The UK is most likely going to face a recession next year as a result of high inflation and interest rates. Nonetheless, JP Morgan has labelled two FTSE 100 shares as ‘potential winners’ in 2023. With attractive valuation multiples, I’m strongly considering buying these companies for my portfolio.

1. Tesco

The Bank of England stated yesterday that inflation has hit its peak. Even so, retailers are still expecting to face high energy and labour costs in 2023. What’s more, they will also have to battle with consumers downtrading.

Therefore, the US bank is forecasting what it calls the “low-end” grocery retail sector to do well. One example of this is Tesco (LSE: TSCO). JPM believes that the FTSE 100 supermarket is “well positioned to navigate 2023”. This is due to its strong execution, more urgency to address its cost structure, and an enhanced mix of products.

Should you invest £1,000 in B&M right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if B&M made the list?

Kantar’s latest grocery report indicates that increases in food prices are starting to slow. Consequently, Christmas sales are expected to hit record levels as consumers snap up better deals. If this momentum remains strong going into the New Year, I’m expecting the FTSE 100 grocer to benefit with its large market share and loyal customer base.

Tesco is also revising its app and Clubcard programme to remain competitive with its peers. Coupons will be handed out a lot more often with more personalised offers to attract and retain customers.

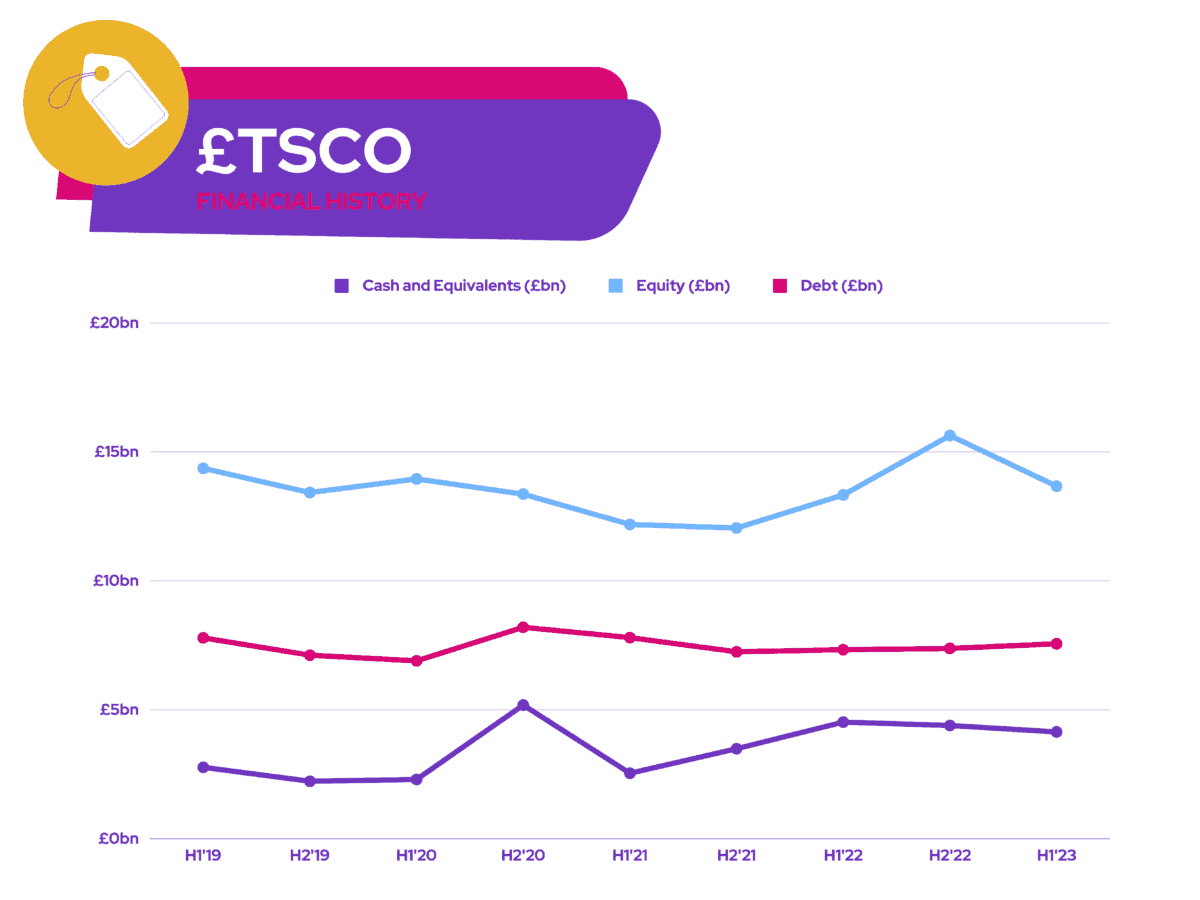

Moreover, Tesco has attractive valuation multiples. It has a price-to-earnings (PEG) ratio of 0.1 that complements its price-to-sales (P/S) and price-to-book (P/B) ratios of 0.3 and 1.3 as well. It also boasts a dividend yield of 5.1%, which it can cover comfortably at two times from the strength of its balance sheet.

These multiples have led to JP Morgan reiterating its ‘overweight’ rating on the stock with an average price target of £2.70. Headwinds are now slowly turning into tailwinds. Provided these positive developments continue, I’m anticipating the retailer’s top and bottom lines to see improvements next year.

2. B&M

Another FTSE 100 share that I’m eagerly watching is home goods and DIY retailer, B&M (LSE: BME). Despite the value retail market facing strong competition, the company remains well positioned to benefit from the market trend of downtrading.

The Bank of England also noted yesterday that the retail sector is slashing prices amid lower footfall. As a result, UK retail parks have been seeing higher shopper numbers as customers opt to travel to out-of-town locations. As such, B&M should benefit from this, as the bulk of its stores are in more remote locations.

Furthermore, JP Morgan predicts that the home improvement sector will see demand increase significantly going into 2023. Which is why the bank has identified B&M as one of the few players in the UK retail sector that has the strength to capitalise on the home improvement trend. Hence, it slapped an ‘overweight’ rating on the stock with a £5.55 price target.

Given its attractive valuation multiples, I’m confident that B&M has the potential to outperform the wider index next year. It has a PEG and P/S ratio of 0.2 and 0.8 respectively. This, together with its solid balance sheet and dividend yield of 4.0%, suggests that the company is relatively undervalued.