Since hitting a bottom of $17.25 this year, Pinterest (NYSE: PINS) stock has rallied by 40%. With a price target as high as $34, this growth stock could still see another 40% increase from its current price. So, here are several reasons why I’ll be investing £3,000 into Pinterest stock.

Remarkable results

Pinterest’s main revenue driver comes from advertising. This is why it came as a surprise to many that its results came in better than analysts were expecting. Unlike many of its advertising peers, the hybrid e-commerce and social media platform saw robust growth in its top line and a better than expected bottom line.

| Metrics | Estimates | Q3 2022 | Q3 2021 | Growth |

|---|---|---|---|---|

| Revenue | $667m | $685m | $633m | 8% |

| Non-GAAP earnings per share (EPS) | $0.06 | $0.11 | $0.28 | -61% |

| Monthly active users (MAUs) | 440m | 445m | 444m | 0% |

| Average revenue per user (ARPU) | $1.52 | $1.56 | $1.41 | 11% |

Aside from that, investors like me were happy to see the platform’s MAUs finally rebound after consecutive quarters of decline. In fact, MAUs jumped 3% since the second quarter. To complement this, ARPU also saw a healthy increase overall.

Additionally, the impressive growth beat analysts’ expectations considering how other stocks such as Meta, Alphabet, and Snap saw slower or declining rates of growth in advertising.

| Social media platforms | Revenue growth |

|---|---|

| Alphabet | 6% |

| Meta | -4% |

| Snap | 6% |

| 8% |

A great growth stock

Apart from the top line numbers though, there were several other metrics that really impressed me. For one, mobile MAUs, which generate 80% of the company’s revenue, increased by 11% year on year (yoy). Meanwhile, the number of desktop users continue declining. This is great for growth considering that it’s now receiving higher-quality users.

Pinterest also has an accumulated deficit worth $2.13bn, which is amazing news for long-term investors like me. This is because the deficit essentially gives the company a tax allowance of up to 80% on future profits. This would serve to boost its bottom line.

Moreover, CFO Todd Morgenfeld cited 50% growth (yoy) in shopping ads revenue, which is where the stock’s largest potential lies. He also mentioned that the rate of growth is accelerating, presenting a strong tailwind for Pinterest’s top line moving forward.

Furthermore, the firm is continuing to roll out impressive features to both businesses and advertisers globally. The new interface now allows for more control over catalogues in the shop tab, as well as advertisements shown. The impact of these introductions are already starting to reap benefits as rest of world ARPU grew a staggering 38% (yoy).

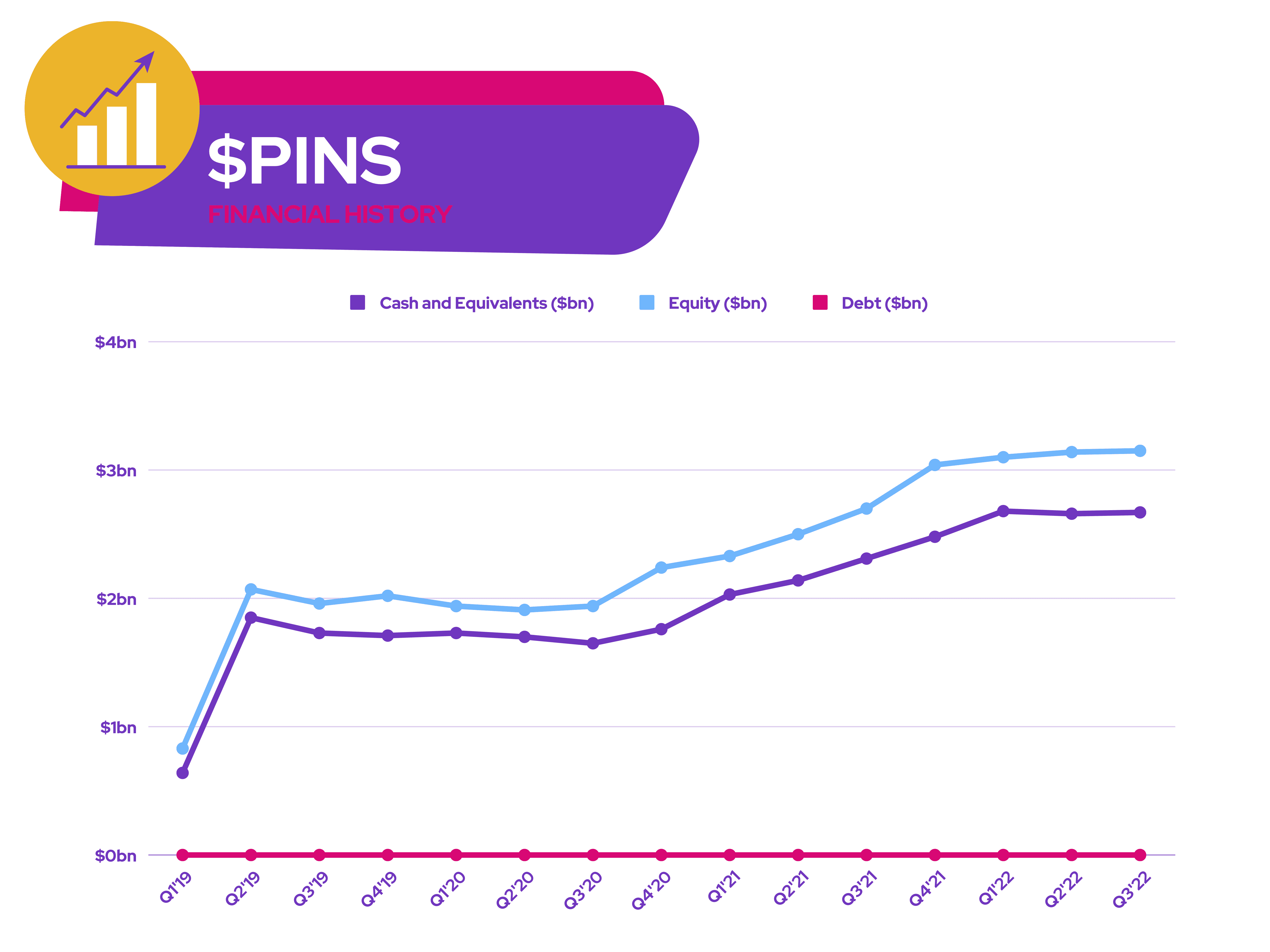

Flawless financials

The board guided for quite a somber Q4. CEO Bill Ready only expects revenue to grow by mid-single digits due to the impact of the strong US dollar. Nonetheless, he’s still confident in the growth stock’s ability to return to meaningful margin expansion next year.

That being said, there’s a headwind worth considering when investing in Pinterest stock. High interest rates have been affecting retail sales. And although the latest data from October and this month’s Black Friday event showed positivity, the future may see a slowdown as borrowing costs surge.

Nevertheless, Pinterest is extremely well equipped to handle an economic downturn with no issues from a financial standpoint. The platform has virtually no debt and has enough cash to run its business for at least nine years without having to earn a single cent. After all, Wells Fargo has a ‘buy’ rating on the growth stock with a price target of $34.

It’s for the above reasons that I feel so optimistic about the growth stock, and why I’ll be investing more of my spare cash into Pinterest stock.