Scottish Mortgage Investment Trust (LSE: SMT) has a reputation for delivering market-beating returns. Investors who bought shares a decade ago would be sitting on a 471% return today. Few other FTSE 100 stocks could match these gains.

Yet 2022 proved brutal for Baillie Gifford’s flagship investment trust. Many of its key holdings endured severe haircuts, causing the Scottish Mortgage share price nearly to halve this year.

So, can the trust’s rebalanced portfolio return to explosive growth in 2023? Here’s my take.

Should you invest £1,000 in Scottish Mortgage right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Scottish Mortgage made the list?

International exposure

Scottish Mortgage’s top holdings are largely concentrated in the US. Therefore, it’s unsurprising the share price suffered as the Nasdaq and S&P 500 declined into bear markets this year.

Three of the fund’s top five positions are US stocks, although Dutch semiconductor supplier ASML and Swedish lithium-ion battery maker Northvolt also feature.

| Scottish Mortgage holdings | Portfolio weighting |

|---|---|

| Moderna | 9.9% |

| ASML | 6.8% |

| Tesla | 4.9% |

| Illumina | 4.1% |

| Northvolt | 3.6% |

The trust might benefit from an improved stock market performance from its biggest holdings next year.

For instance, Moderna stock — Scottish Mortgage’s largest position — is currently in a strong uptrend. The pharmaceutical company has been buoyed by news that its new mRNA skin cancer vaccine could reduce the risk of death or recurrence of melanoma in patients. The vaccine’s about to enter stage 3 trials.

Moving away from China

Scottish Mortgage adds international diversification to my portfolio. However, under manager Tom Slater’s leadership, the trust has slashed its exposure to Chinese stocks.

The regulatory environment in China remains challenging, and we are concerned that ongoing uncertainty will harm the risk-tolerant culture that has driven the long-term success of China’s private sector.

Scottish Mortgage interim statement, 11 November 2022

That’s not to say it’s abandoning China altogether. Stocks like e-commerce platform Meituan and online agricultural marketplace Pinduoduo are still prominent investments.

Nonetheless, considering the country’s economic slowdown and the looming prospect of its first major Covid-19 surge, I see logic in the decision to look elsewhere for growth in 2023.

Investing in innovators

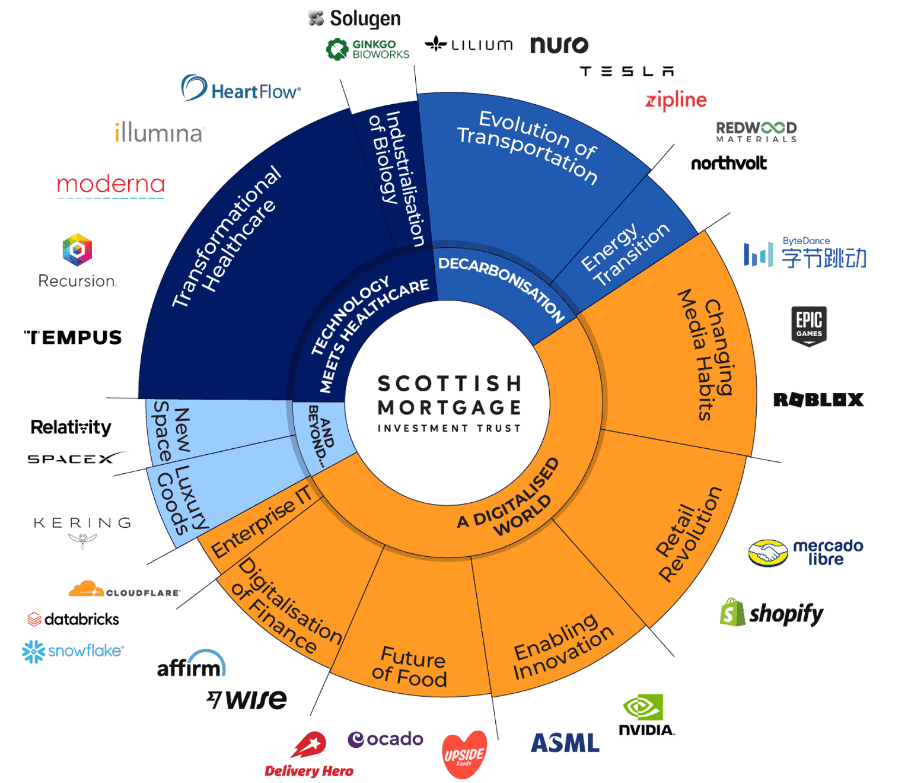

Ultimately, innovation is paramount to the trust’s investment philosophy. Its central mission is “to own and support the world’s most exceptional growth companies“.

In its search for future innovators, the fund’s unlisted equity exposure has ballooned to around a third of the portfolio. This concerns me.

Scottish Mortgage was forced to write-down the value of its private equity investments earlier this year amid spiralling inflation.

Admittedly, unquoted shares can offer big growth opportunities. However, they’re notoriously difficult to value. I believe the fund’s private equity exposure is too high. After all, it’s breached the 30% limit, which restricts Scottish Mortgage’s ability to deploy further capital.

How the trust manages this could be critical to next year’s performance.

Should I buy Scottish Mortgage shares?

I already own Scottish Mortgage shares and they’ve suffered in this year’s drawdown. I’m bracing for further falls ahead, depending on the severity of possible global recessions.

Nonetheless, at around 720p today, I believe the share price offers long-term value for me given the stock’s high risk/reward profile.

If economic conditions improve, 2023 could mark the beginning of a growth stock recovery. I’d buy more Scottish Mortgage shares before that happens to capitalise on any potential gains.