Investors in Rolls-Royce (LSE:RR) shares had a torrid time last year. The stock dropped by as much as 50% at one point, but managed to regain some of its losses towards the second half of the year. With that in mind, I believe these five catalysts can continue to spur its strong momentum in 2023.

1. Long-haul flying hours take off

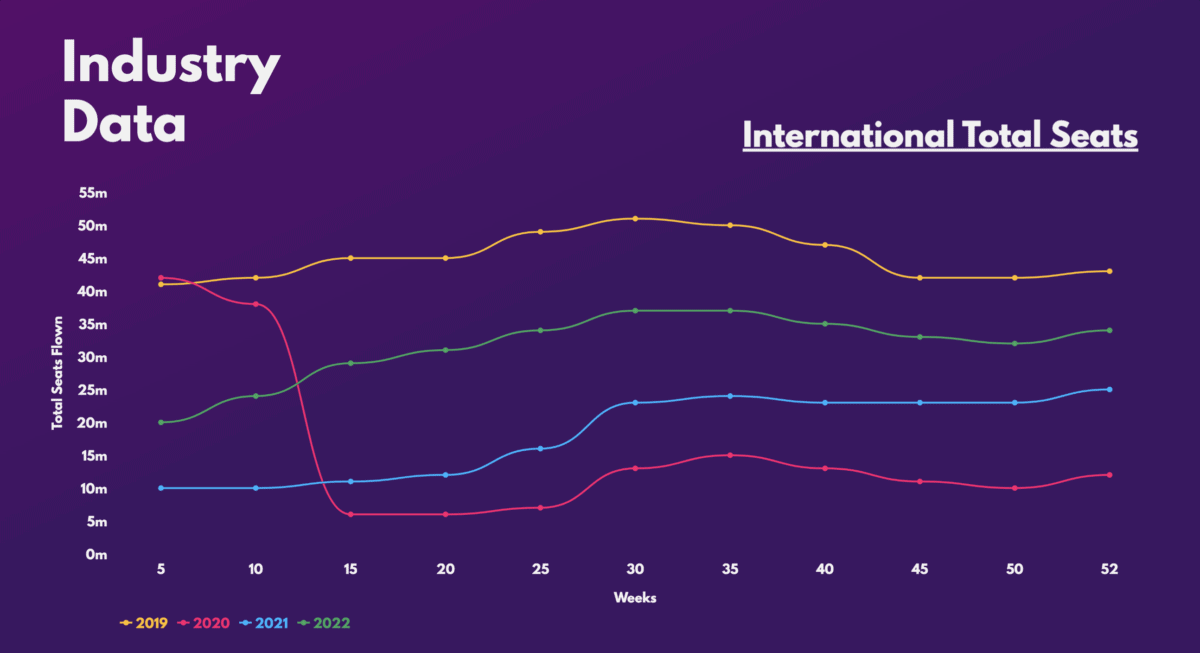

The FTSE 100 firm receives the bulk of its revenue from its Civil Aerospace division, particularly from servicing engines of commercial aircraft. These engines are mostly used on long-haul aircraft. Hence why flying hours came in at a mere 65% of pre-pandemic levels when Rolls-Royce last shared its Q3 numbers.

Travel to and from the far east has been limited due to strict Covid measures. Nonetheless, as airlines begin to reinstate routes, and China begins to ease travel restrictions, I’m expecting the engineer to benefit from the uptick in flying hours this year.

2. UltraFan progression

Additionally, tests of the firm’s UltraFan engine are set to take place very soon. The world’s biggest commercial aircraft engine is meant to improve fuel burn and provide more thrust. This should help airlines save on their operating costs as it runs on sustainable fuels.

What’s more, the technology can be retrofitted to Rolls’ older engines, further boosting its top line potential. As such, further good news in this regard could help propel Rolls-Royce shares higher.

3. Energy ventures continue to grow

Speaking of sustainable fuels, I’m most interested in the company’s energy segment. That’s because I believe it to be a key growth area for the conglomerate in the long term.

