Shares of commodity giant Rio Tinto (LSE: RIO) have been on a rollercoaster ride this year. Nonetheless, the stock is set to end the year on a high. With its reputation as a dividend aristocrat and tailwinds coming from China, I think Rio could be an great buy for my portfolio in 2023.

Strong demand

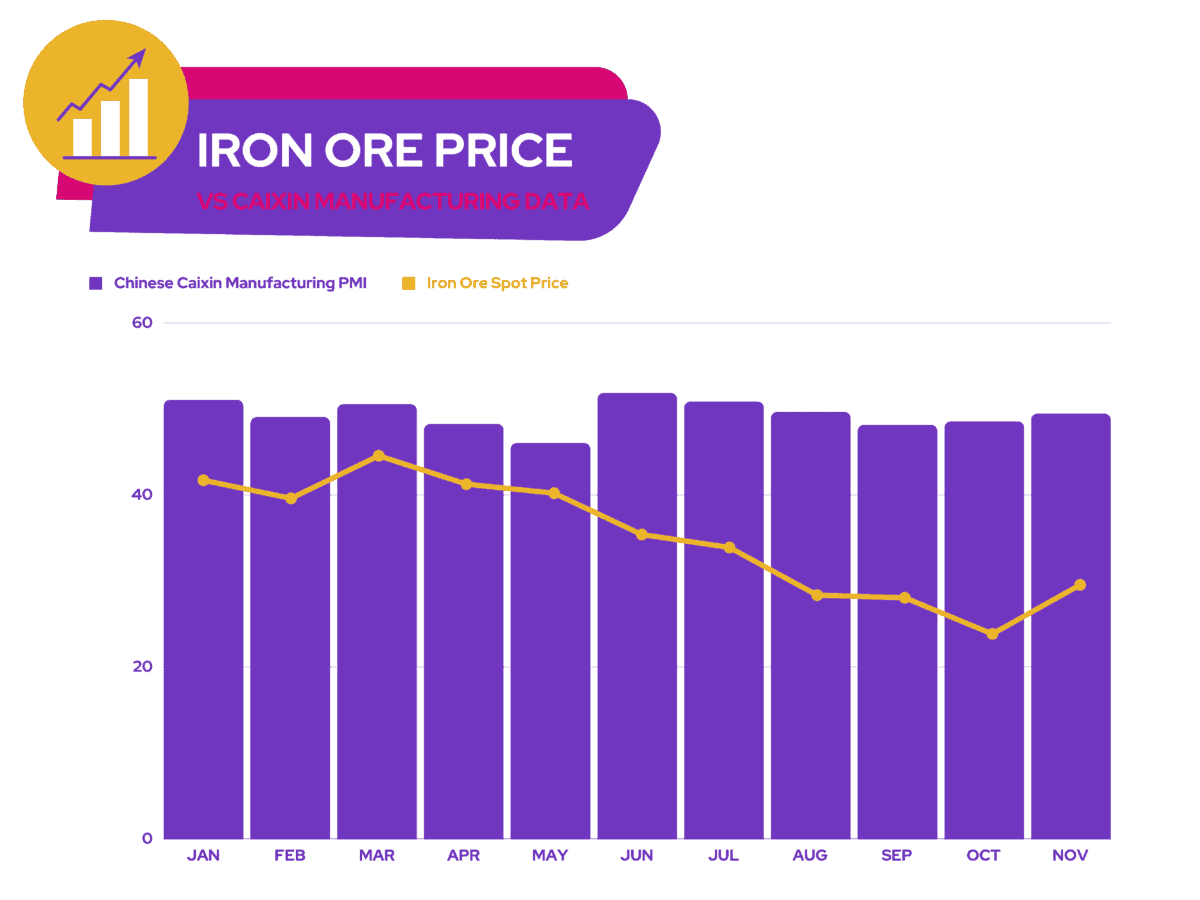

Rio generates the bulk of its revenue from iron ore and China. As such, its share price has a tendency to trade in tandem with the price of the commodity and Chinese construction activity. As China reopens and pivots away from its zero-Covid policy, iron ore prices have rebounded. Which is why Rio Tinto’s stock has seen a 25% uptick since finding a bottom in late October.

Fears regarding a property bubble in China have also been alleviated for the time being. That’s because its largest lenders are expected to pump over $162bn of credit into the country’s property developers. Given that the property sector constitutes more than a quarter of China’s economic output, this move serves to benefit the iron ore producer.

Too hot too fast?

Having said that, several analysts think that Rio’s share price has gone up too quickly. UBS is one such as it recently cut its rating for the stock to ‘sell’. Although the Swiss bank is bullish on the outlook for commodity prices, it’s still cautious about the long-term macroeconomic stability of the global economy.

The macro backdrop is still fragile with global growth slowing. China’s reopening [is] challenging [this] winter, and iron ore fundamentals are still weak. Therefore, Rio Tinto shares look expensive at normal prices given its free cash flow yield.

