Vaccine maker shares have fallen from grace since Covid restrictions were lifted, and Moderna (NASDAQ: MRNA) stock has been no exception. Nonetheless, one analyst has a price target of $506 on the biotech stock, indicating that it could triple my money from current levels. Here’s my take.

Targeting cancer

mRNA technology only gained its fame through its application in Covid vaccines. It’s important to note however, that this was not its main function. In fact, its main purpose was to study and develop cancer treatments. And that’s exactly what it’s been doing as of late.

The company has been collaborating with Merck to find a cure for skin cancer. Moderna stock rallied by as much as 30% after it released its latest test results. The trial showed that patients with stage 3/4 melanoma saw a reduction in the risk of recurrence or death by 44% when combining Moderna’s new cancer vaccine with Merck’s immunotherapy treatment Keytruda.

Should you invest £1,000 in B&M right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if B&M made the list?

This is the first breakthrough with mRNA technology on the cancer front, and presents a breath of opportunities as the firm plans on conducting further studies in melanoma and other forms of cancer.

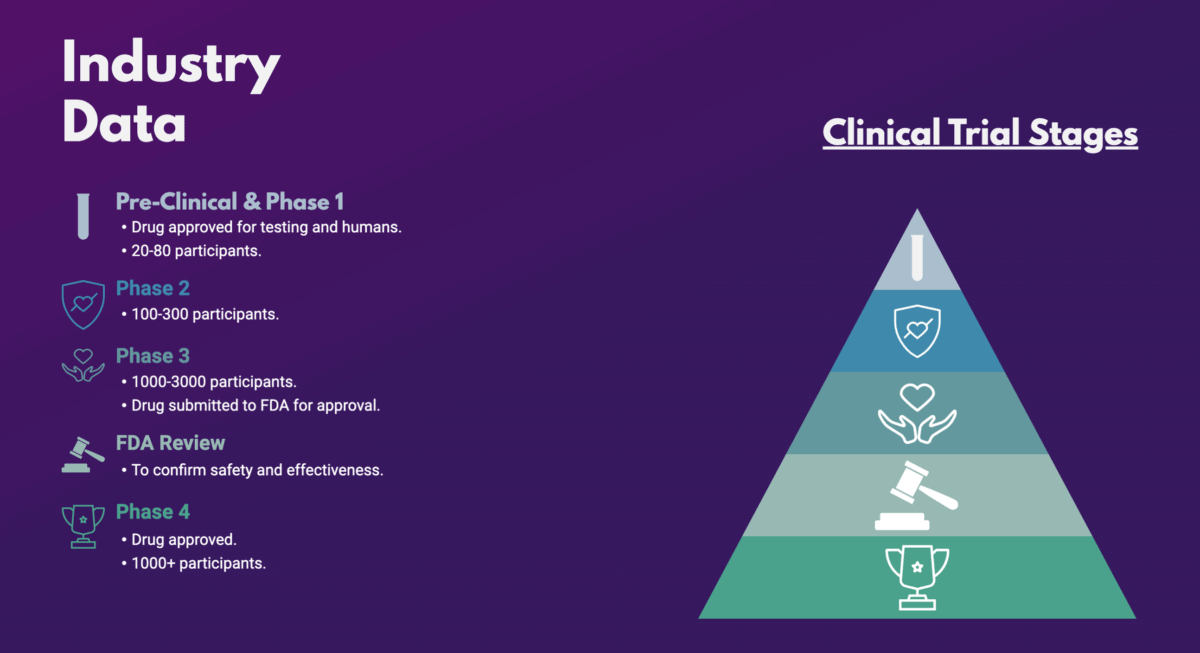

Nevertheless, it’s worth noting that these studies are still at a relatively early stage. Discussions are being held with regulatory authorities in hopes of launching a Phase 3 study this year. If successful, this could send Moderna stock soaring beyond its all-time highs. Analysts are estimating that the treatment could generate about $1bn in annual sales, and $5bn if its applications go beyond skin cancer.

