The FTSE All-Share Index has massively underperformed over the past decade when comparing its performance against the S&P 500. Nonetheless, I believe 2023 could be a great opportunity to snap up UK shares on the cheap for their high upside potential and passive income.

Resilient in recession

Over the past few months, Britain’s GDP has been contracting. As such, analysts are projecting it to continue its downward slide for most — if not all — of 2023. This would put the UK in one of the worst recessions it’s ever faced. In fact, a recent Financial Times report said the British economy will experience one of the weakest recoveries among the G7 countries in the year ahead. Therefore, it may seem odd to want to buy British-listed shares at such a time. But here are two reasons why I’m bullish.

The first is that stocks always bottom during a recession, before they go on to rally during an economic recovery. This is because the market tends to trade based on future cash flows and speculation. While Britain’s economy isn’t going to fare too well over the next year or two, I’ve got no doubt that it will eventually start growing again.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

More importantly, the biggest shares get much of their income from outside the UK. This is especially the case for the FTSE 100. As a result, a local recession shouldn’t impact the top and bottom lines of big firms too drastically. This is even more the case for commodities stocks and miners.

Interest for income

This leads me to why I think investing in UK-listed companies could be an amazing opportunity for passive income and growth this year. And research from Shore Capital seems to agree.

Based on predictions from broker AJ Bell, the best-performing UK shares this year are expected to be in oil & gas, financials, mining, consumer staples and industrials. To complement this, their dividends are also forecast to grow substantially, which would be extremely beneficial for an investor seeking passive income, such as myself.

| Sector | Forecast pre-tax profit growth | Forecast dividend growth |

|---|---|---|

| Oil & Gas | 24% | 23% |

| Financials | 23% | 18% |

| Mining | 16% | 16% |

| Consumer staples | 12% | 12% |

| Industrials | 7% | 8% |

Oil prices are predicted to remain at elevated levels this year. So it’s easy to see why the broker sees healthy double-digit growth in the sector’s pre-tax profits and dividends. Meanwhile, interest rates should remain at a reasonably high level. This should see banks such as Lloyds continuing to benefit from additional net interest income. Moreover, slowing inflation should allow for a consumer staples retailer like Tesco to expand its bottom line again.

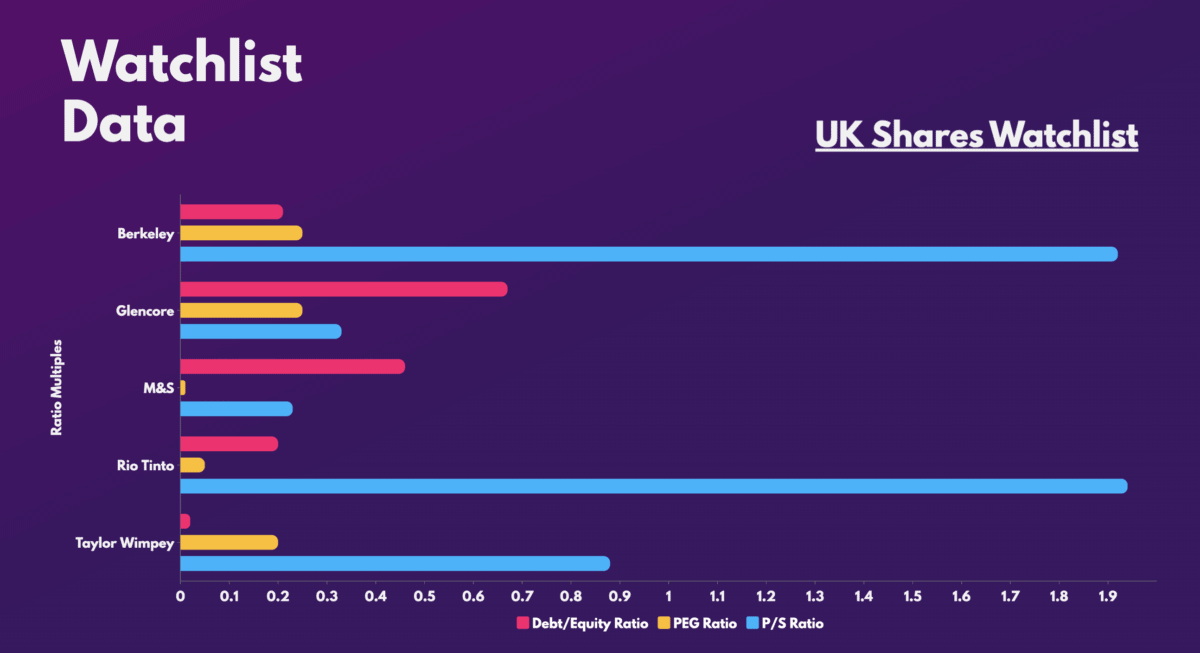

More notably, mid-cap UK shares such as housebuilders could present a buying opportunity as well. Property developers such as Taylor Wimpey have lost up to 40% of their value over the past year. Even so, house prices are only anticipated to decline by as much as 10%. With healthy balance sheets, good dividend cover, low valuation multiples and high target prices, buying UK housebuilder stocks at this level could be a bargain for me.

What I’ll do

Given that most UK shares are trading at relatively discounted valuations and have high dividend yields with sufficient dividend cover, I’ll definitely be looking out for such cheap names with good upside potential to invest in.