Recessions and bear markets don’t come often, and they often create some of the best opportunities for long-term investors. For that reason, I’ll be looking to snatch up shares on the cheap for attractive, long-term growth. So, here are two FTSE 100 shares I’m planning to buy.

1. Rio Tinto

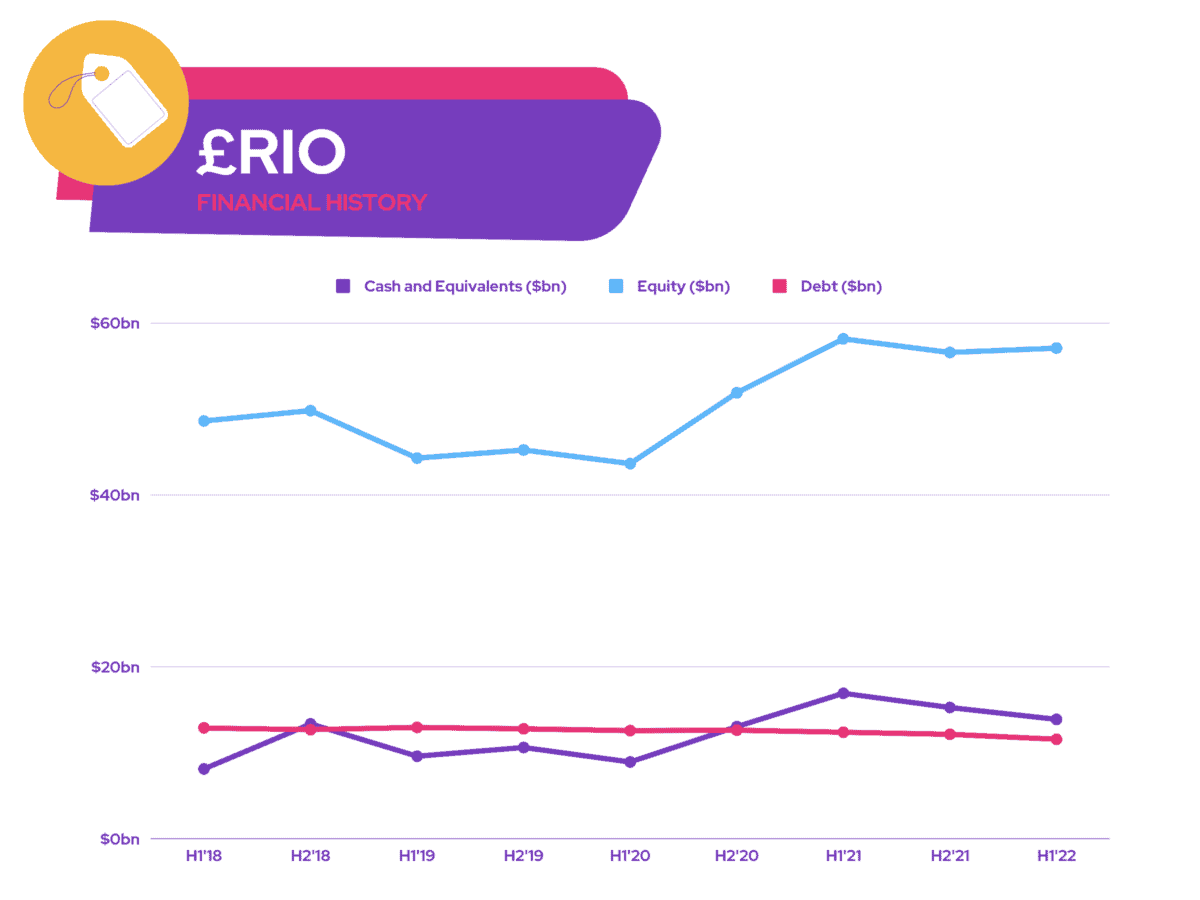

Lower iron ore prices along with slower construction activity have pushed the Rio Tinto (LSE: RIO) share price off its highs this year. Nonetheless, its strong balance sheet and low levels of debt put it in an excellent position to weather a recession. Additionally, its current low price-to-earnings (PEG) ratio of 0.1 indicates that it could be undervalued.

Brokers like Berenberg are bearish on the FTSE 100 miner and are forecasting its dividend to take a hit this year due to more restricted cash flows. While that may be the case, I’m not convinced that the hit will be drastic given its excellent cover of 1.7x.

Moreover, it’s worth noting that Rio earns the bulk of its revenue from China, and iron ore. As a result, a British recession shouldn’t affect its top line. With the Chinese government seemingly taking a step back from its zero-COVID policy, constructing activity may return to pre-pandemic levels soon.

