High mortgage rates and declining house prices have spooked investors in property stocks. As a result, the Taylor Wimpey (LSE: TW) share price has fallen by more than 40% this year. But with most analysts predicting a house market correction rather than a crash, I’m considering buying Taylor Wimpey shares.

Moving downwards

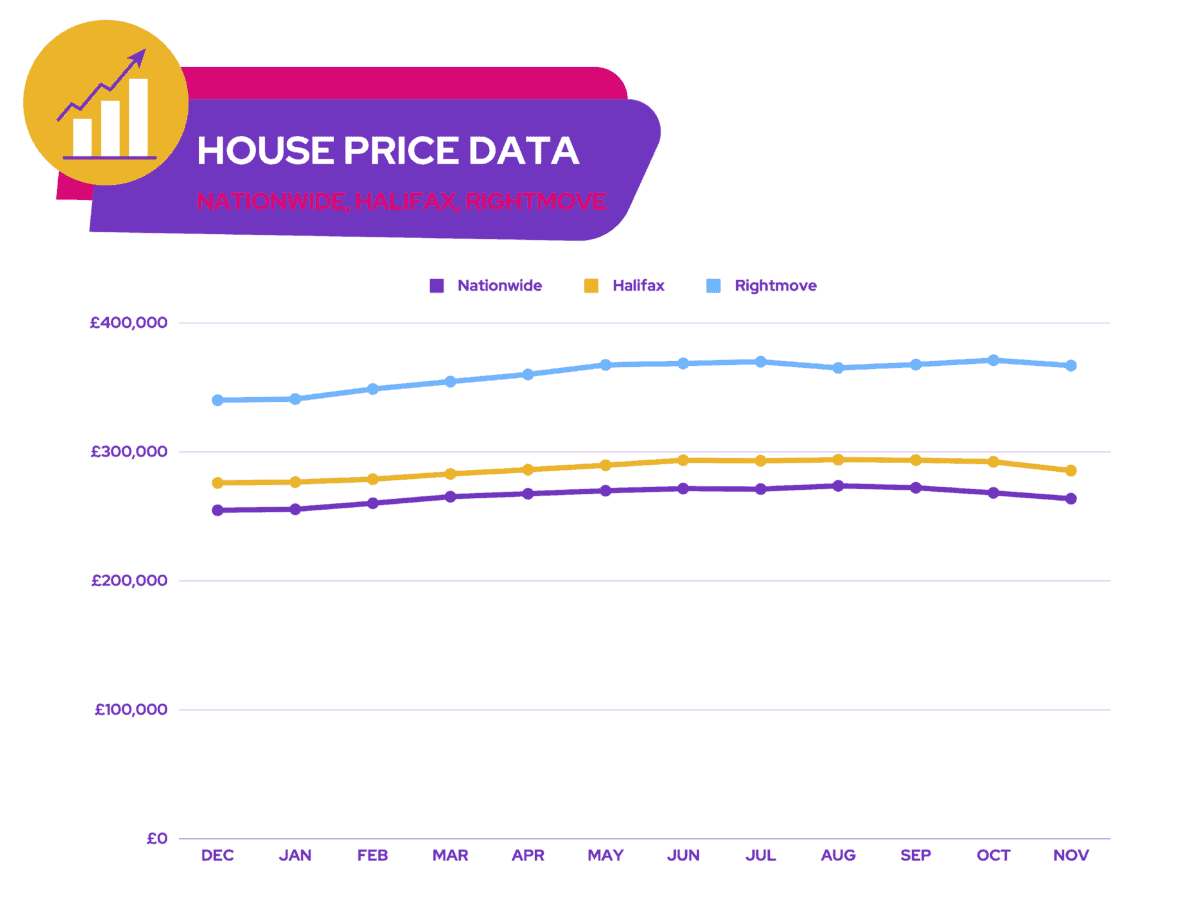

The most recent house price indexes have shown weakness in the market. Consequently, the likes of Zoopla and the UK’s biggest mortgage provider, Lloyds, have predicted a slowdown in the housing market going into 2023. The same sentiment was echoed by brokers from Citi and Berenberg, citing affordability constraints.

