Warren Buffett is renowned for his ability to outperform the market. His fund, Berkshire Hathaway, has managed to beat the S&P 500 since its conception. With that in mind, here are three of the investor’s best rules I could follow to potentially emulate his success.

1. Never lose money

This is undoubtedly one of the most important lessons Buffett has taught. As he famously said, “If you’ve been playing poker for half an hour and you still don’t know who the patsy is, you’re the patsy”. This means that if you don’t take necessary precautions to protect your money, you are likely to lose it.

So, how do I protect my money? The Oracle of Omaha suggests not being frivolous with my investments. Don’t gamble, and don’t go into an investment with a cavalier attitude. He advises investors to stay informed and to do their homework. This is why Warren Buffett only invests in companies he thoroughly researches and understands.

Nonetheless, contrary to popular belief, Buffett believes the most important quality for an investor isn’t intellect. The stock market will experience swings, as has been the case this year with a bear market. But in good times and bad, it’s temperament that prevails.

2. Good business fundamentals

Warren Buffett’s investing philosophy stems from Benjamin Garham, also known as the father of value investing. So when searching for a stock to invest in, he looks for businesses that satisfy certain criteria:

- Dominant business and brand reputation

- Consistent operating history

- High and sustainable profit margins

- Strong cash flow and balance sheets

- Favourable long-term prospects

The idea is to look for stocks that aren’t overpriced, and have the potential to keep my portfolio afloat when the stock market takes a turn for the worse. And in this instance, diversification has been a key strategy for mitigating risks.

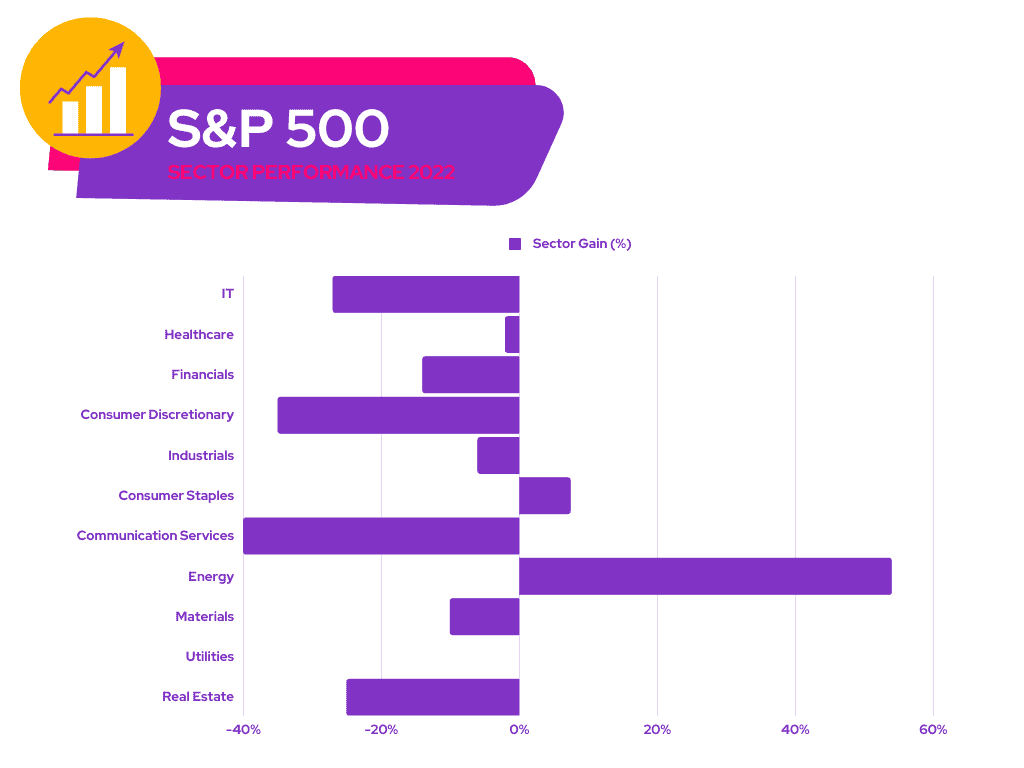

Consequently, Berkshire Hathaway has managed to outperform the main US indexes this year. This is because the fund is invested in sectors such as commodities and energy, which have seen healthy gains compared to the monumental declines in tech and consumer discretionary stocks.

3. Wonderful potential at fair prices

Part of Buffett’s investing philosophy is to buy wonderful companies at fair prices, rather than fair companies at wonderful prices. That’s because when he buys a stock, he plans to hold it “forever“. Therefore, an investment’s potential to generate solid profits and improving returns for years is paramount.

But what constitutes fair value? Well, Warren Buffett uses a number of valuation multiples to help determine whether a company is fair valued. These include ratios such as price-to-earnings (P/E), price-to-earnings growth (PEG), price-to-sales (P/S), and many more.

Apart from that, there are also other indicators used to distinguish whether an investment is undervalued and has potential. These include a business’ return on assets (ROA), equity (ROE), and capital employed (ROCE). Companies that exhibit high returns include the likes of Alphabet and Apple.

More importantly, the Oracle has practiced what he preaches. His fund has generated healthy returns with an average ROA of 5%, ROE of 10%, and ROCE of 7% over the last decade, beating many other funds. For that reason, I can understand why Buffett is so highly regarded, which is why I’ll be following his advice before making future investments.