Furthermore, fears surrounding a property market crash have been refuted. Recently, China’s largest lender announced that it was extending its credit lines to approximately $92bn. This has seen iron ore prices climb 35% in the span of a month.

The headwinds that originally pushed the FTSE 100 share lower are dissipating, and there’s certainly potential for long-term value and dividend growth. With that in mind, I’ll be investing in Rio Tinto shares when I’ve got more spare cash on hand.

2. Taylor Wimpey

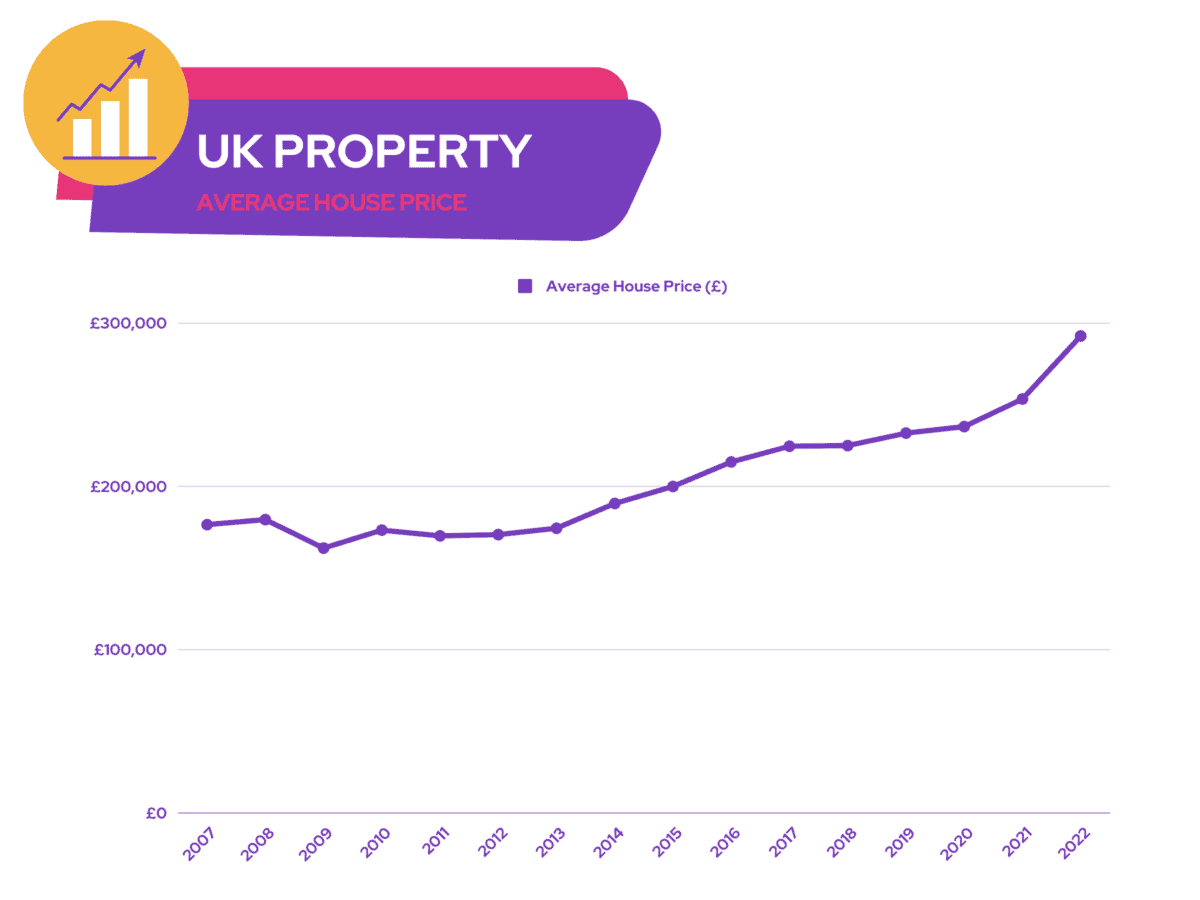

The current housing market isn’t in good shape. House prices have come down substantially from their highs. Property website Zoopla has even forecasted a 5% decrease in house prices in 2023. As such, it may seem odd for me to invest in a housebuilder like Taylor Wimpey (LSE: TW). However, I see this recession as a prime opportunity, and here’s why.

