One of the FTSE 350‘s biggest losers last year was International Distributions Services (LSE: IDS). The stock lost more than 60% of its value at one point, but regained some of its losses towards the latter part of the year. So, here’s whether I think IDS shares can make a comeback in 2023.

Striking reality

Consumer discretionary spending took a hit in 2022 due to high inflation and the cost-of-living crisis. This impacted parcel deliveries. Additionally, unhappiness over below-inflation pay rises sparked a flurry of strike action across the country, and IDS’s Royal Mail was no exception.

To make things worse, talks between management and unions are still at a standstill. As a result, more industrial action can be expected this year unless a consensus can be found. This isn’t going to help the company’s top and bottom lines, which have already seen monumental drops.

Should you invest £1,000 in Royal Mail Group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Royal Mail Group made the list?

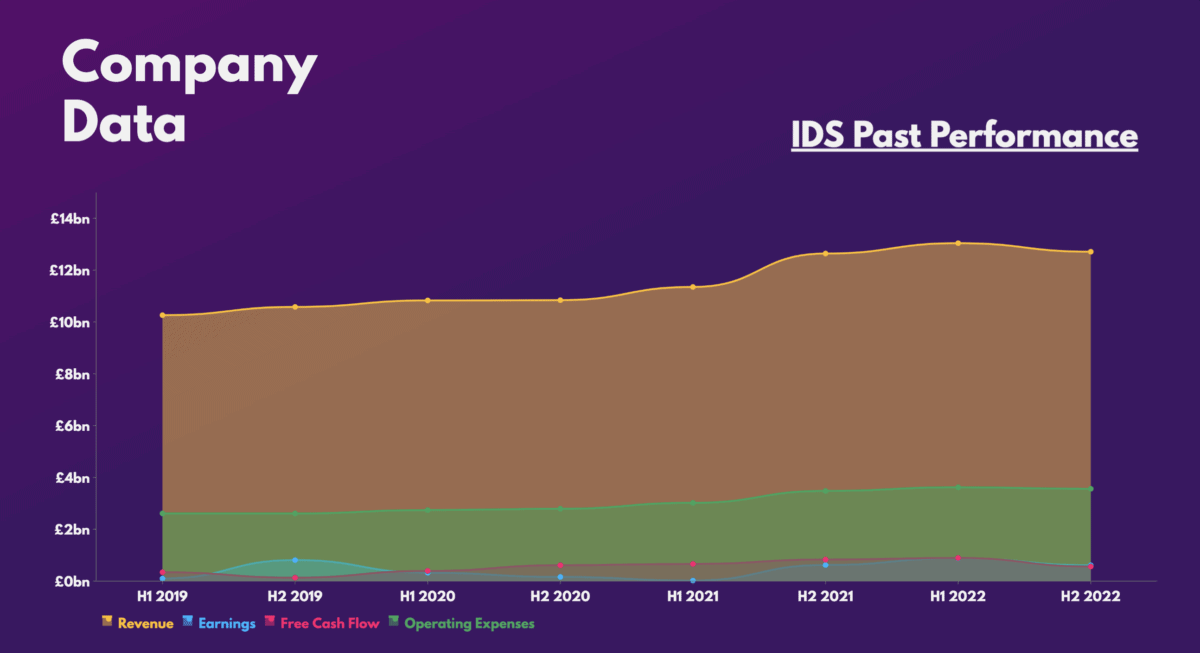

The numbers so far have been eye-watering and painful as many of IDS shares’ appealing traits have lost their lustre.

For one, the firm’s lure as a passive income stock has been jeopardised. That’s because its cash flow and balance sheet can no longer support dividend payments. Moreover, it isn’t expecting to turn a profit for the next year or two. Britain is forecast to enter a long recession too, which will further dent any hopes of a quick rebound for the group’s top line.

Restructuring required?

This has led to calls for CEO Simon Thompson to resign. If this does happen, I can imagine IDS shares seeing a relief rally, as it would give investors a glimmer of hope for a turnaround. That said, a lot still has to be done for an enduring increase in its share price.