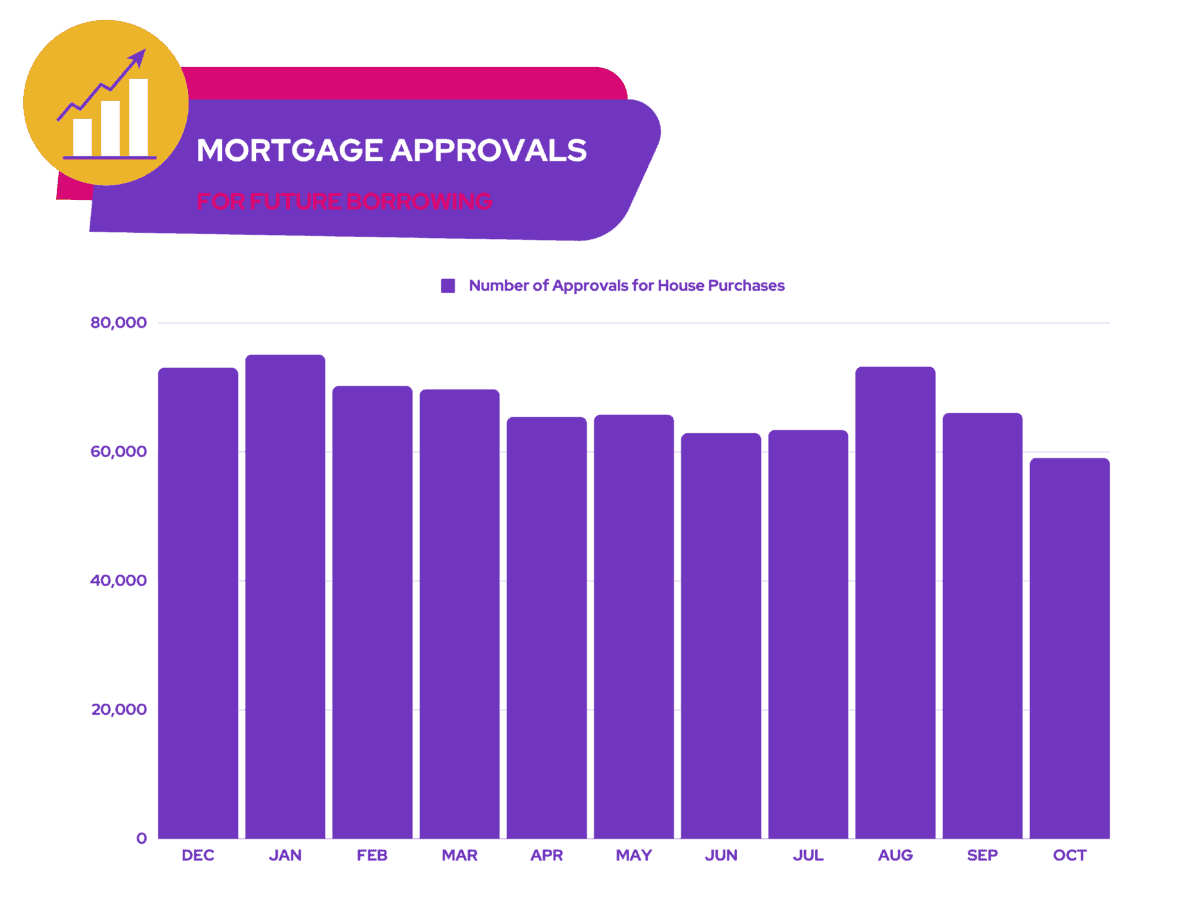

Mortgage costs as a proportion of income have increased. Thus, mortgage approvals have also taken a hit, and are at the lowest level since the aftermath of the Covid outbreak in June 2020. The impact of this can be seen at Taylor Wimpey as management reported a slight uptick in cancellation rates as well as lower sales and orders in its latest trading update.

Mortgage rates to normalise?

Nonetheless, there’s some good news to celebrate. Despite house prices declining in the latest Halifax report, property valuations in the North East saw an increase. This is good news for Taylor Wimpey as it’s got quite a decent exposure to that area. This should serve to protect its top line a little more.

| Regions | Percentage of land plots |

|---|---|

| Central & South West | 27.1% |

| Scotland, North East, North Yorkshire | 22.9% |

| Midlands & Wales | 20.8% |

| London & South East | 17.3% |

| North West & Yorkshire | 11.9% |

Additionally, brokers Citi and Davy aren’t anticipating house prices to crash. In fact, they’re forecasting conditions to improve in the second half of the year. Mortgage rates are expected to normalise by that time and should provide greater visibility of market conditions. This could boost sentiment and improve prospects for cash returns and share buybacks for the FTSE 100 housebuilder.

To complement this, Citi is forecasting the Bank of England to start slowing its rate hikes from 75bps to 50bps this week. This spells good news for two reasons. The first is that this should translate into slower increases in mortgage rates, which could allow affordability to catch up. The second — and more significant for mortgage-payers — is that the terminal rate could be near. This could mean mortgage rates peaking or even declining.

