The stock market has a tendency to rise in the week after Christmas and going into the new year. This is otherwise known as a ‘Santa Rally’. Unfortunately, the last week of 2022 wasn’t so jolly for the FTSE 100.

Nonetheless, this doesn’t necessarily spell bad news for the index this year. Here’s why!

A stingy 2022

Stock markets in the UK and US didn’t have the most amazing 2022. And to make things worse, they rounded off the year with falls in December. The FTSE 100 fell 1.6% in the final month of the year, while the S&P 500 slid by 6%.

This is a rarity given that, since the inception of the Britain’s main index, it’s only ever fallen just eight times in the month of December, including in 2022. December has got a strong history for being the best-performing month on average. Therefore, many investors are worried that its poor performance this round could paint a gloomy picture for UK equities this year.

A green year ahead?

On the flip side, AJ Bell investment director Russ Mould has plenty of reason to hope otherwise. The analyst states that, “such a sorry end to one year does not mean that the new year is guaranteed to lack cheer, at least if history is any guide”.

| Failed Santa Rally years | FTSE 100 return in the preceding year |

|---|---|

| 1985 | 18.9% |

| 1990 | 16.3% |

| 1994 | 20.3% |

| 2002 | 13.6% |

| 2013 | -2.7% |

| 2015 | 14.4% |

| 2018 | 12.1% |

As such, Mould is bullish on the FTSE 100. After all, six out of the seven times Santa failed to show up, the benchmark index rose at double-digit percentages in the following year. What’s more, the UK’s leading index is trading at much cheaper valuation multiples than its US counterpart. Additionally, it provides a much bigger opportunity to earn passive income through its bigger dividend yields.

War, inflation, recession, and rising interest rates remain dominant themes. So who is to say that what looks, on paper, like a cheap currency, coupled with a low earnings multiple and plump dividend yield for the FTSE 100, will not tempt buyers and confound the doubters in 2023? The US does not look as cheap relative to its own history as the UK and doesn’t come with the same dividend yield either (although buybacks usually form a larger part of US cash returns to investors).

AJ Bell Investment Director Russ Mould

What I’ll do

Will I be adjusting my portfolio based on this data then? Well, I’ll certainly be buying more FTSE 100 shares given the good track record. And it’s important to note that the bulk of the top companies’ income stems from outside the country. Hence, a local economic downturn shouldn’t be overly detrimental to earnings.

In fact, based on predictions from AJ Bell, the best-performing shares this year are expected to be in oil & gas, financials, mining, consumer staples and industrials. These industries make up a vast majority of the FTSE 100 index.

| Sector | Forecast pre-tax profit growth | Forecast dividend growth |

|---|---|---|

| Oil & Gas | 24% | 23% |

| Financials | 23% | 18% |

| Mining | 16% | 16% |

| Consumer staples | 12% | 12% |

| Industrials | 7% | 8% |

To complement this, their dividends are also forecast to grow substantially, which would be extremely beneficial for me as I seek to diversify my current growth-heavy portfolio with some passive income names.

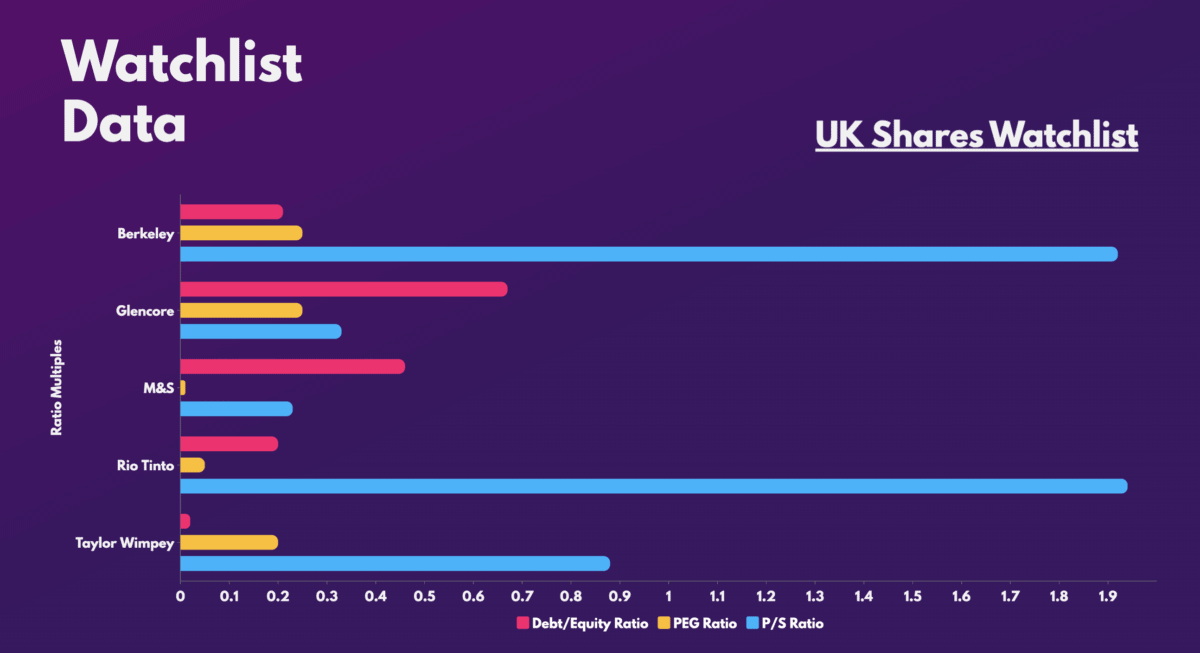

So, with a number of FTSE companies currently trading at low valuation multiples, here are a list of British shares I’m looking to buy very soon.