PayPal (NASDAQ: PYPL) stock was close to hitting $100 just under a month ago. Nonetheless, its share price is back down in the $70 range. With that in mind, I’m planning to continue building my position. Here are the reasons why.

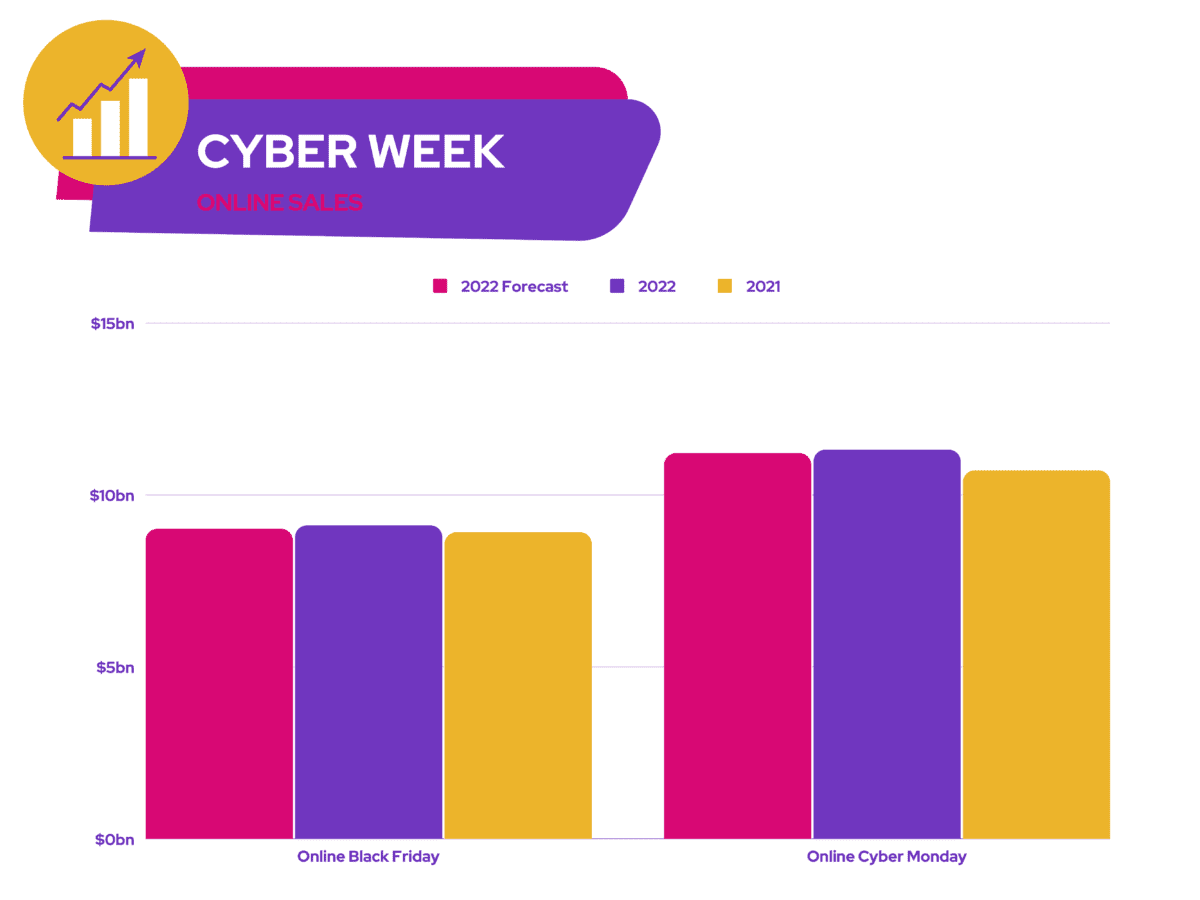

Bright Friday and Cyber Monday

In PayPal’s latest Q3 earnings call, management was rather reserved about sales going into the festive season due to a contracting global economy. At that time, interim CFO Gabrielle Rabinovitch cited lower-than-normal transaction volumes for Q4.

Yet fears of a slowdown have been eased for now. Black Friday and Cyber Monday spending in the US exceeded analysts’ expectations at $9.1bn and $11.3bn, respectively. As a result, online sales for the holiday season are now expected to hit a high of $209.7bn.

