Semiconductor stock AMD (NASDAQ:AMD) has had a nightmare this year with its share price down 50%. Nonetheless, the current decline in its stock presents a silver lining, and these charts show why.

Chipping away?

Once a pandemic darling due to sky-high prices, AMD’s momentum has quickly died down this year. Fears of a recession have dented demand for semiconductors substantially. Nevertheless, this is due to demand for graphics cards and computer processors taking a hit. Thankfully for shareholders like myself, AMD is more than that.

| Business segment | Revenue (Q3 2022) | Operating margin (Q3 2022) |

|---|---|---|

| Client | $1.02bn | -2.5% |

| Gaming | $1.63bn | 8.7% |

| Data Centre | $1.61bn | 31.4% |

| Embedded | $1.30bn | 48.7% |

| Other | $0bn | N/M |

| Overall | $5.57bn | -1.2% |

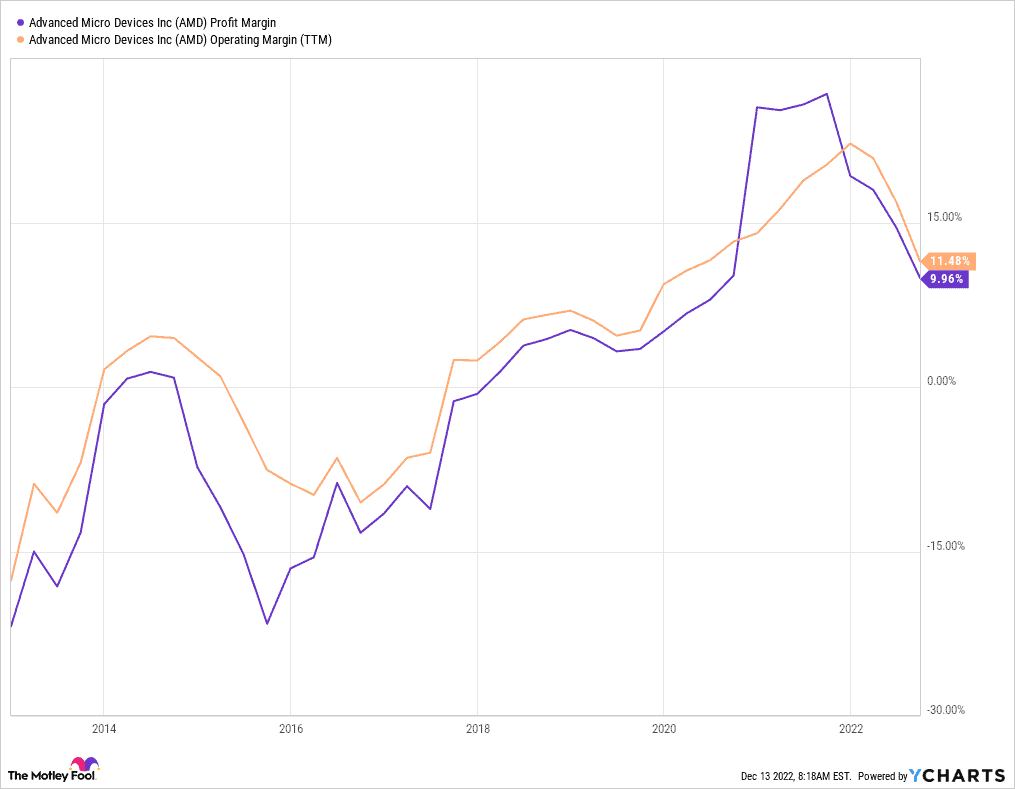

These segments all have different margins and prospects. But all together, the group’s operating and profit margins are considered to be healthy at above 10% on a trailing 12-month basis. More importantly, these margins have been growing on average, which is always a positive indicator of a good investment.

Should you invest £1,000 in BP right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if BP made the list?

