I don’t own National Grid (LSE: NG.) shares, but I’m considering adding the FTSE 100 utility giant to my portfolio this year. With a remarkable record of hiking dividends for over a quarter of a century, the stock has historically been a handy passive income generator.

Before I invest in a new company, I find it useful to consider how the shares have performed recently to inform my decision.

So, let’s explore what would’ve happened if I’d invested £1,000 in National Grid a year ago.

Should you invest £1,000 in BT right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if BT made the list?

One-year return

2022 was a dramatic year for global energy markets. Sparked by Russia’s invasion of Ukraine, commodity prices have been on a roller coaster journey. Given its central role in the UK’s electricity and natural gas transmission networks, it would make sense to think the chaos would have had a big impact on National Grid’s one-year return.

Surprisingly perhaps, after see-sawing over 12 months, the stock’s overall performance has been rather static. The share price fell just over 1% in that time frame.

One year ago, shares in the business were trading at £10.53 each. With a four-figure sum to invest, I could have purchased 95 National Grid shares for a grand total of £1,000.35 to be exact. Today, I’d be almost where I started with my shareholding valued at £988.

However, as I mentioned, dividends are one of this stock’s biggest draws. I’d have received one dividend payment during that period totalling £32.07.

This means my total return would be £1,020.07, so I’d have made a profit from holding the shares for just over a year — albeit a small one.

Where next?

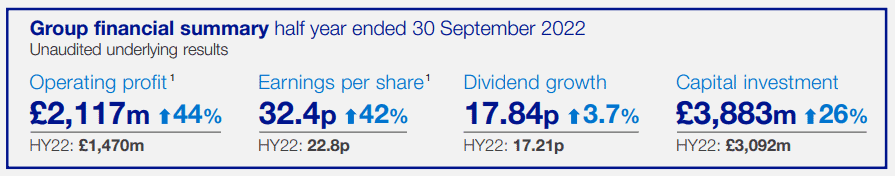

Although the 12-month return isn’t too exciting, I think 2023 could be a big year for the utility company. The latest half-year results contained some impressive numbers.

Beyond growth across the board in a number of key metrics, the company also updated its five-year financial framework. It now expects to invest up to £40bn between FY22-26.

Over 70% of this amount will be earmarked for decarbonisation of the group’s energy networks. I view this as a promising goal, given the importance of green energy in the 21st Century.

The company’s operations on the other side of the Atlantic have contributed significantly to the bottom line. Its half-year 23 operating profit rose by 25% in New York to £202m and by 11% in New England to £316m.

Granted, the huge capital expenditure required to deliver the network’s transition to net zero could reduce the money available to the company to meet its dividend forecasts. Currently, National Grid’s dividend yield is 4.96%, which comfortably beats the FTSE 100 average.

While weak dividend cover isn’t uncommon for utilities businesses, I think the company faces some challenges to maintain its stellar reputation as a top passive income stock.

Would I buy National Grid shares?

Yet despite potential risks to the dividend, I believe National Grid shares should perform well this year and beyond.

The finances appear healthy and its monopoly status makes the firm a relatively safe investment for me in a tricky economic environment. I’d buy.