Scottish Mortgage Investment Trust (LSE:SMT) is one of the most popular investment trusts in the UK. But it hasn’t performed well in 2022.

Here, I’m going to review SMT’s 2022 performance. I’ll discuss whether, as a holder, I would buy more shares for 2023 and beyond.

2022 performance review

It’s fair to say that Scottish Mortgage’s performance in 2022 has been disappointing. At the start of the year, SMT’s share price was 1,338p. But, as I write (on 21 December), it’s 720p. That represents a decline of around 46%. Ouch!

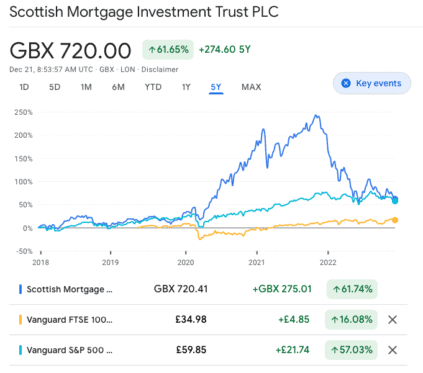

However, we need to put this in perspective. Over the last five years, SMT has still delivered a solid return of about 60%. And as the chart below shows, higher than the returns from the FTSE 100 and the S&P 500 indexes (I’ve used Vanguard tracker funds as proxies for these indexes).

Meanwhile, over the 10 years to 30 November, the trust delivered a return of about 471% – more than double the return from its benchmark, the FTSE All World index.

It’s also worth noting that while SMT has underperformed, it’s done better than Cathie Woods’ ARKK Innovation ETF, which has a similar investment philosophy.

Why the sharp drop?

As for why the trust has performed poorly in 2022, a lot has to do with the fact that financial conditions have changed dramatically.

This year, interest rates have risen sharply. As a result, investors have put a lot more focus on profits, and valuations. This has hurt SMT more than other funds and trusts because it has a focus on high-growth companies, many of which have high valuations and no profits.

Should I buy more SMT for 2023?

So should I buy more shares in the trust? Well, as a long-term investor, I still think there’s a lot to like about SMT.

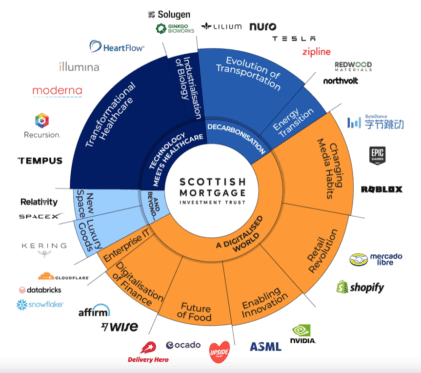

For starters, it gives me exposure to powerful themes and trends including:

- Decarbonisation

- Digital transformation

- The evolution of transportation

- Healthcare innovation

These are trends I want exposure to. They are likely to create many investment opportunities in the years ahead.

Secondly, it provides exposure to innovative companies such as Tesla, Nvidia, Moderna, Snowflake, Roblox, and Wise.

A lot of these stocks are higher risk, so I wouldn’t buy them individually. However, I’m happy to own them as part of a diversified investment trust.

Additionally, SMT gives me exposure to unlisted companies such as Swedish battery developer Northvolt and Fortnight creator Epic Games. Normally, unlisted companies are only accessible to sophisticated investors through venture capital funds.

The fact that I can get all this, at a very low fee of just 0.32% per year (plus trading commissions), is appealing to me.

So I plan to buy some more SMT shares for 2023.

High-risk

Having said that, this is a high-risk investment. If interest rates keep rising, growth stocks could fall further, sending the share price lower.

Stock-specific risk is another issue to consider. SMT tends to make big bets on individual companies (Moderna is about 10% of the trust currently). This approach can backfire if things go wrong.

Given these risks, I’m going to keep my holding in Scottish Mortgage small, relative to my overall portfolio.