Rolls-Royce (LSE: RR.) shares were among the pandemic’s biggest losers. As international travel came to a standstill, demand for the FTSE 100 aerospace manufacturer’s products evaporated and the share price tumbled.

Thankfully, I didn’t buy the company’s shares, but if I had here’s how my position would look today.

Pandemic woes

If I’d invested £1,000 in December 2019, I’d have paid £2.34 per share. So I’d have scooped up 427 shares with 82p left as spare change.

Should you invest £1,000 in Balfour Beatty Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Balfour Beatty Plc made the list?

That might have seemed reasonable considering the Rolls-Royce share price was above £2 for nearly 10 years prior to that, bar a handful of occasions. Indeed, for a brief period the company’s shares were trading above £4.

However, that was before Covid-19 wreaked havoc on Rolls-Royce’s business. In March 2020, the share price fell off a cliff and it’s never truly recovered. At the time of writing, the company’s mired in penny stock territory, trading at 91p per share.

This means my initial investment would have shrunk to £388.57 today. To add to the misery, the last ex-dividend date was in October 2019, so I’d have no dividend income during the past three years to mitigate hefty losses.

Signs of a recovery

I’ve been bearish on Rolls-Royce shares this year, but I can see a strengthening case that they’re undervalued.

A return to the skies could lift the stock higher in 2023. In its most recent trading update the company revealed large-engine flying hours are at 65% of pre-pandemic levels. This is encouraging, but the trend will need to continue for the share price to stage a sustained recovery.

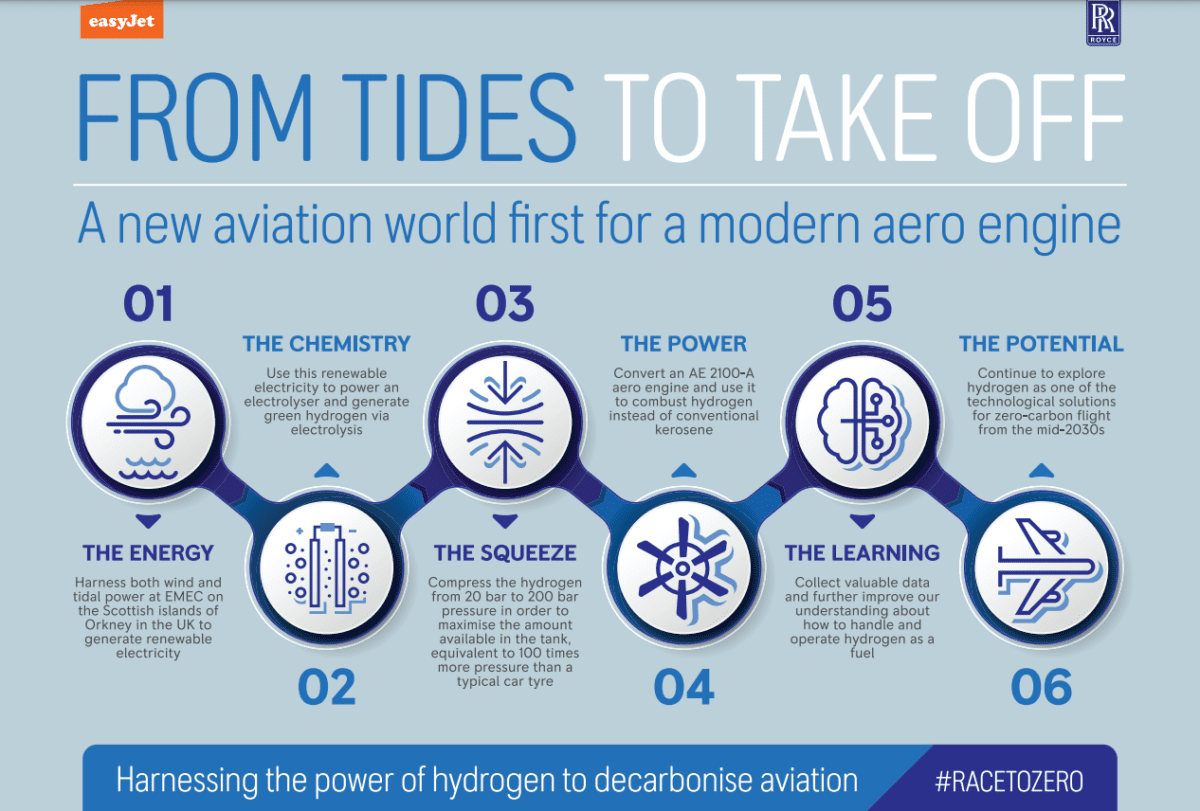

In addition, there are promising developments from a partnership with easyJet. In a landmark achievement with the FTSE 250 airline, Rolls-Royce confirmed last month that it conducted the world’s first run of a modern aero engine on hydrogen.

If the business can remain at the forefront of developing ground-breaking technologies for greener air travel, I think the long-term prospects for the stock are good.

Other aspects of Rolls-Royce’s business also give me reasons to be optimistic. With government backing, plans to build small modular nuclear reactors across the UK could prove a useful revenue source in years to come. The defence arm should continue to perform well too with the ongoing war in Ukraine acting as a tailwind.

However, the company is still grappling with a £4bn debt burden that it accrued in order to survive the turbulent years. This could continue to weigh on the share price, in my view.

Admittedly, Rolls-Royce has time to bring this under control, given most of its debt matures between 2026 and 2028. Nonetheless, if the UK economy enters a recession next year, it won’t be an easy environment for the business to get its finances into shape.

Should I buy the shares?

I think it’s unlikely the next three years will be as bad for Rolls-Royce shares as the last three have been. Despite some lingering concerns, I’m eyeing up the company for my portfolio for the first time.

I plan to rebalance my portfolio in the New Year. If I have some spare cash, I’ll buy some Rolls-Royce shares if they’re still trading below £1.