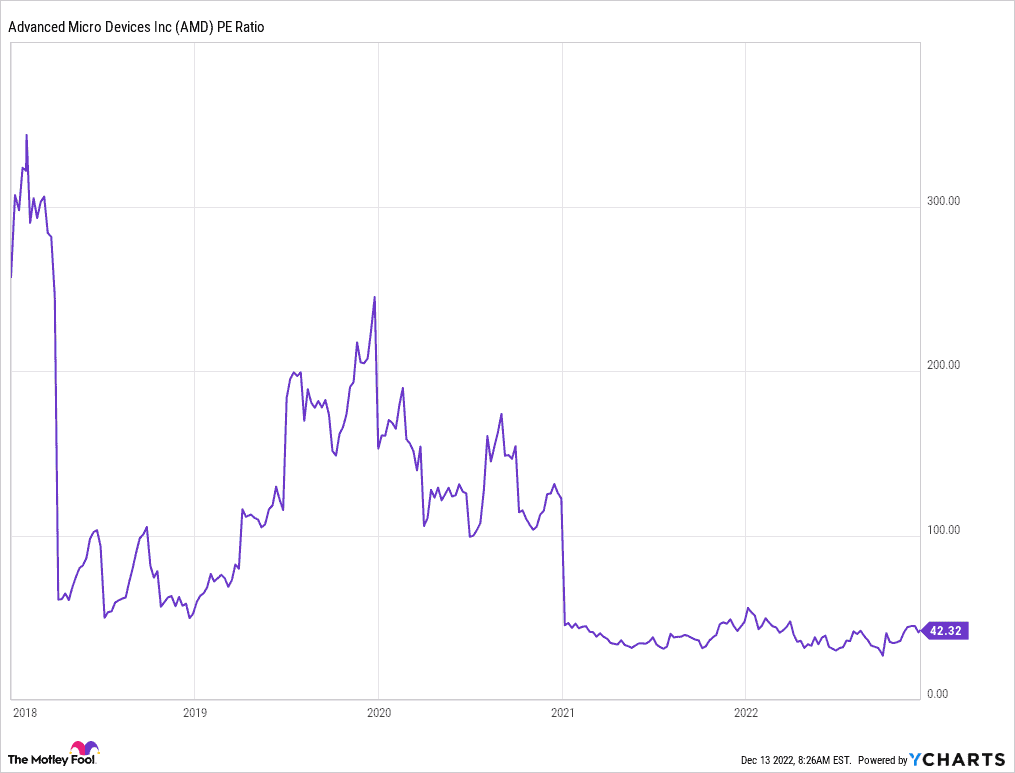

Nonetheless, AMD currently trades at a price-to-earnings (P/E) ratio of 42. This is more than double the S&P 500‘s average P/E of 21, which could indicate that the stock is rather expensive.