UBS

On the flip side, Jefferies feels more bullish about the commodity’s outlook. The Americans believe that China’s increasingly accommodative policies surrounding Covid and the injection of liquidity into its property market will lead to stability in the demand for iron ore. However, its analysts aren’t expecting China’s property market, which accounts for 35% of demand for iron, to completely recover in the near term.

Dividend miner

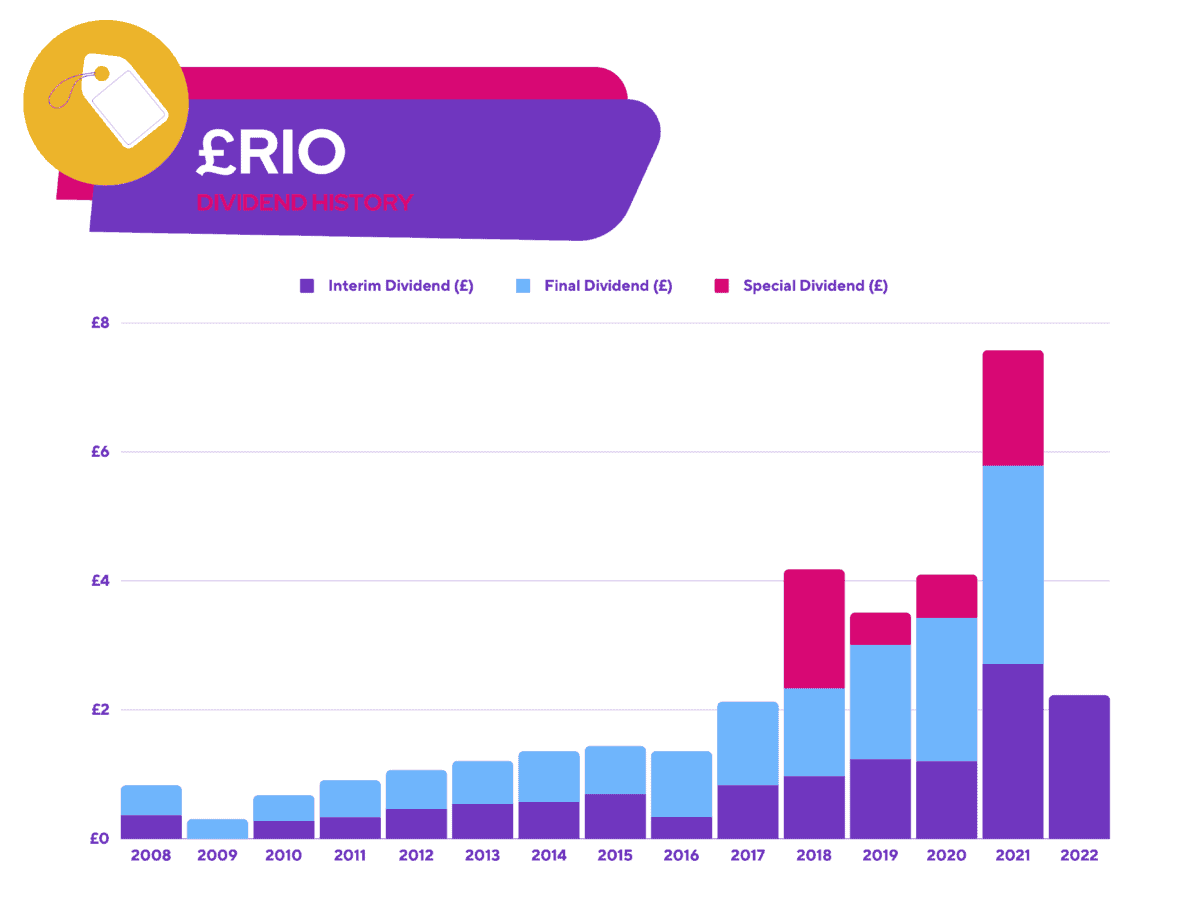

This leads me to wonder whether Rio Tinto shares are worth buying at this price. Its valuation multiples are looking great. It has a price-to-earnings (P/E) ratio of 6 and a forward P/E of 9, so its current share price seems cheap. Additionally, its price-to-earnings growth (PEG) ratio of 0.1 provides further evidence of this. What’s more, its strong balance sheet and cash flows cover its current monster dividend yield of 9.2% up to 1.7 times.

Nevertheless, steel production is only expected to increase minimally going into the New Year. Hence, iron ore prices are forecast to stabilise at approximately $100 per tonne. For context, the metal’s currently trading at $110 per tonne.

That being the case, Rio’s dividend could take a backseat in the near term. Despite that, I still have no doubts that the FTSE 100 miner will start paying hefty and special dividends again. This is especially the case once demand fully recovers and production ramps up.

So, with cheap valuation multiples and a healthy price-to-free-cash-flow ratio of 7.7, I’ll buy Rio Tinto shares for their rebound potential and big dividends before year end.