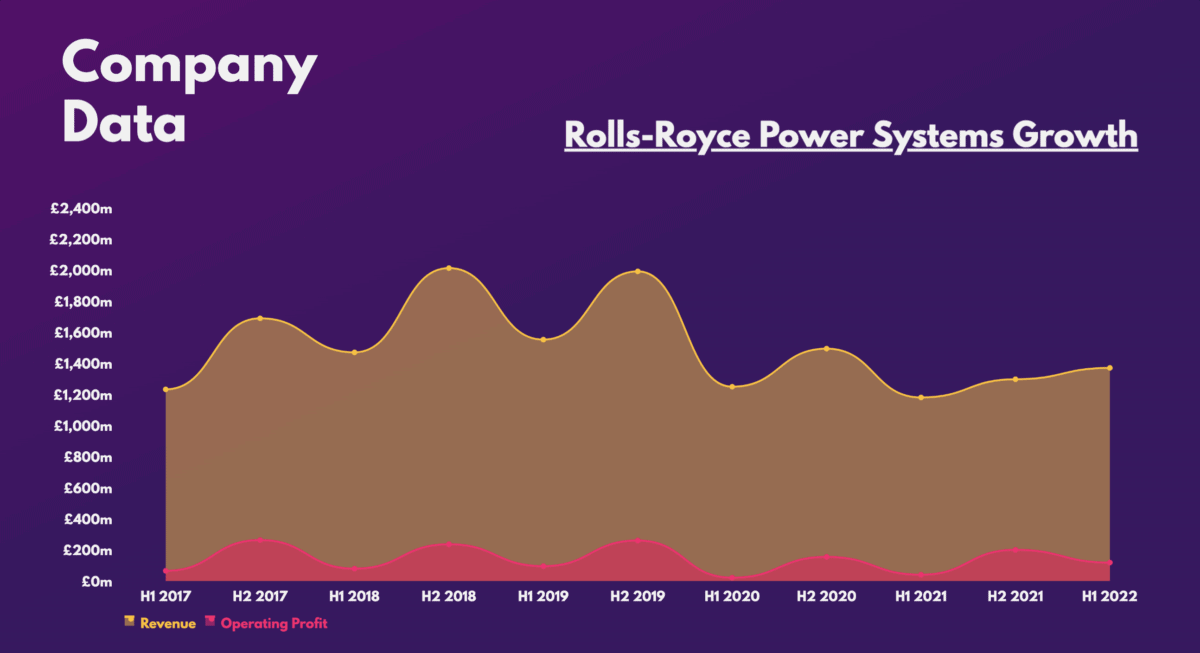

Most recently, the manufacturer reported strong growth in its Power Systems segment, where it creates propulsion systems and storage units. Management expects the market to remain strong in 2023. Thus, I believe the unit is well-positioned to take advantage of the ongoing energy transition.

Moreover, the firm is slowly beginning to make its small modular reactors (SMRs) a reality. Just last month, the producer shortlisted three potential sites for its first factory to manufacture parts for its fleet of nuclear power stations. For that reason, I imagine further progress this year to benefit the Rolls-Royce share price given the excitement surrounding the project.

4. New CEO improves structure

Departing CEO Warren East will be replaced by Tufan Erginbilgic. This move is expected to improve the operational efficiency of the company. The former BP Downstream CEO is renowned for his ability to lead a strong operational turnaround.

During his time at BP, Erginbilgic oversaw record profitability. If such performance can be replicated in his new role, I can see investors growing fond of the growth stock.

5. Improving cash flow

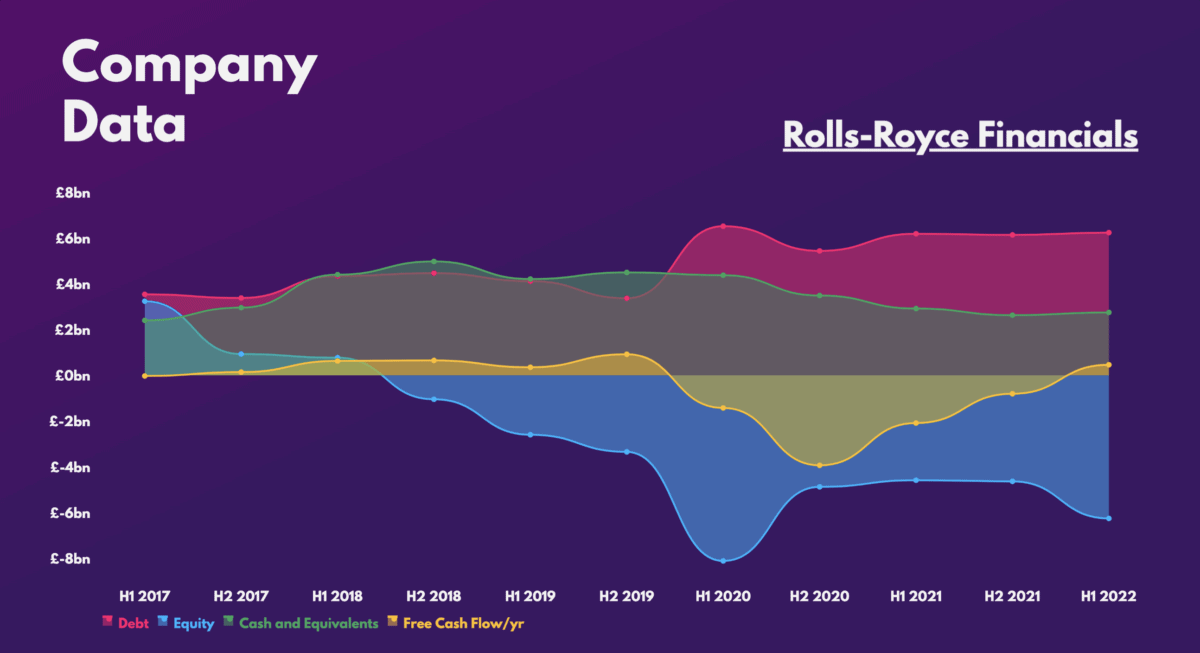

Speaking of profitability, this will be the ultimate metric by which investors will judge Erginbilgic. After all, the group still has a mountain of debt to address. There are no significant debt obligations due until 2024. However, Erginbilgic will have to ensure that free cash flow continues to grow in order to further prop up the Rolls-Royce share price, and reach net cash by 2025.

Provided these innovations and goals continue to make ground, I can see myself as an investor in the near future at the right price.