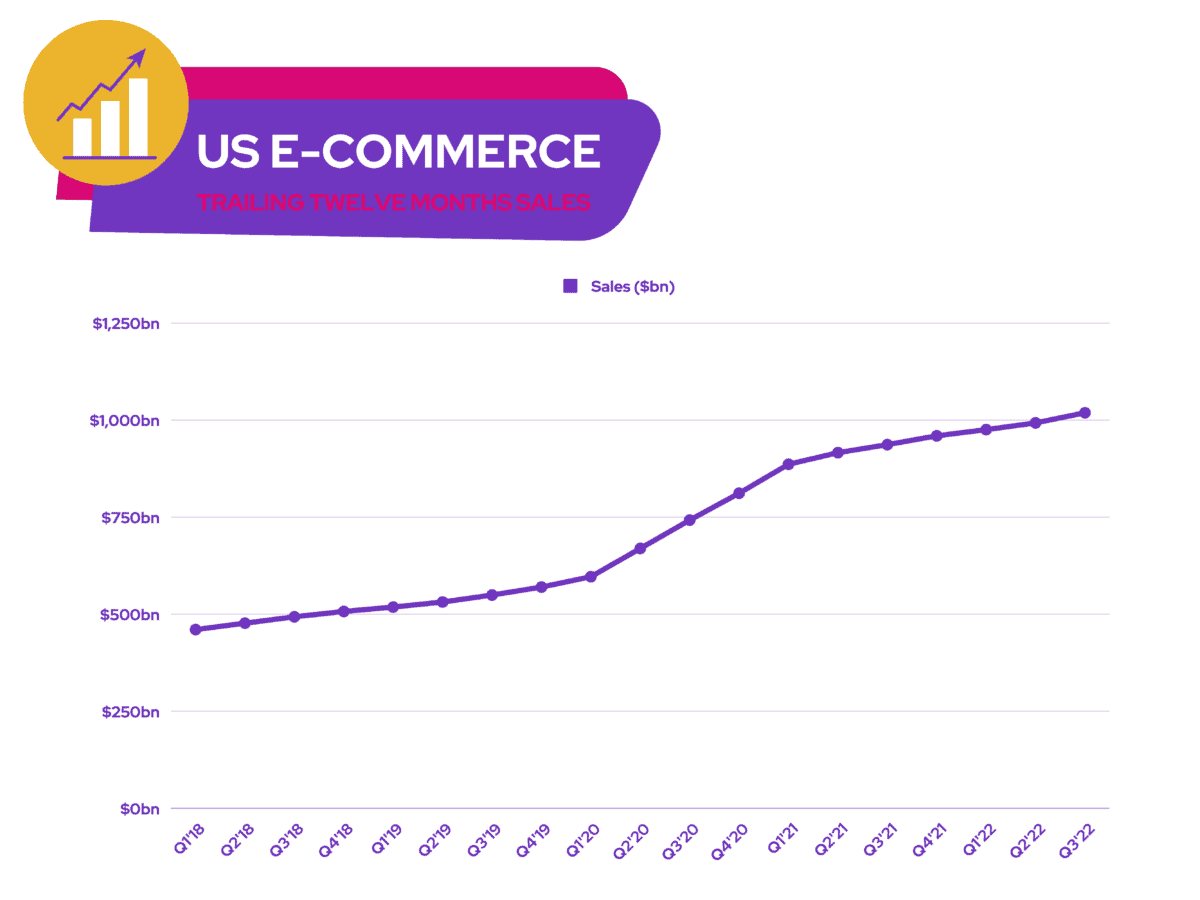

PayPal is expected to benefit from the higher level of online shopping activity. E-commerce sales managed to hit their highest levels at $1trn in the US, on a trailing 12-month basis. This was up 9% compared to last year.

Paying it forward

The most popular purchases from the Black Friday weekend were items that are on the pricier side. These include the likes of an Xbox Series X, drones, and even Macbooks. Consequently, I’m expecting PayPal’s payment volumes to increase healthily in Q4.

To complement these numbers, its buy now pay later (BNPL) service should also see positive momentum. That’s because BNPL services saw a 78% increase compared to October.

This could be seen as a risk for the fintech company, as delinquencies may tick up due to high inflation and interest rates. However, it’s worth noting that PayPal’s clientele tends to be more affluent. Therefore, its loss rates from transactions remain relatively low at 0.1%.

