At one point, Netflix (NASDAQ: NFLX) stock lost more than 70% of its value this year. Nonetheless, the stock has climbed by 70% since. After such a recovery, could the stock still be worth buying at its current share price?

Showing the numbers

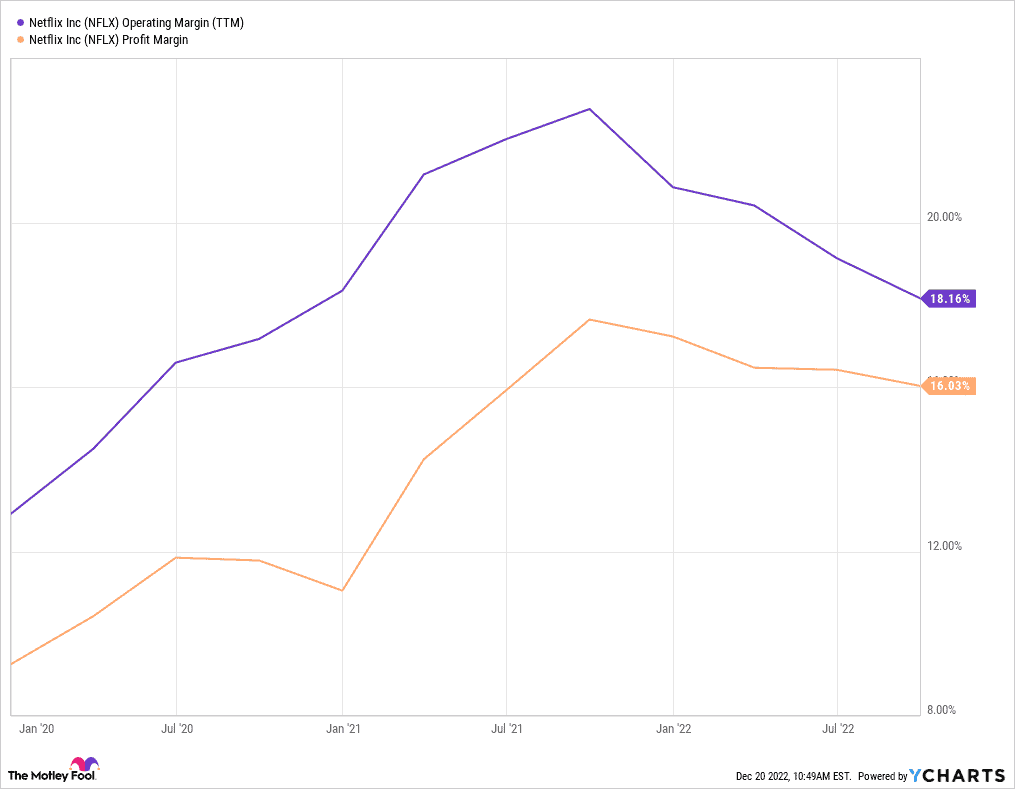

Since hitting an all-time high in 2021, Netflix stock has lost a big chunk of its value this year. As economies reopened and people spent less time watching shows and movies, the streaming service suffered. Along with that, so did its margins. Nevertheless, it’s still worth pointing out that the company’s operating and profit margins remain elevated as compared to pre-pandemic levels.