Robust foundations

Here’s why I think Taylor Wimpey specifically is a buy for me. For one, its current and forward valuation metrics are trading at extremely attractive multiples.

| Metrics | Taylor Wimpey | FTSE 100 |

|---|---|---|

| P/E ratio | 6 | 14 |

| PEG ratio | 0.2 | – |

| P/B ratio | 0.9 | 1.6 |

| P/S ratio | 0.8 | 1.3 |

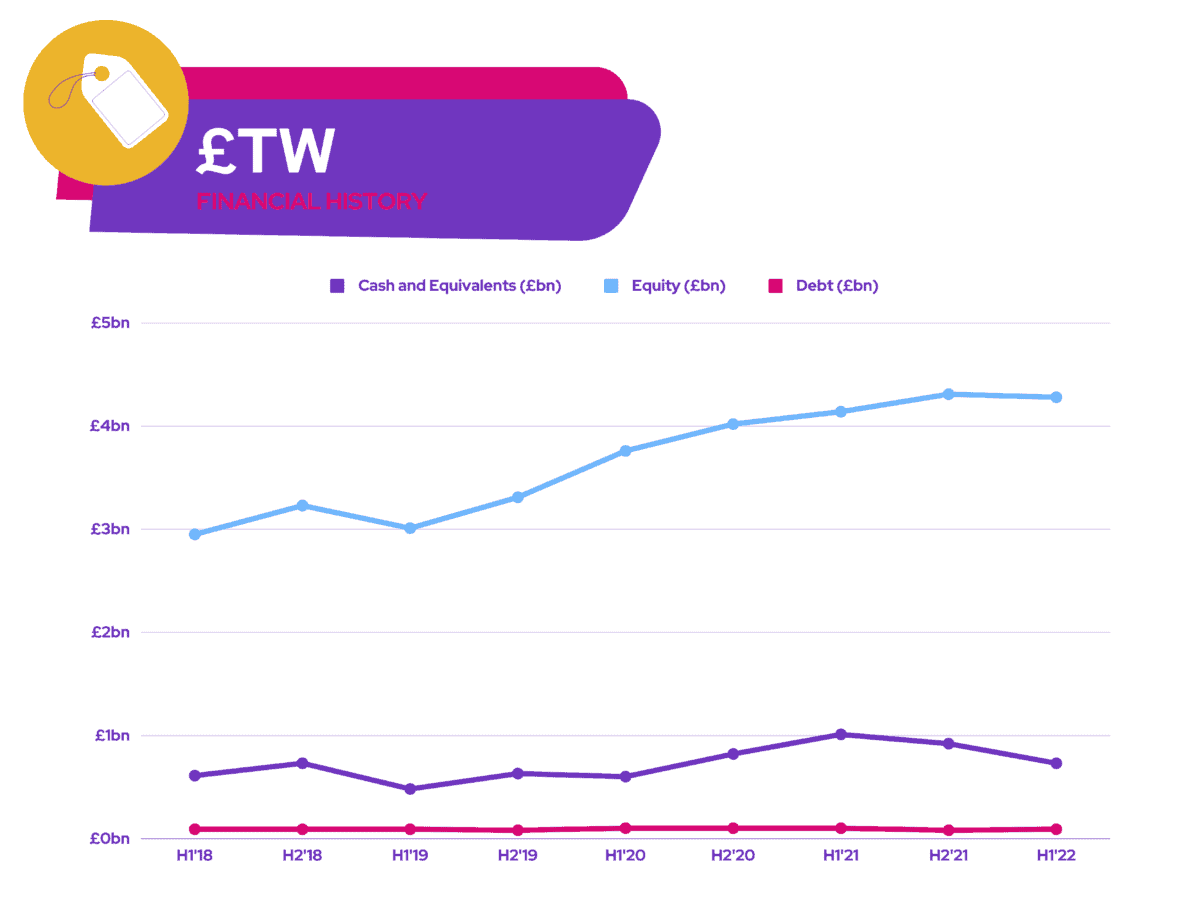

The second is the strength of its balance sheet puts it in a robust position to weather the coming recession. With a debt-to-equity ratio of 2%, the builder has more than sufficient cash and assets to cover its current monster dividend yield of 8.9% with cover of 1.8 times.

Moreover, the likes of JP Morgan, Berenberg, and Deutsche all rate the stock a ‘buy’ with an average price target of £1.36. That means if I buy now, I may be able to capitalise on a potential 33% upside, and that’s without hefty dividend payments.

There’s no shying away from the strong possibility that house prices could go lower. However, given the UK’s strong history of long-term house price growth, I see this is a rare opportunity for me to snatch up housebuilder shares like Taylor Wimpey on a no-brainer discount. Hence, I’ll be buying the stock when I’ve got some spare cash.