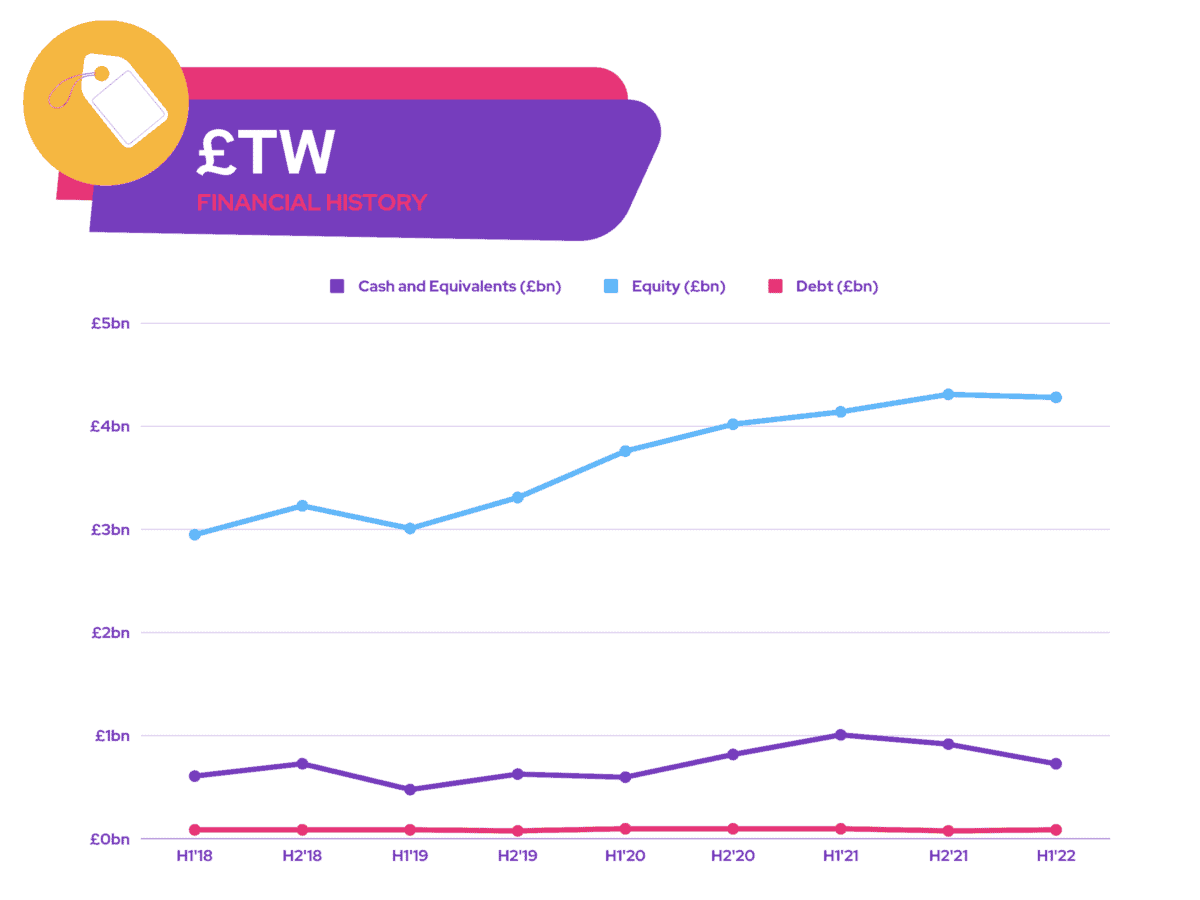

For one, Taylor Wimpey’s balance sheet is immaculate. Its debt-to-equity ratio currently stands at 2%, indicating that the company is in a healthy financial position. This means that its financials won’t be overly affected by the current housing downturn. More importantly, this allows it to cover its current dividend yield of 8.5% by up to 2.1 times. This is also probably why the FTSE 100 developer is yet to rebase its dividend per share.

What’s more, it’s entirely possible that the house market may be nearing a bottom. According to mortgage broker Coreco, transactions and a degree of normality are starting to return.

The fact the mortgage market has now stabilised and that rates are not set to peak as high as we thought has brought some confidence back into the market, despite the predicted long recession that lies ahead.

Andrew Montlake, Coreco

UK properties have a steady record of price growth. Which is why I believe this could be a once-in-a-lifetime opportunity for me to buy housebuilder shares. After all, the likes of Berenberg and Deutsche rate the FTSE 100 share a ‘buy’ with a price target of £1.15. For those reasons, I’ll be adding Taylor Wimpey to my portfolio.