I’m searching for the best FTSE 100 dividend shares to buy for 2023. Should I invest in these high-yield stocks to boost my passive income?

Rio Tinto

I invested in Rio Tinto (LSE:RIO) in the summer to capitalise on heavy price weakness. That’s even though the outlook for commodities demand is plagued with uncertainty heading into 2023.

Of particular concern are worries over China’s economy for next year, and more specifically the impact of Covid-19.

Just before Christmas, a Bloomberg report showed a huge 37m people there had come down with the virus in one day. Fresh waves could be coming too as the Beijing government eases lockdown restrictions.

No wonder analysts at ING Bank have warned that there are “stormy seas ahead” for the commodities sector next year. On top of the pandemic-related dangers it also warned that “the metal-intensive property market in China remains very weak.”

Rio Tinto produces a wide range of metals including iron ore, copper and aluminium. They’re all consumed in vast quantities by Chinese manufacturers and construction firms.

But the company’s broad portfolio also gives it excellent links to the exciting growth industries of the next decade. So when economic conditions improve the FTSE 100 firm’s profits could explode.

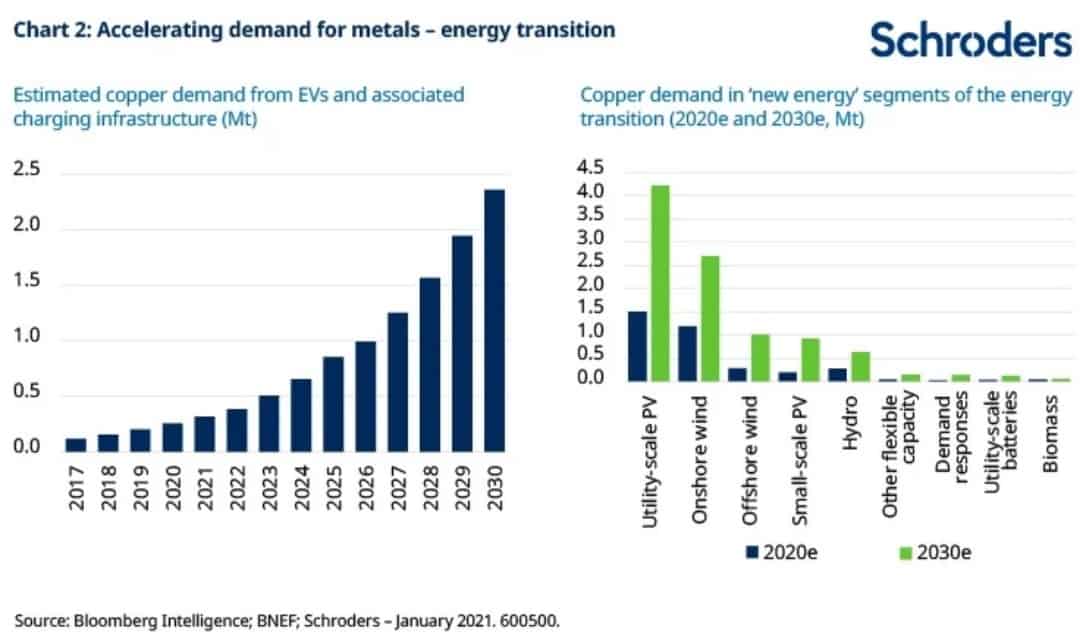

Copper revenues alone could rise strongly as demand for electric vehicles (EVs), consumer electronics, renewable energy technology and white goods increases.

And Rio Tinto’s ownership of multiple copper mines like Oyu Tolgoi in Mongolia — thought to be one of the world’s largest deposits — gives it brilliant exposure to this exciting commodities segment.

Today the FTSE 100 miner trades on a forward price-to-earnings (P/E) ratio of 10.9 times. It also carries a market-beating 6.2% dividend yield. At current prices I’m tempted to boost my Rio Tinto holdings.

Legal & General Group

I also find Legal & General’s (LSE:LGEN) ultra low share price highly tempting right now. In fact at current levels it offers even better value for money than Rio Tinto on paper.

The financial services giant trades on a forward P/E ratio of 7.2 times. It also commands a mighty 7.8% dividend yield, more than double the FTSE 100 average.

Legal & General’s long history of impressive cash generation makes it a go-to stock for many income investors. Its strong balance sheet even allowed it to continue delivering big shareholder payouts during the pandemic.

Encouragingly for 2023 the stock remains flush with cash too. Its Solvency II capital ratio ranged between between 225% and 230% as of mid-November. This gives me confidence that it should pay more huge dividends even if trading conditions worsen.

My chief worry as an investor is that Legal & General operates in a highly competitive sector. It therefore has to paddle extremely hard to generate decent earnings growth.

But if I had spare cash to hand, I’d still invest in it today. I expect profits here to soar over the long term as rising elderly populations fuel demand for pensions and certain other financial products.