Advancing growth

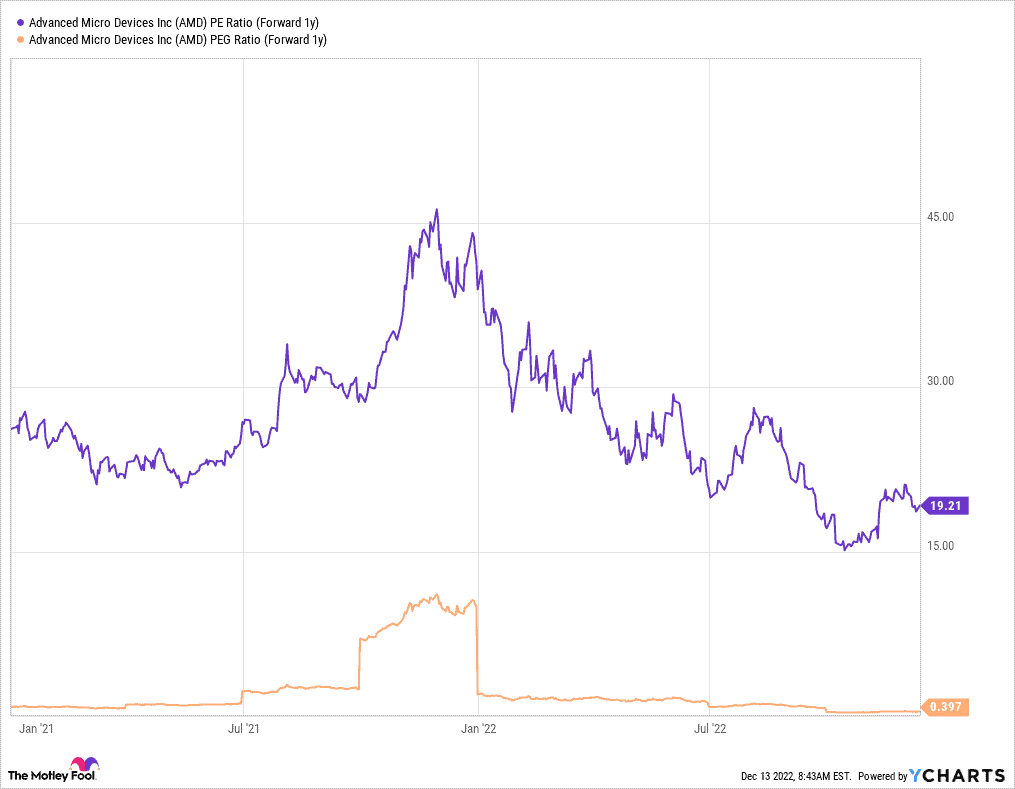

It’s worth noting, however, that the P/E ratio is a lagging indicator. A more accurate way to value AMD would be to look at its forward P/E. This takes its forecast future earnings into consideration. With a forward P/E of 19, it can be said that I’m paying a fair value for future earnings growth within a year. To complement this, the tech stock’s forward price-to-earnings (PEG) ratio stands at 0.4.

