The Rolls-Royce (LSE: RR) share price has shown relative strength over the past couple of months. The stock has rallied by 35% from its bottom and could see further upside given the number of positive developments lately. With that in mind, I’m tempted to open a position.

Powerful developments

November was a great month for Rolls-Royce. First, it successfully tested the world’s first hydrogen-powered aero engine. The FTSE 100 firm is partnering with easyJet to develop short-haul commercial aircraft powered by hydrogen, and these are promising first signs.

Additionally, the engineer began holding talks with INEOS on funding for its small modular reactors (SMRs). This is an exciting development considering the high potential surrounding nuclear energy and energy independence.

Moreover, Rolls-Royce has shared a number of contract wins in its Power Systems segment as it continues to grow at a rapid pace. The firm has struck an agreement with Semper Power to supply and install large-scale battery storage systems. Plus, it has signed a letter of intent with Sumec to cover over 200 MTU engines.

Turbulent supply

There’s certainly excitement surrounding its energy branch. However, Rolls-Royce will still have to fund these developments through the cash its generates from its Civil Aerospace division. As such, it’s crucial for the sector to recover to pre-pandemic levels as soon as possible.

Nonetheless, the engineer faces a number of stumbling blocks. For one, flying hours for its engines are still lagging behind the overall industry. This is because recovery for long-haul travel remains slow. Second, it faces supply chain issues, particularly in China. These problems are hindering its ability to service engines and bring in revenue at a quicker pace.

The manager of Rolls-Royce China shared that the zero-Covid policy has meant plenty of disruption. This has led to issues surrounding the company’s operational efficiency as parts aren’t arriving on time.

A welcome arrival

Having said that, the group remains upbeat about finishing the year on a positive note, which could see Rolls-Royce shares recover further. In its latest trading update, the board maintained its guidance for the full year. That means revenue growth of 3-6%, an operating profit margin of approximately 3.8%, and free cash flow to be modestly positive.

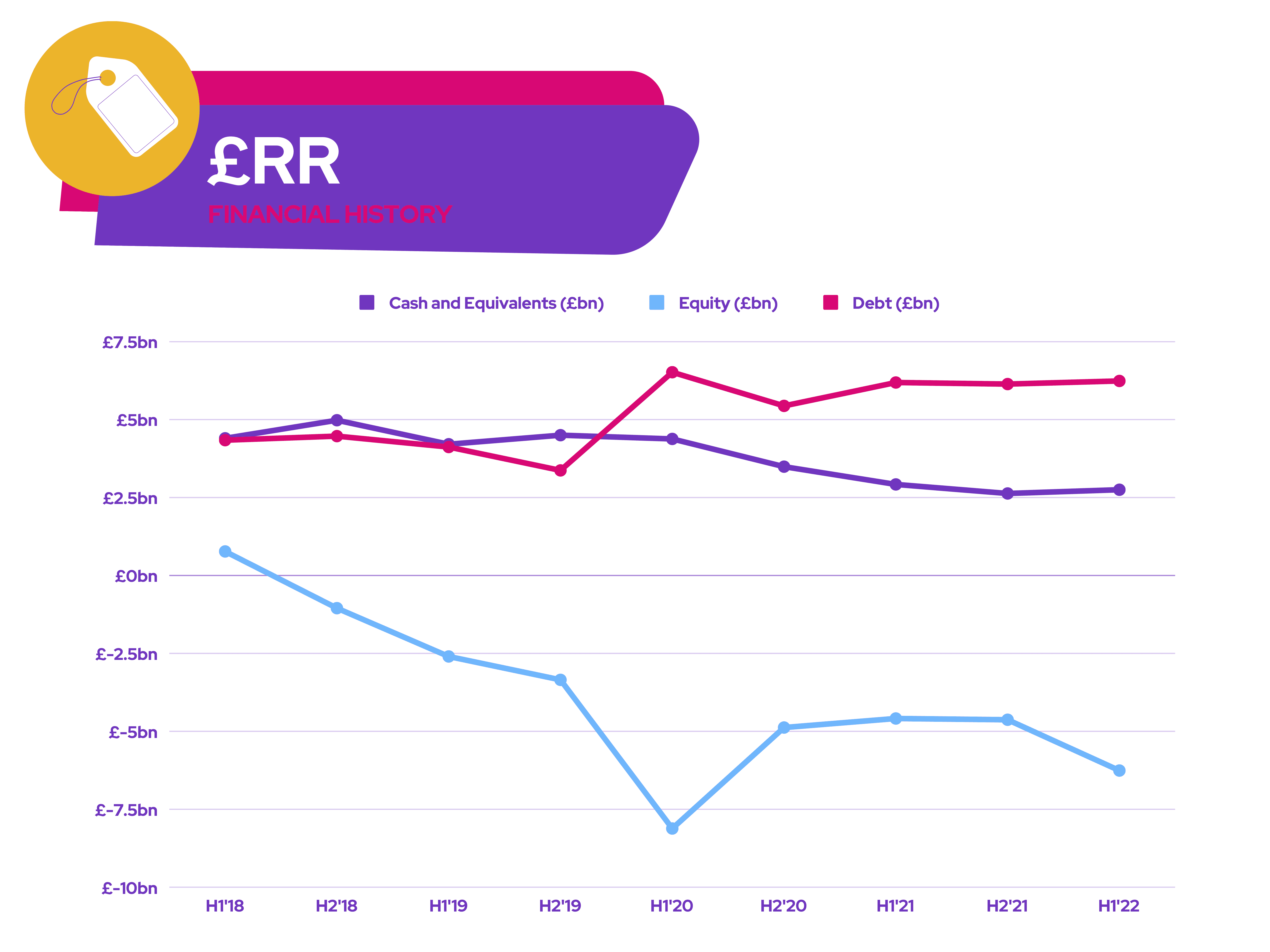

This is very welcome considering the state of the manufacturer’s balance sheet, where it holds negative shareholder equity. Furthermore, the arrival of new CEO Tufan Erginbilgic should shore up investor confidence. After all, the former BP downstream chief is renowned for his track record of leading a strong operational turnaround.

That being said, it may only be a matter of time before Rolls starts to enjoy the travel industry’s tailwinds. With travel showing no signs of cooling and China being pressured to reopen, the stars are aligned for a recovery in long-haul travel. This would stimulate higher flying hours for wide-body aircraft and lift the Rolls-Royce share price above £1.

Not to mention, with no significant debt obligations due until 2024, the runway is set for the supplier to recover its balance sheet and reach net cash by 2025. So, having said all that, a recently upgraded ‘buy’ rating from Barclays and a price target of £1.10 could push me over the line to buy Rolls-Royce shares this month.