IAG (LSE: IAG) shares are down 15% this year, but they’ve seen a 40% increase in just two months in spite of this. As travel demand shows no sign of abating, a return to dividend payments could be on the cards. With that in mind, I think the group’s shares have a bright long-term future.

Flying in the right direction

Having had a stellar set of Q3 results, the conglomerate is now only 17% away from hitting its pre-pandemic passenger numbers. Management plans to increase capacity so it can capitalise on the reopening of Asia-Pacific routes and robust travel demand. As a result, the board has guided for passenger capacity to hit 95% of 2019 levels by Q1 next year.

Additionally, IAG is planning to double the number of British Airways aircraft based at Gatwick from 14 to approximately 28 in the coming years. While this is part of its expansion drive, it’s also to hedge against the volatile operating landscape of London’s flagship airport, Heathrow.

Should you invest £1,000 in IAG right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if IAG made the list?

As such, I view this move as a smart one by CEO Luis Gallego. After all, airlines at the West London airport dodged a bullet this Christmas as strikes from border staff were called off in the last minute.

Returning value

Having said that, the most exciting news came last week. The British Airways owner signed a new agreement with the trustee of its pension scheme. A deal will see the airline resuming its dividend payments as early as 2024. Nonetheless, there are certain requirements in order for this to happen.

- The fund can’t be in deficit. If it is, IAG has to contribute to it.

- If there’s a dividend, there must be a 50% matching contribution to the scheme.

- British Airways must maintain a minimum cash level of £1.6bn, after paying any dividends and matching contributions.

- Payouts are capped at 50% of pre-exceptional profit after tax in 2025.

- Dividends will be paused if the scheme is in deficit.

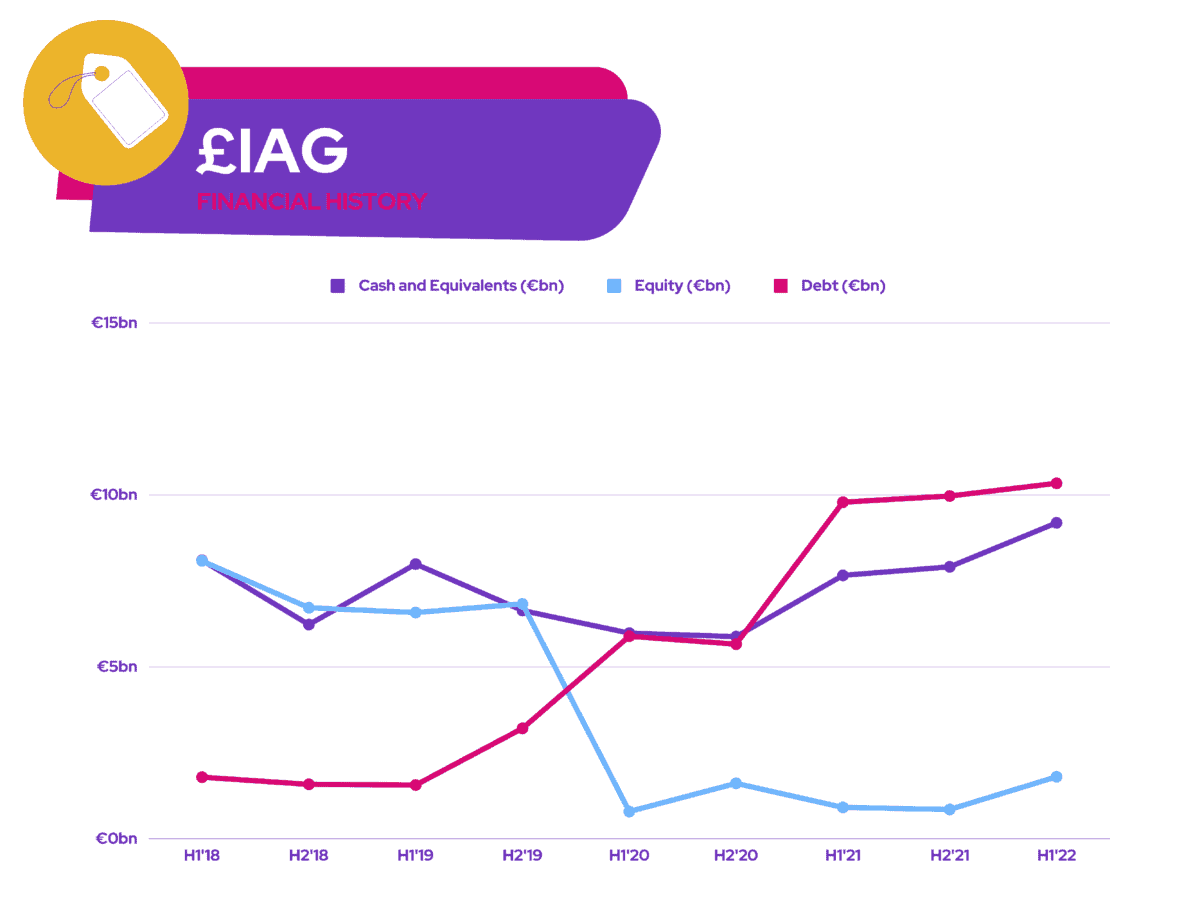

On that basis, I assume investors will be hoping for IAG to cut spending and maximise profits over the coming years. Most importantly, free cash flow growth will have to be a priority, and the FTSE 100 firm will have to ensure it doesn’t incur more debt.

IAG on sale?

So, should I buy IAG shares? More importantly, are they fairly valued? Well, it only returned to profitability in the summer. On that basis, ratios such as price-to-earnings (P/E) and price-to-earnings-growth (PEG) aren’t available. However, its current price-to-sales (P/S) ratio indicates good value as it stands at 0.4.

With air travel volumes and forward bookings showing strength going into the New Year, I’m feeling optimistic about the company’s prospects. Fuel prices seem to be coming down too as more refineries come on-line. Pair this with the increasing strength of the pound, and IAG may see further bottom line improvement in 2023.

While these are certainly promising signs, the likes of JP Morgan and Deutsche still have the stock on a ‘hold’ rating with an average price target of £1.40. This is only an 8% upside from current levels. I don’t think the stock is about to surge. Even so, I’m thinking about starting a small position due to what I see as the firm’s promising future.