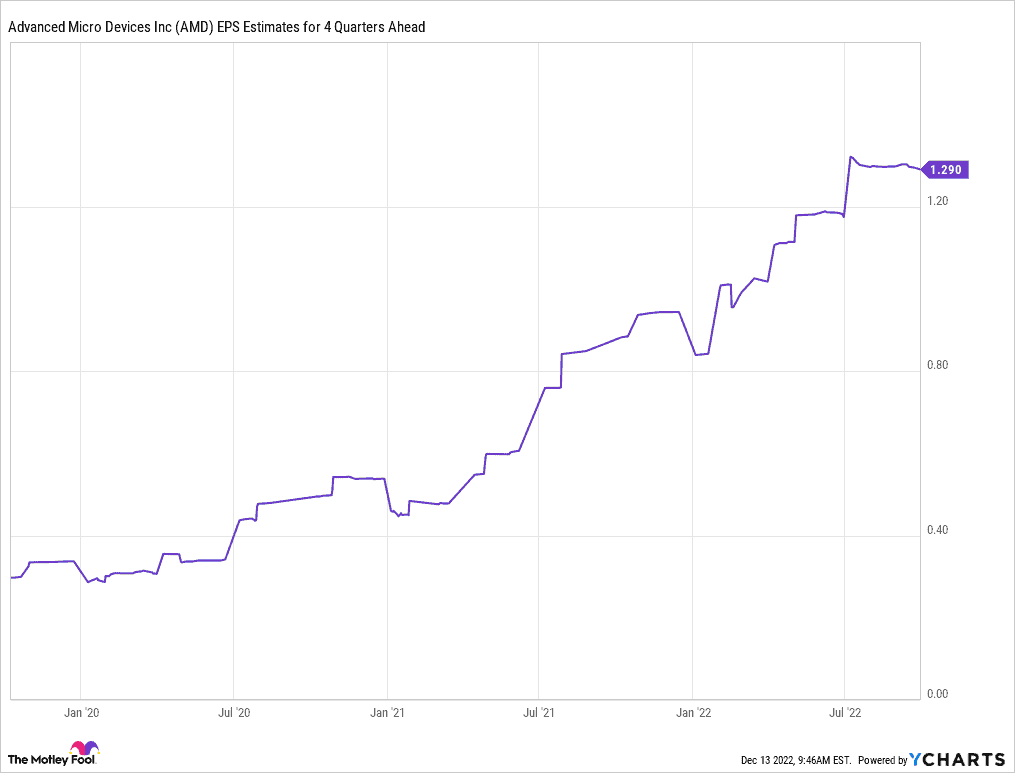

The bulk of AMD’s growth next year is expected to come from its Data Centre and Embedded segments, while Gaming and Client stay relatively ‘flat’. Thus, it’s possible to see the former two segments overtaking the latter in revenue by the end of next year.

More crucially, the Data Centre and Embedded branches have higher margins. Consequently, that should allow the chip producer to improve its bottom line in 2023. This is evident in the projected earnings growth for the company.

Processing returns

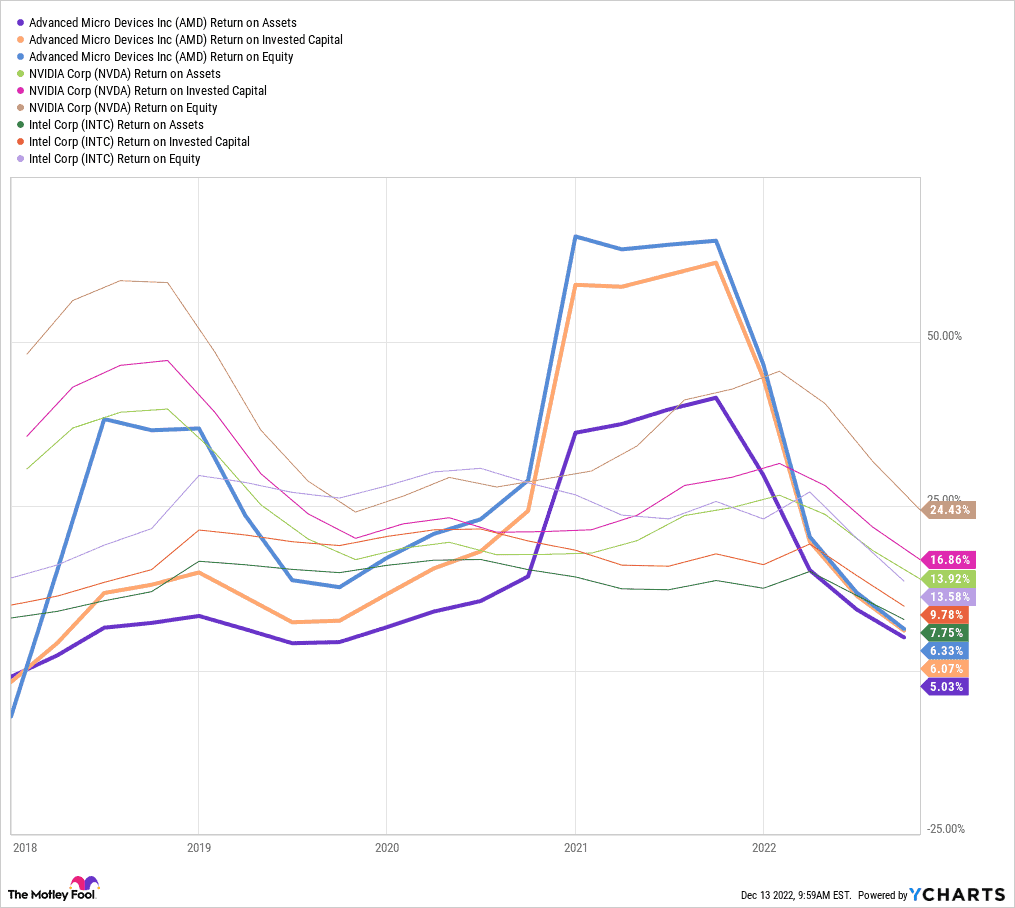

Having said that, AMD isn’t exactly renowned for its amazing return on assets, capital employed, and equity. In fact, it’s underperformed the likes of NVIDIA and Intel in 2022. This indicates that the firm isn’t able to make the best use of its assets and capital to generate profits in recent times.

