In recent months, I’ve been stockpiling cash in my Stocks and Shares ISA. As a result, I now have a cash balance of around £16,000 within my account.

Interested to learn how I plan to invest this cash? Read on and I’ll tell you.

Buying opportunities

Let me start by saying that I don’t plan to invest all of this money immediately.

I am seeing some good investment opportunities today. However, I’m convinced that there is likely to be some even better buying opportunities in the months ahead. There are plenty of issues (inflation data, interest rates, lower corporate earnings, China weakness) that could create some market volatility and throw up some bargains.

So for now, I’m going to be patient, and save the bulk of my cash pile for a better entry point.

What I plan to buy

When volatility returns to the markets, and share prices are a bit lower across the board, I’ll start to deploy my capital across a range of funds and stocks.

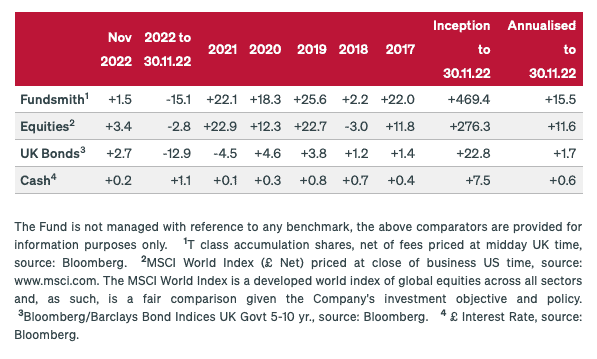

One fund I’ll almost certainly add to is Fundsmith Equity. This is a global equity fund that has a focus on high-quality, profitable companies. Its top holdings currently include tech giant Microsoft, diabetes specialist Novo Nordisk, makeup powerhouse L’Oreal, and luxury goods company LVMH.

I’ve been invested in this particular product for over five years now, and it has performed well for me. Past performance is not an indicator of future performance, though.

Following Buffett

In terms of individual stocks, one industry I want more exposure to is semiconductors or ‘chips’ – an area Warren Buffett just made a $4bn investment in.

Semiconductors play a huge role in our lives these days as they power almost all electronic devices. And demand is only likely to rise in the years ahead as the world becomes more digital.

Here, I’d like to top up my positions in Nvidia, which is one of the biggest players in the market, and ASML and Lam Research, which both make chip-manufacturing equipment.

I’m also looking to buy KLA, which provides process control solutions to the industry.

Chip stocks can be volatile, but I like their long-term prospects.

A safer bet?

Another sector I’d like more exposure to is healthcare. I see it as a safer bet in the current environment as healthcare spending is quite resilient in downturns.

One stock I’m looking to buy more of here is US-listed Edwards Lifesciences. It’s a leading medical technology company that specialises in artificial heart valves and blood flow monitoring.

This stock is quite expensive in terms of its valuation. But I think it’s poised to do well in the long run on the back of the world’s ageing population. In older adults, heart disease is one of the most frequent medical conditions observed.

Other stocks I want to buy for my ISA

Some other stocks I’m looking to buy for my Stocks and Shares ISA include alcoholic beverages company Diageo, online shopping powerhouse Amazon, payments firm Visa, skincare giant Estee Lauder, and financial data specialist S&P Global.

None of these stocks are particularly cheap. However, the underlying companies all have strong competitive advantages and significant long-term growth potential. So, there’s a decent chance they will turn out to be good investments in the long run, in my view.