A healthy relationship

Apart from new vaccines, it’s also encouraging to know Moderna has been able to continue its strong relationships with large organisations and governments. That’s been evident with its latest agreement with the UK government. The group recently agreed to continue investing in Covid vaccine research and development, while building a new vaccine manufacturing facility in Britain.

The 10-year deal will see as many as 250m mRNA vaccines produced annually. These include shots for flu and respiratory syncytial viruses that are in the development pipeline.

A jab from Pfizer

Investing in Moderna stock also presents its risks. The first is its ongoing legal battle with Pfizer and BioNTech regarding the use of mRNA technology. The second would be the conglomerate’s lack of revenue streams. Aside from Covid vaccines, Moderna currently has no other approved products to generate income.

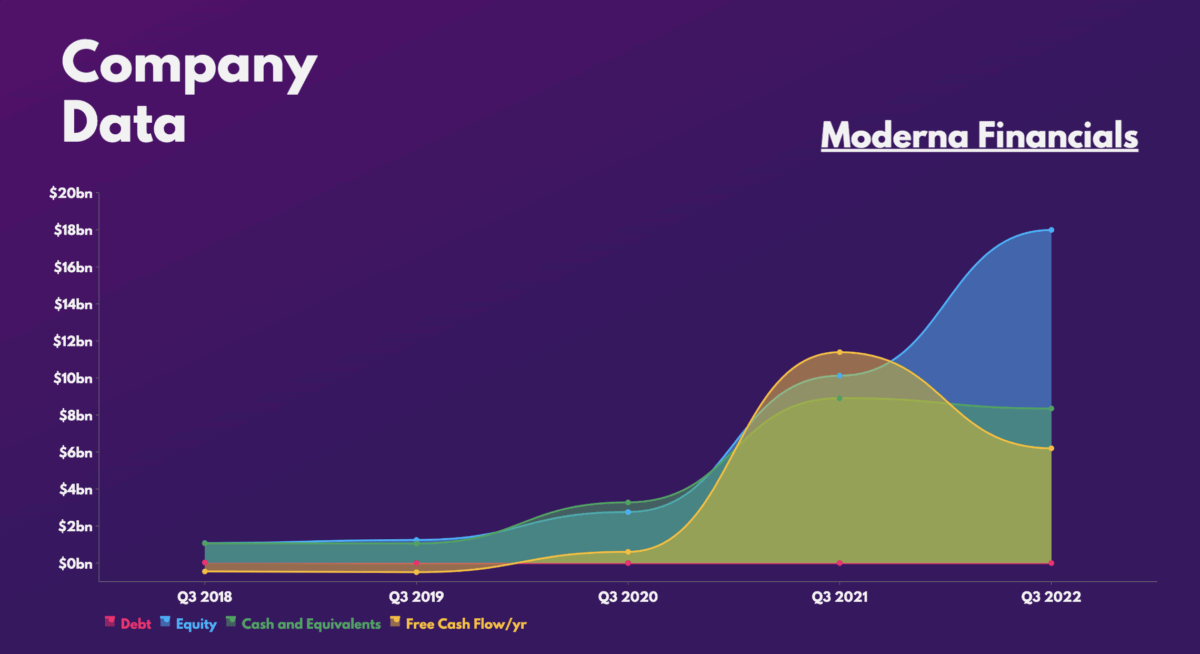

As such, it’s forecasting its 2022 sales to be in the range of $18bn to $19bn. This would mean little-to-no growth from the year before. What’s worse, analysts are projecting the company’s sales to drop by more than 50% this year as use of Covid vaccines wane.

While the short-to-medium term remains uncertain, it’s the future of cancer treatments that I’m excited about. In the meantime, I can see Moderna’s strong balance sheet and pipeline of other incoming vaccines propping up its stock.

Therefore, with relatively reasonable valuation multiples today, I recently opted to start a small position. The stock may only have an average price target of $219, but I have hopes that my money could very well increase 10-fold over the next decade if it makes an mRNA cancer vaccine breakthrough.

| Metrics | Valuation multiples |

|---|---|

| P/E ratio | 6.7 |

| PEG ratio | 0.09 |

| P/S ratio | 3.7 |

| EV to EBITDA | 4.4 |