The Aston Martin (LSE:AML) share price is steadily recovering ground. But at 159p it remains one of the worst performing FTSE 250 stocks since the spring.

To be precise, James Bond’s favourite carmaker has lost around 70% of its value since mid-April.

Should you invest £1,000 in Future Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Future Plc made the list?

But could this be a great dip buying opportunity? Certain market analysts certainly believe Aston Martin’s shares should fly higher.

A model stock?

Take the boffins over at Barclays, for instance. They started covering the luxury carbuilder last month and have slapped a 175p per share target on it.

That represents a 10% premium to Aston Martin’s current share price.

Explaining their bullish view of the battered stock, Barclays’ analysts predict that “product launches… should drive higher volume, higher revenue per unit and support [Aston’s] more than 40% gross margin target for new models”.

Barclays says that Aston Martin’s growth strategy carries “significant execution risks”. But based on earnings forecasts for 2025, the carmaker’s shares trade on a reasonable price-to-earnings (P/E) ratio of 15 times.

The case for

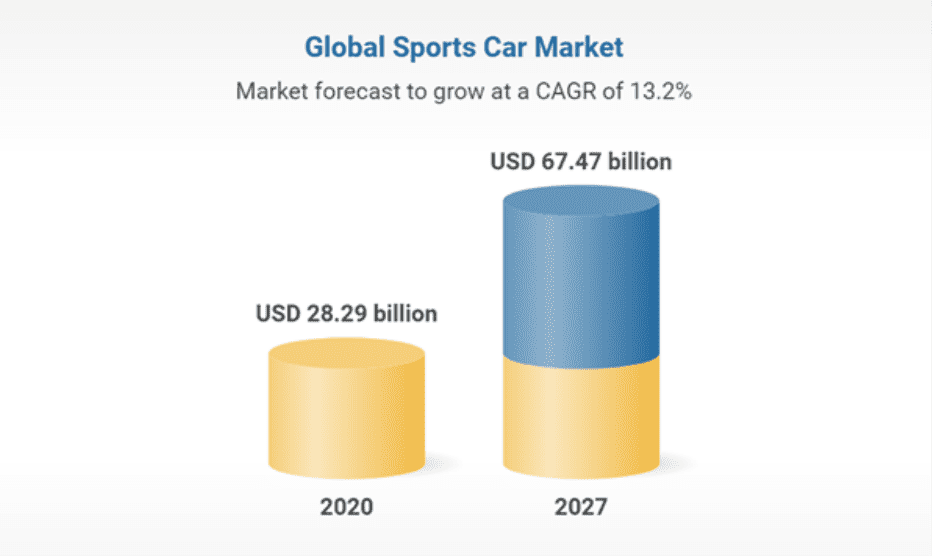

Investing here could help me exploit soaring demand for sports cars. Analysts at Knowledge Sourcing Intelligence think this market will grow at an annualised rate above 13% between 2020 and 2027. This will be driven by soaring numbers of ultra-wealthy individuals, they say.

Aston Martin could be one of the best ways to exploit this booming industry, too. Its brand is synonymous with speed and luxury, a winning combination with this growing class of super rich people. An ongoing 60-year association with the world’s most famous (fictitious) spy also makes it products seriously attractive.

I also like the ambitious steps it’s making to electrify its range. The business is aiming for all its models to have an electrified option by 2026.

The case against

But Aston Martin shares also expose investors to colossal risk.

Brokers including Barclays aren’t expecting the business to break into profit until 2025 at the earliest. The business may have to overcome several serious obstacles to reach this target, too.

The threat of persistent supply chain and logistics problems is one. These difficulties remain an issue across the auto industry and have already hit delivery of Aston Martin’s cars in 2022. A long period of high cost inflation is another threat to earnings.

An extended period of weak economic growth meanwhile could sap demand for its supercars. The danger is particularly acute in Aston’s critical Asian market, too, where Covid-19 remains a huge problem. Extreme competition from other luxury marques like Bentley, Mercedes-Benz, and Porsche is another big risk to profits.

At the same time Aston Martin has huge net debt. It had £833m worth as of September, to be exact. This not only threatens the amount it could invest in its expensive growth programmes. It also endangers the company’s very survival in the short-to-medium term.

The verdict

So I won’t be buying Aston Martin shares following its recent share price fall. I’d rather buy other FTSE 100 and FTSE 250 stocks today.