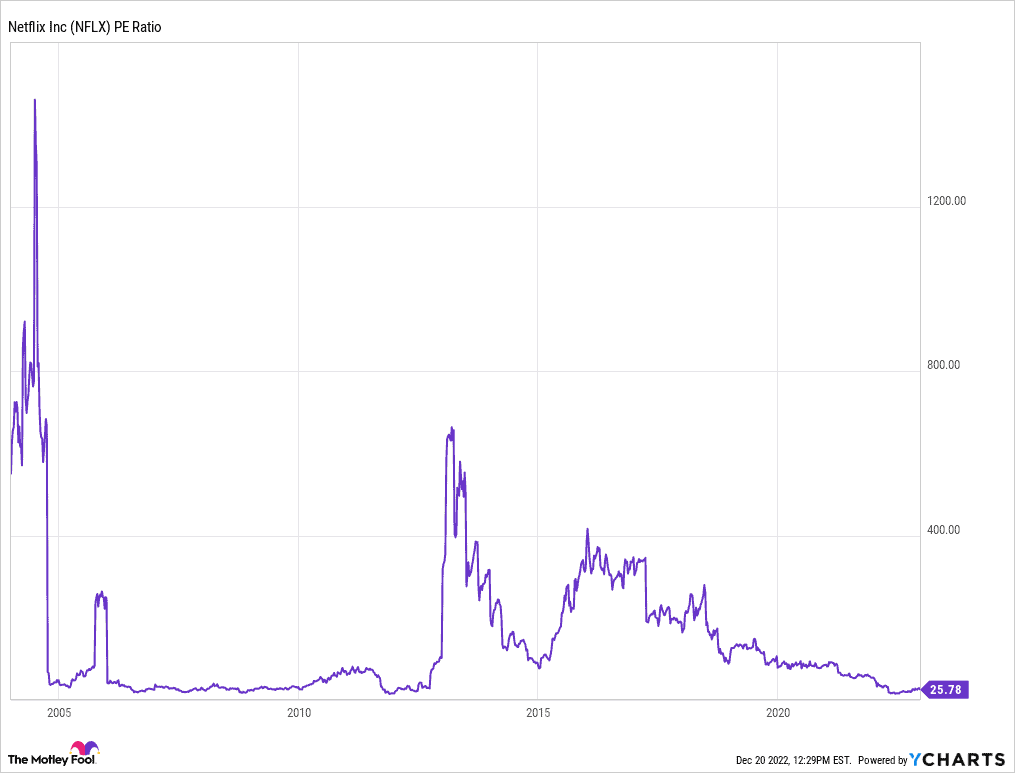

But that hasn’t stopped the stock from hitting a low not seen since 2019. But what’s even more eye-popping is its current price-to-earnings (P/E) ratio, which is 26. Although this is still higher than the S&P 500‘s average of 21, Netflix stock hasn’t traded at such a cheap valuation in almost a decade.