Despite that, it’s still worth pointing out that the group did briefly overtake its competitors in 2021. This shows that it’s got the potential to do it again, once its overall margins improve, backed by its two growth juggernaut segments.

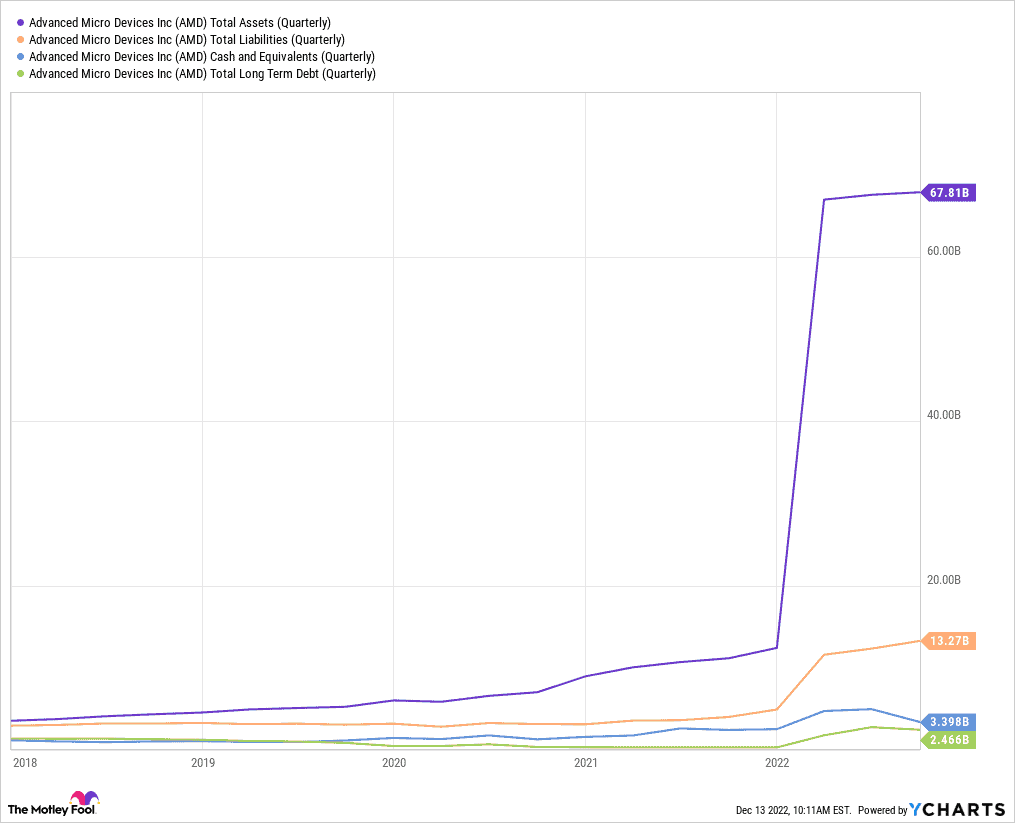

So, will I be buying more AMD stock then? Well, the Nasdaq-listed firm has got an amazing balance sheet. With a debt-to-equity ratio of 4.5%, Lisa Su’s company is well equipped to traverse an economic downturn.

What’s more, the conglomerate is continuing to grow its market share, which goes to show how well it’s doing despite the tough economic environment. Not to mention, in a world that’s becoming increasingly digital and with cloud computing expanding rapidly, AMD is well positioned to capitalise. It’s no surprise that analysts rate the stock a ‘strong buy’ with an average price target of $84. As such, I’ll be looking to buy more of its shares when I’ve got more spare cash on hand.