The UK economy looks set to enter a recession next year. With this in mind, I’m searching for reliable high-yield dividend stocks that can generate passive income and cushion the potential impact on my portfolio.

I’ve selected one FTSE 100 stock that could provide me with £1,200 per year if I bought 850 shares today. I’m talking about tobacco giant Imperial Brands (LSE: IMB). It’s trading at £21.14 per share (at the time of writing) and yields just shy of 6.7%.

A defensive investment

Tobacco stocks are traditionally viewed as defensive investments during inflationary times. There’s a variety of reasons for this including robust balance sheets, relatively low price-to-earnings ratios, and the ability to raise product prices higher than inflation.

Indeed, the Imperial Brands share price has significantly outperformed the index in 2022. It has soared 29%. Importantly for me, as an investor seeking passive income, this growth comes on top of a market-leading dividend.

A recent trading update confirmed that FY22 trading is in line with expectations. I’m particularly encouraged to see the business has grown its aggregate market share in its top-five priority markets. These collectively account for around 70% of the firm’s operating profit.

I also like the desire to add value through a new £1bn share buyback programme ending in September 2023. This represents approximately 5.5% of the company’s issued share capital.

Industry headwinds

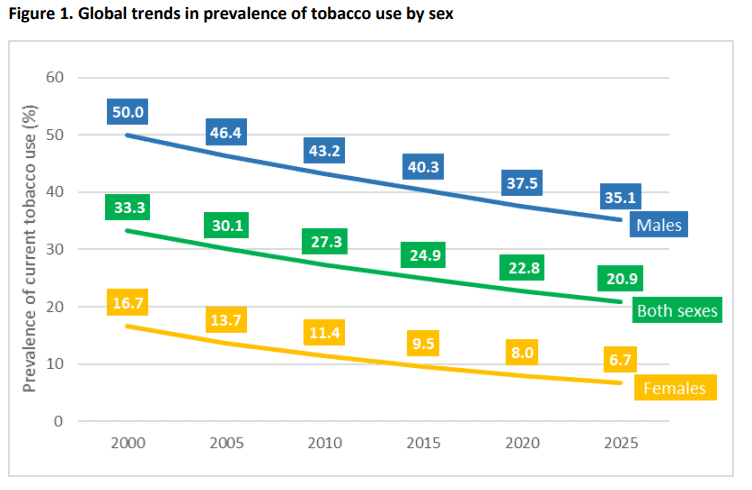

It’s not all plain sailing for the tobacco multinational, however. Yesterday, the Office for National Statistics confirmed that 13.3% of the UK adult population currently smokes cigarettes — the lowest proportion since records began.

This isn’t unique to Britain, either. World Health Organisation (WHO) data confirms falling tobacco consumption is part of a wider global trend. The WHO predicts this will continue throughout this decade.

A decline in worldwide consumers of its combustible products could weigh on Imperial Brands’ balance sheet. The company’s seeking to counter this with its range of next generation products, such as the blu vape device and its ZONE X range of oral nicotine pouches.

It remains to be seen whether these alternatives can sufficiently offset predicted declines in the group’s cigarette sales.

My passive income portfolio

So, how much would 850 Imperial Brands shares cost me? At today’s price, the total would come to £17,969. This neatly fits within my annual £20k Stocks and Shares ISA allowance. If the dividend yield remains at 6.7%, my holding would provide me with slightly more than £100 in income each month.

Unfortunately I don’t have enough spare cash today to buy the shares in one go. However, by investing £100 per month at a 6.7% yield, I’d hit my desired target in a little over 10 years. This calculation assumes zero capital gains.

Companies can suspend or slash dividend payments at any time. I’d invest bearing this risk in mind. Nonetheless, I already own shares in Footsie competitor British American Tobacco and I’m pleased with my returns so far.

Accordingly, I’d like to add to my tobacco stock holdings in anticipation of further macroeconomic turbulence in 2023. For me, Imperial Brands looks well positioned to be a reliable passive-income generator during a recession.