Gaming with possibilities

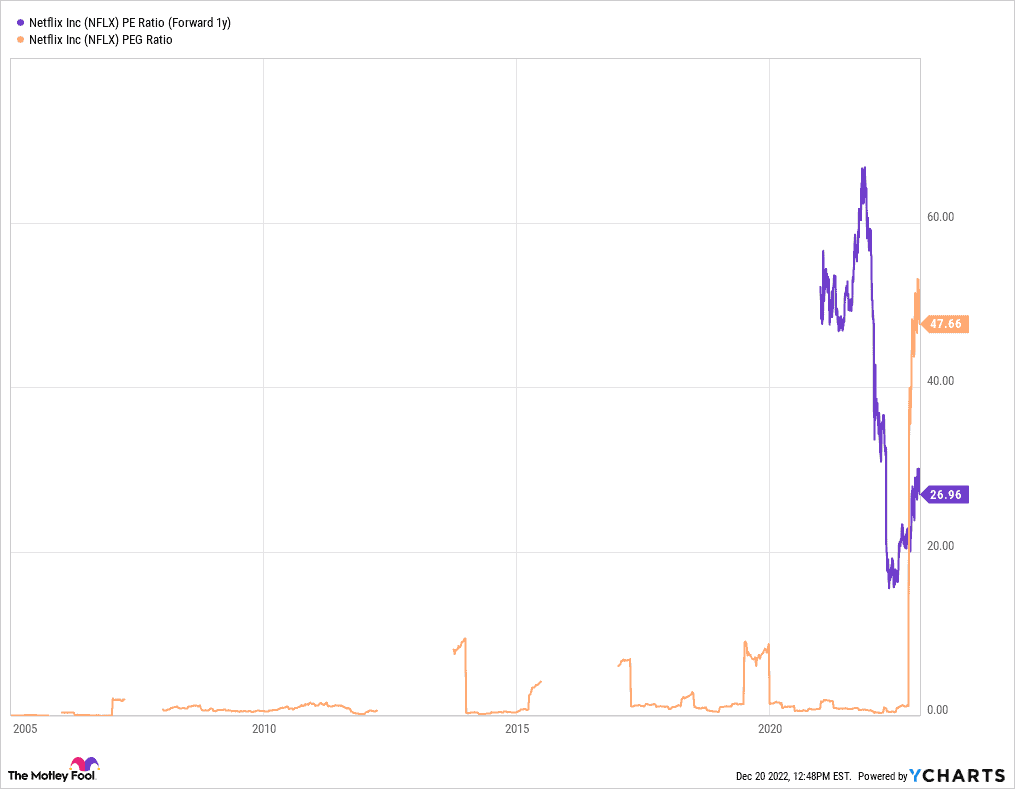

It’s worth noting that the P/E ratio is a lagging indicator. A more accurate way to value Netflix would be to look at its forward P/E. This takes its forecast future earnings into consideration. With a forward P/E of 27, it’s still more expensive than the S&P. Pair this with the stock’s forward price-to-earnings (PEG) ratio of 48, and there’s certainly an argument to be made that the service’s stock could be overvalued.

Having said that, I believe there to be reason for such elevated multiples. This can be explained by the excitement surrounding two main factors.

The first is the firm’s new advertising tier, where users pay a cheaper fee but are obliged to watch advertisements. The board hopes that the introduction of this tier will bring back some users lost in 2022. The second is its venture into gaming within the platform. These include the likes of trivia and arcade games.

Hoping for a pop

Unfortunately, the two main drivers for the group have failed to live up to the hype thus far. Users aren’t growing as quickly as anticipated. But more importantly, advertising revenue is underperforming the targets set by management by more than 20%. As such, Netflix has been issuing discounts and refunds to advertisers. To make matters worse, the platform has also lost its crown as the market leader in the streaming space, as Disney continues to aggressively snatch market share.