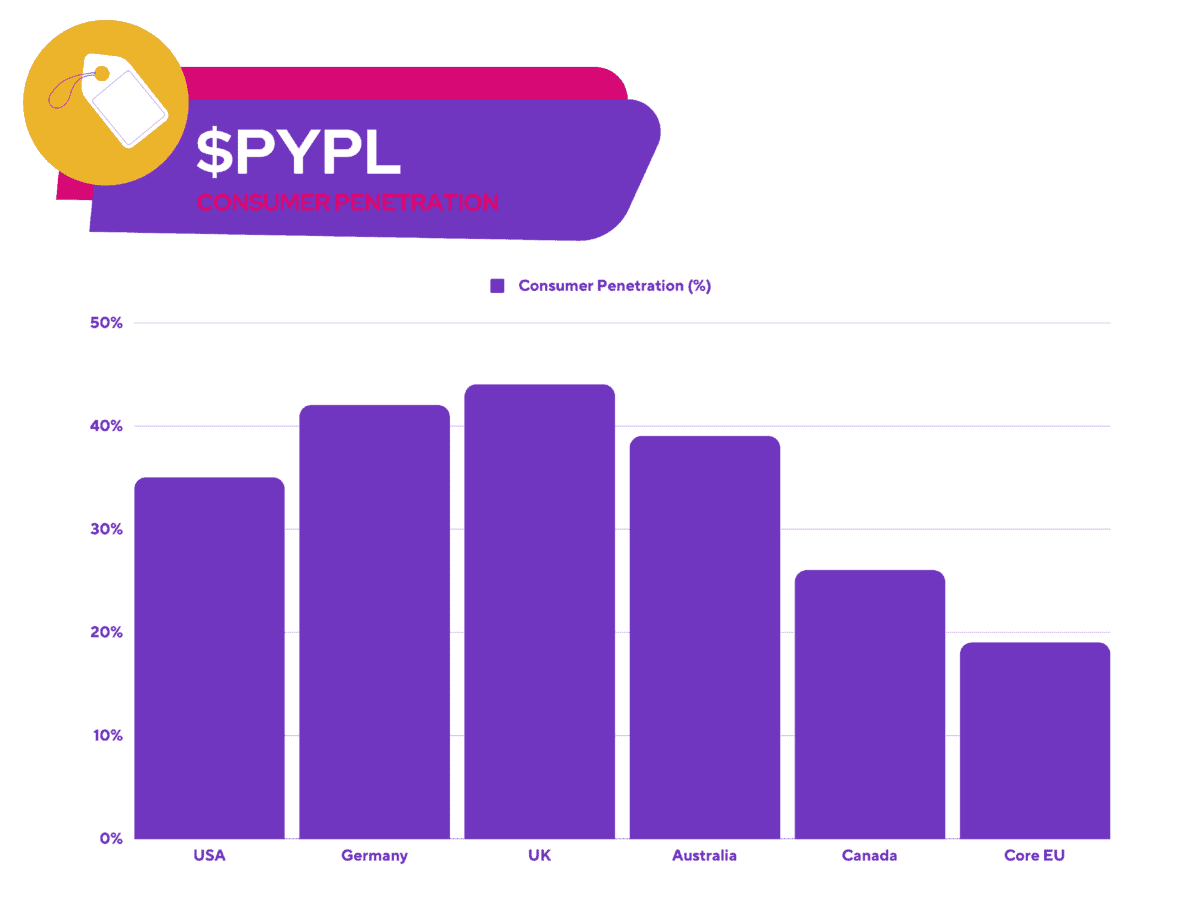

Big market for PayPal and Apple

Nevertheless, the latest data from Salesforce has dampened investor confidence in PayPal stock, as it points towards Apple Pay growing at an “extremely rapid pace“. In November alone, Apple Pay grew 52% year on year in global transactions. Meanwhile, PayPal adoption fell 8%. That being said, I’m still bullish about the company for several reasons.

Firstly, PayPal remains a much larger payment platform than Apple Pay. It makes up 16% of global e-commerce purchases against the latter’s 5%. And with e-commerce only making up 15% of total retail sales, I believe the competition still lies with cash and other payment processors like Visa and Mastercard, not payment platforms like Wise or Apple Pay. As such, this leaves plenty of room for both PayPal and Apple to continue expanding in tandem with digital banking and e-commerce.

Secondly, I’m a big fan of the synergies PayPal has via the companies it’s acquired, such as Braintree and Honey. This gives merchants and customers more incentive to use the platform, as it allows for a smoother process when transferring funds and/or buying items.

Most importantly, it’s got a robust balance sheet. With a debt-to-equity ratio of 52.6%, the tech stock is more than equipped to deal with a potential recession. Pair this with the board’s positive outlook for 2023, and I can understand why analysts have an average ‘strong buy’ rating on PayPal stock, with an average price target of $108. For those reasons, I’ll be buying more of its shares to capitalise on a potential upside of 50%.