A massive restructuring of its loss-making Royal Mail division needs to be executed, as its current business model makes it unprofitable given the steep increase in labour costs. A possible spin-off for the conglomerate’s international division GLS could release capital for such a restructuring. However, it would significantly dilute the value available for GLS shareholders. Therefore, the board will have to act decisively or risk the stock heading downwards again.

Delivering value?

The current valuation multiples for IDS shares indicate a possible bargain. But it’s worth noting that these are lagging indicators, which paint a false picture when considering its future outlook.

| Metrics | Valuation multiples |

|---|---|

| Price-to-earnings (P/E) ratio | 8.4 |

| Price-to-sales (P/S) ratio | 0.2 |

| Price-to-book (P/B) ratio | 0.6 |

| Enterprise value-to-EBITDA | 2.8 |

In its latest half-year report, the conglomerate mentioned that it doesn’t expect to see growth or to generate positive free cash flow in the medium term.

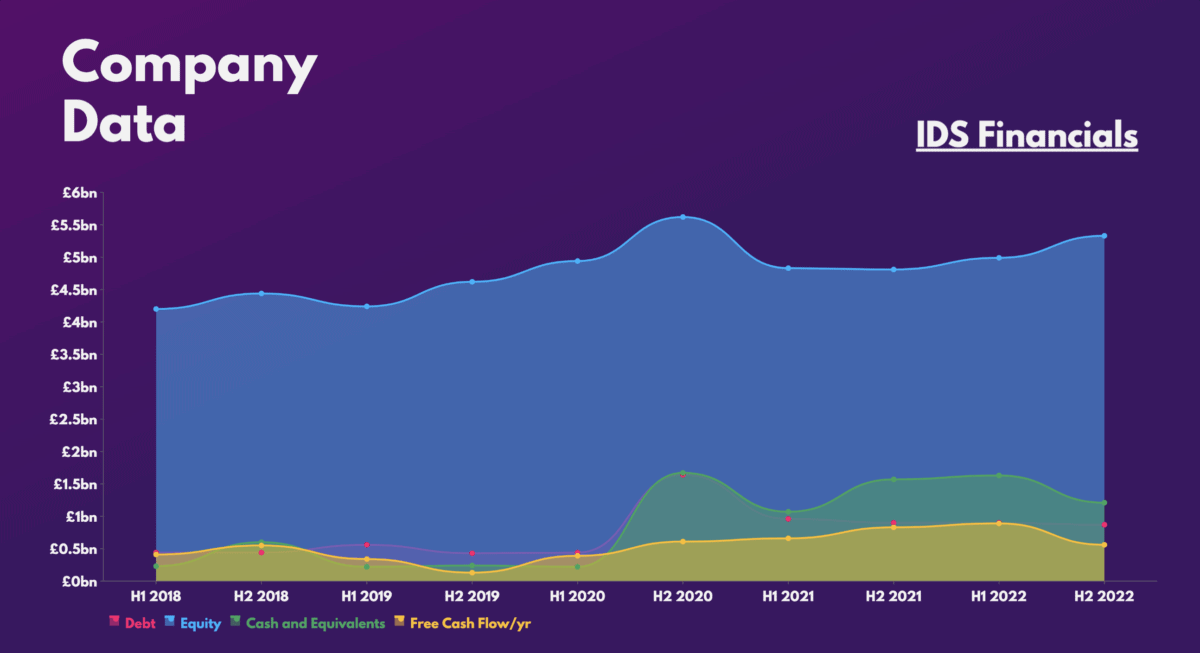

And despite having a rather healthy balance sheet, declining cash flow is going to be a worry because the business still has £872m worth of debt to pay off. If IDS stays unprofitable for too long, shareholders may risk dilution or it may have to service debt at a higher cost.

Overall, there’s potential for a turnaround in the share price, especially if a restructuring takes place before more damage is done. But Deutsche and Liberum have ‘sell’ ratings on the stock. And the lack of a clear path, the risk of prolonged unprofitability, and the current macroeconomic environment make it too risky a bet for me. I won’t be buying.