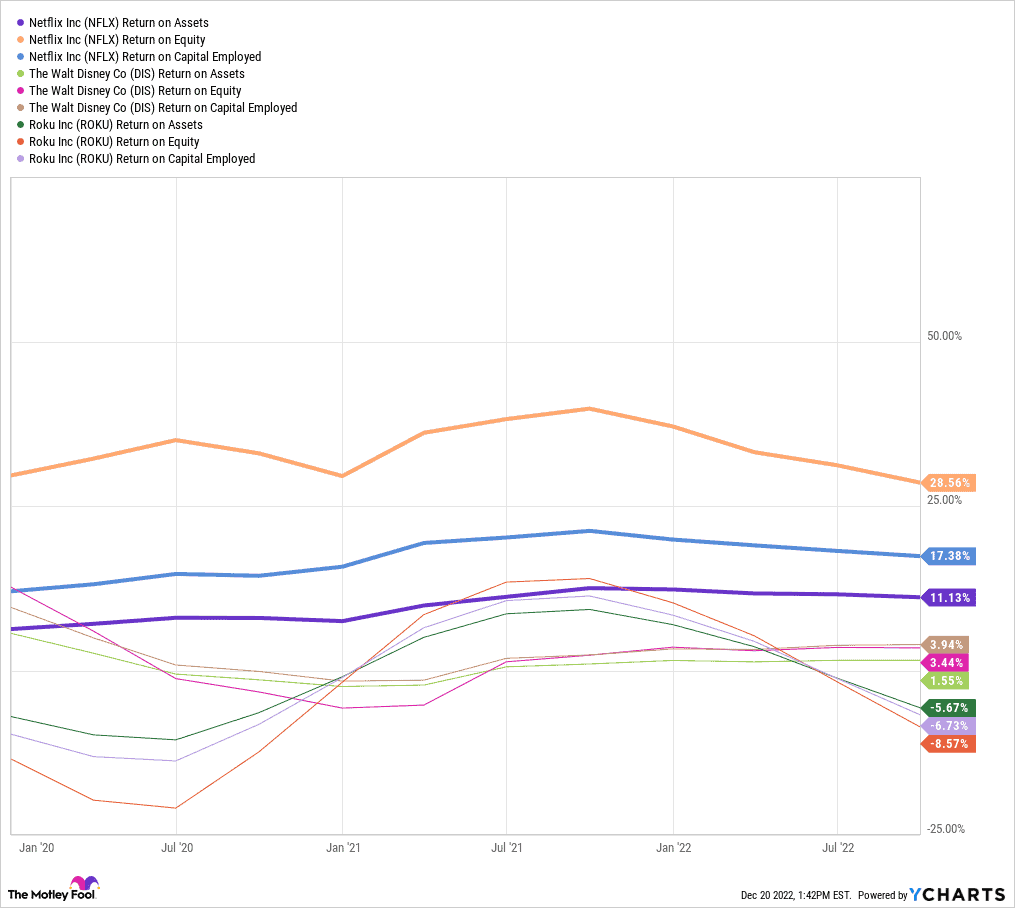

The silver lining, however, is that Netflix has a good track record on returning value to shareholders. This is evident in its return on assets, equity, and capital employed, which all beat its competitors by substantial margins.

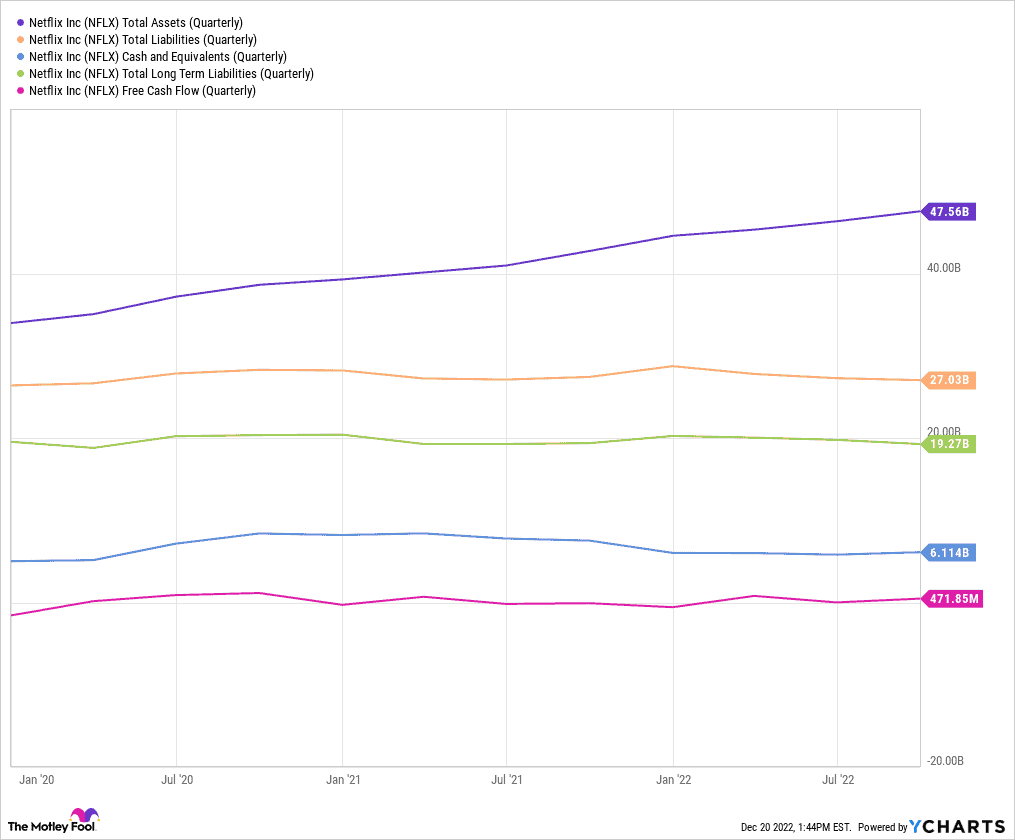

These returns have resulted in its robust balance sheet. However, while its debt-to-equity ratio of 67.7% is reasonably healthy, its cash and equivalents fall short of its total debt. This raises concerns particularly when the conglomerate is finding difficulty generating free cash flow.

Overall, the streamer still retains an average ‘moderate buy’ rating. But its average price target of $303 only presents a minimal upside from current levels. Macroeconomic headwinds paired with low-impact solutions just don’t make the stock look very appealing to me. I won’t be investing in Netflix stock today.