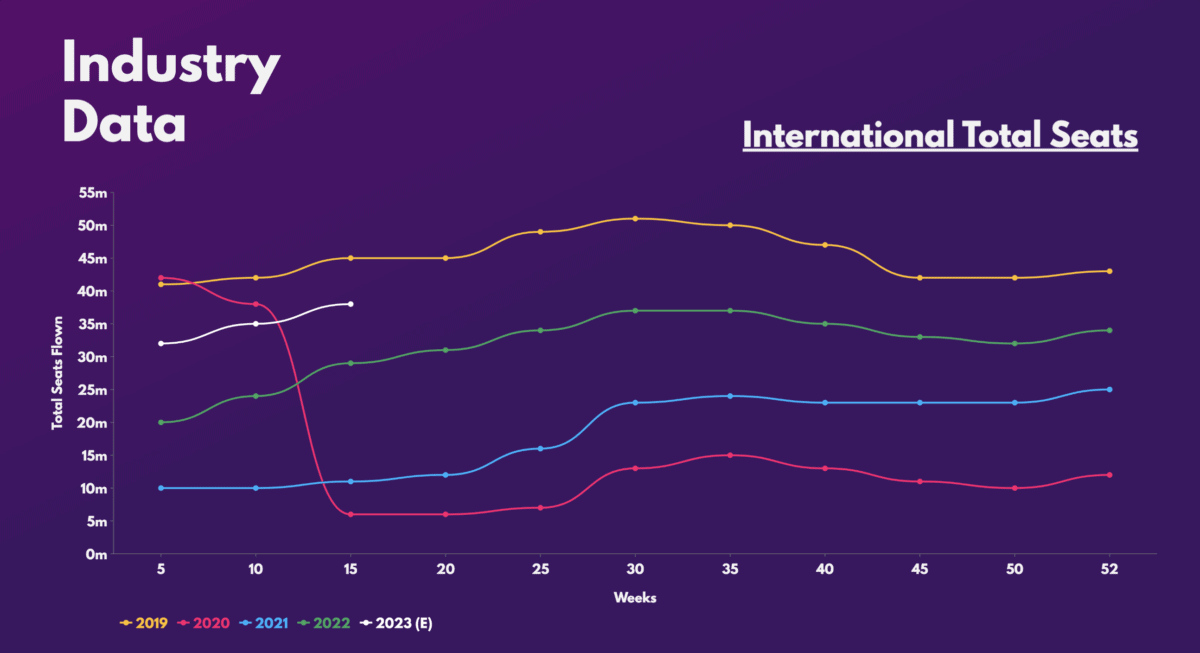

In the short term, Rolls has got the tailwinds of a rebounding travel sector. This is especially the case with long-haul air travel, where the company earns the bulk of its revenue as it services engines of long-haul commercial aircraft. As China gradually reopens and relaxes quarantine rules for international travel, I’m expecting flying hours to improve in 2023. Rolls-Royce should benefit from this.

The FTSE 100 conglomerate also has a number of promising long-term prospects. These include the development of its UltraFan engine and small modular reactors (SMRs), which would provide nuclear energy for Britain for decades to come. If successful, the British engineer could benefit substantially.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

A potential dividend engine

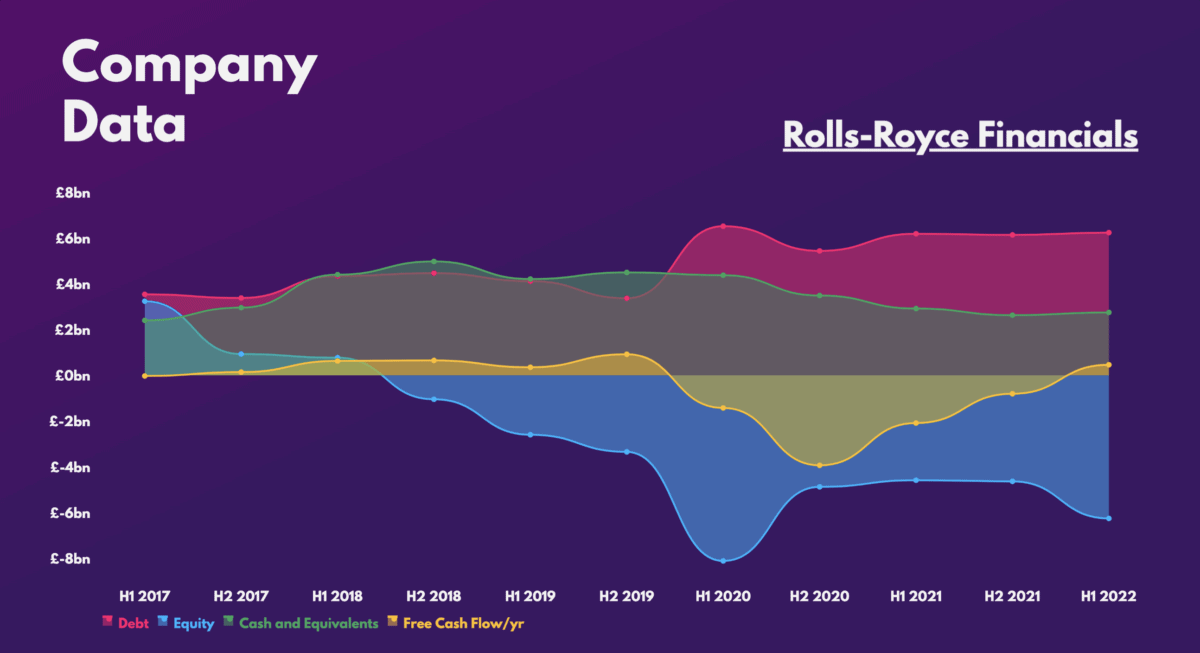

That being said, it’ll be the medium term that will determine whether the Rolls-Royce share price can continue rising. The current state of its balance sheet looks atrocious. Thus, an improvement to shareholders’ equity and debt levels is desperately needed. In order for this to happen, the firm will need to generate positive free cash flow. I’m expecting Rolls-Royce to achieve this by the time its full-year results are released next month.

All eyes will be on new CEO Tufan Erginbilgic to fix the eye-watering state of the business. The former BP Downstream Chief Executive has a reputation for strong turnarounds. Investors like me are hoping that his operational improvements continue to raise the manufacturer’s free cash flow.

Provided Erginbilgic is successful, analysts are forecasting a return to dividend payments as soon as FY24. This would see an increase in interest surrounding the stock, given its past allure as a passive income generator. In turn, this could see more institutions and investors buying in and pushing the Rolls-Royce share price upwards.

Ratings upgrades

To complement these prospects, a number of investment banks have upgraded their ratings on Rolls-Royce shares. Barclays is already rating the stock as ‘overweight’ with a price target of £1.10, and Jefferies recently joined the party too. The American bank upgraded its rating on the stock to a ‘buy,’ with a price target of £1.25.

The broker sees a number of positive catalysts for Rolls-Royce in 2023 and beyond. These mainly include potential credit upgrades and continued recovery in flight hours, which could see the biggest gain from a Chinese reopening.

These factors have led to me to decide to start a small position in Rolls-Royce once my preferred broker launches UK shares on its platform. After all, a number of Rolls-Royce’s current valuation multiples suggest that its current share price is relatively cheap.

| Metrics | Valuation multiples |

|---|---|

| Price-to-sales (P/S) ratio | 0.7 |

| Enterprise value-to-EBITDA | 10.2 |

The state of its financials aren’t desirable. But I’m confident in Erginbilgic’s ability to turn the FTSE stalwart’s fortunes around and eventually steer the share price back to its all-time high.