Shares in Wise (LSE: WISE) may be down 20% this year. Despite that, its underperformance shouldn’t be overshadowed by its momentous growth from its bottom in June. In fact, the stock has recovered by approximately 100% since then. Having said that, I think the FTSE share is still worth exploring.

Flowing with cash

Wise mainly facilitates the transfer of money across borders, and earns the bulk of its revenue from taking a percentage of each transfer. With a market cap of around £6.1bn, the company is actually big enough to be a constituent of the FTSE 100. But it misses out due to its standard listing status.

Nonetheless, the size of the conglomerate is big enough to pique my interest. That’s because Wise’s long-term future looks very promising. The firm has already set itself up as a go-to international money transfer provider, and it still has plenty of room to grow.

Should you invest £1,000 in Aston Martin right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Aston Martin made the list?

Additionally, the amount of global money transfers is forecasted to double by 2030. With a strong brand and competitive rates, the growth stock is well positioned to capitalise as digital payments become increasingly popular.

Taking money

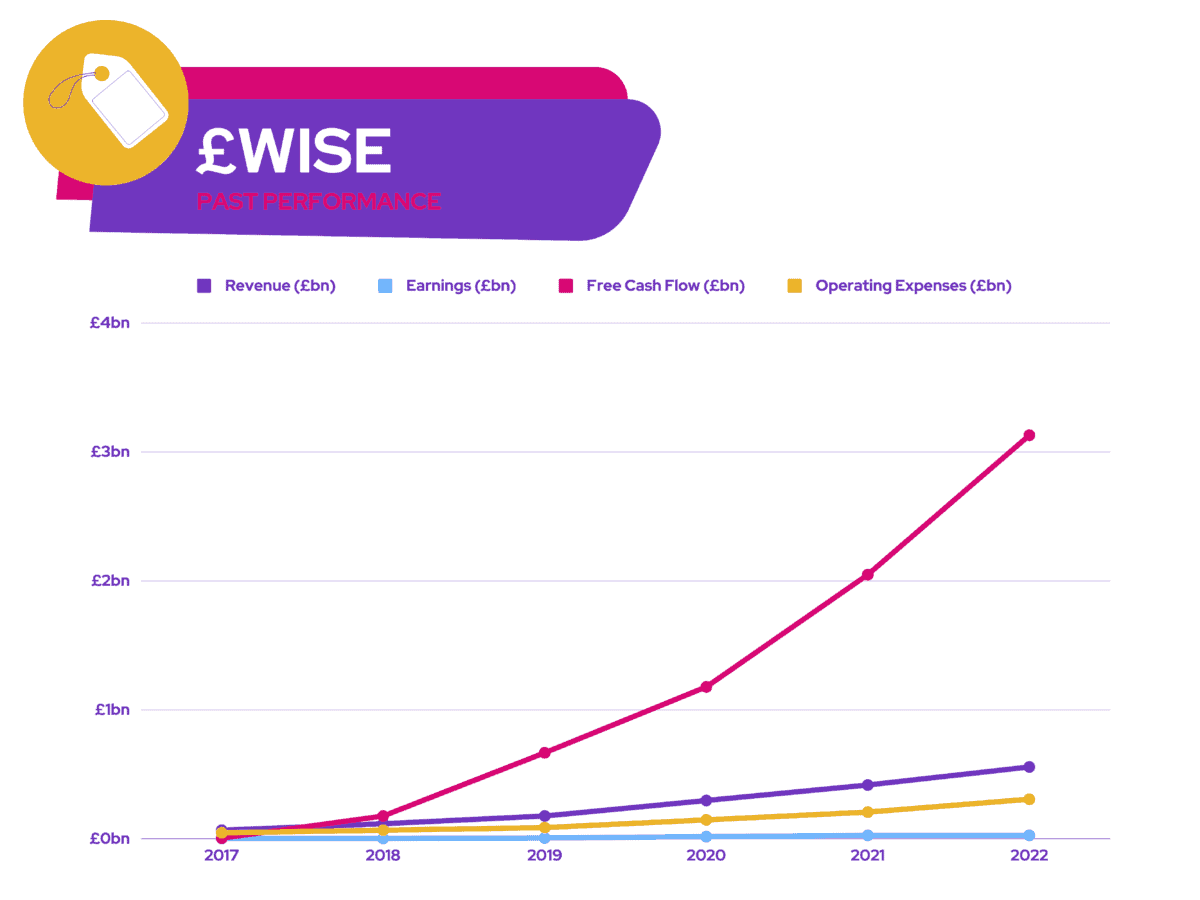

Wise has been growing its top line at an unprecedented rate. In its latest-half year report, management reported yet another set of satisfactory numbers, which surpassed analysts’ estimates.

| Metrics | H1 2023 | H1 2022 | Growth |

|---|---|---|---|

| Revenue | £398m | £256m | 55% |

| Total income | £416m | £255m | 63% |

| Profit before tax (PBT) | £51m | £19m | 173% |

| Diluted earnings per share (EPS) | 3.61p | 1.23p | 193% |

Along with that, Wise also witnessed an uptick in customer volumes and numbers. This is great news as it shows that the group is aggressively grabbing market share from its competitors. Even better, it managed to increase its take rate. That’s the amount of commission it takes per transaction.

| Metrics | H1 2023 | H1 2022 | Growth |

|---|---|---|---|

| Customers | 10.5m | 7.6m | 38% |

| Volume | £51.3bn | £34.4bn | 49% |

| Volume per customer | £4,900 | £4,550 | 8% |

| Total income take rate | 0.81% | 0.74% | 0.07% |

Customer satisfaction went up too. Now, more than half of all its transactions were completed instantly, compared to 39% in Q2 last year. This is a result of its new partnerships, which allowed for faster transfers in Hong Kong, Chile, and Japan.

To complement this, the board now expects a total income compound annual growth rate (CAGR) of more than 20% in the medium term, as it continues on its growth journey. All while aiming for its adjusted EBITDA margin to come in at or above 20%. Things are definitely looking up for the payments facilitator.

Wise investment?

So, should I invest in Wise shares then? Well, the strong tailwinds associated with increasing digitalised payments would suggest so. However, it should be noted that it also faces stiff competition from neo-banks such as Revolut.

Moreover, I need to assess whether it’s currently trading at a fair price. And unfortunately, its valuation multiples suggest that the FTSE stock could be overpriced. For starters, its price-to-earnings (P/E) ratio comes in at a sky-high 107. Nevertheless, given its status as a growth stock, looking at its forward earnings multiples could give a much better indication. But even so, its price-to-earnings (PEG) ratio stands at a whooping 64, while its price-to-sales (P/S) ratio sits at 9.

Taking those factors into consideration, I can understand why the likes of Barclays and Liberum think the stock is overpriced. That being said, I’m still a big fan of the brand, its vision, and its financials. As such, I’ll be keeping it on my watchlist for now and may start a position when its multiples become cheaper.