The Rolls-Royce (LSE: RR) share price has picked up significantly in recent weeks.

The plane engine manufacturer remains more than a quarter cheaper than it was a year ago. But it’s risen around 30% since the start of October thanks to better-than-expected trading from airlines like IAG and Ryanair.

I haven’t been tempted to buy Rolls-Royce shares for my portfolio. Though I am encouraged by the FTSE 100 company’s attempts to boost its credentials in the field of green technology.

And these two pieces of news during the past 24 hours have boosted my feelings towards the enginemaker. Could now be the time for me to buy the recovering engineer?

Hydrogen power

Rolls-Royce is spending fortunes to make its plane engines more fuel efficient. This is a potentially lucrative growth market as airlines look to reduce fuel costs and reduce their carbon emissions.

Rolls has been developing its UltraFan for years. These engines burn 25% less fuel than the first generation of Rolls’ mega-popular Trent power units.

And today the company announced it had successfully tested a hydrogen-powered aeroplane engine with easyJet. Rolls described the experiment as “a major step towards proving that hydrogen could be a zero-carbon aviation fuel of the future”.

Going nuclear

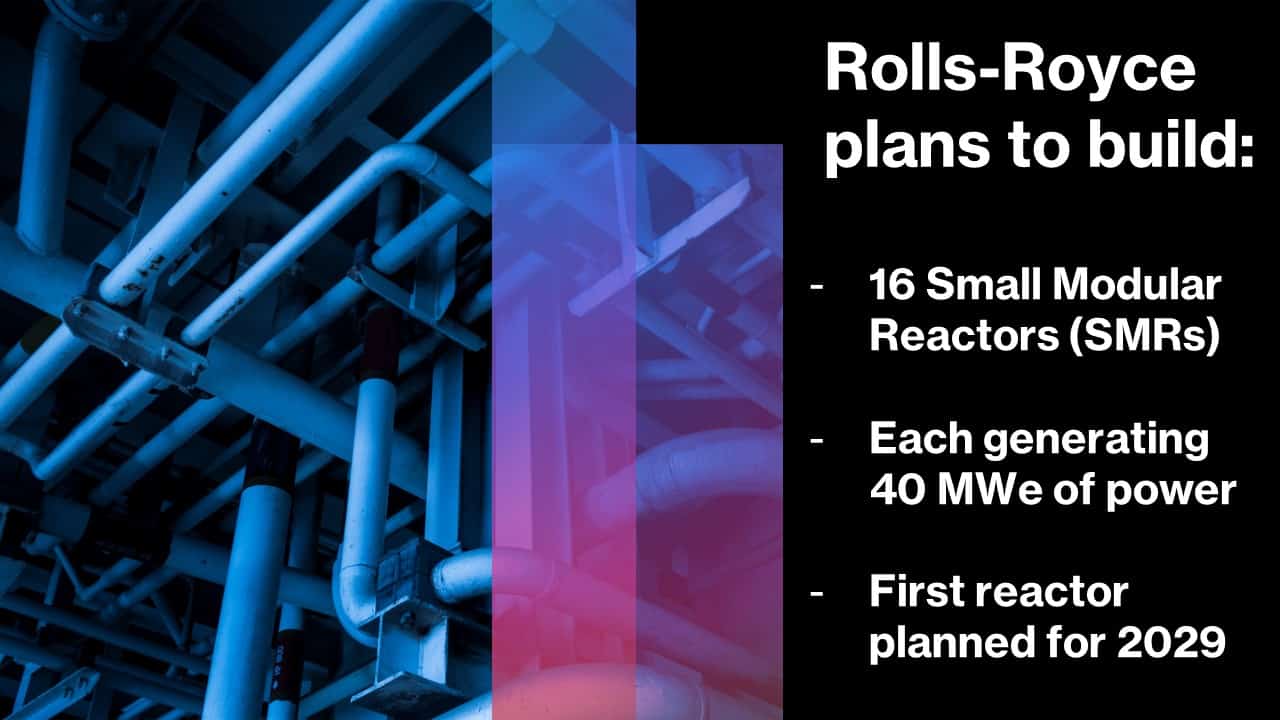

Other positive news in the past two days concern Rolls-Royce’s push into nuclear power.

Chemicals giant Ineos is in talks to acquire one of the engineer’s small modular reactors (SMRs), according to The Sunday Telegraph. The plant would reportedly be used to help Ineos’ Grangemouth refinery run on hydrogen.

Word is that talks are at an early stage between the two companies. But the news does shine a light on the enormous commercial potential of Rolls’ technology as firms try to decarbonise their operations.

The company has already received government backing to build a fleet of SMRs to help Britain meet its net zero targets.

The verdict

The green technology revolution has plenty of potential for UK share investors. I myself have purchased shares in wind and solar energy business The Renewables Infrastructure Group. I also have holdings in TI Fluid Systems, a share that builds critical components for electric vehicles (EVs).

But I’m more reluctant to buy Rolls-Royce shares. This is mainly because I’m not comfortable owning companies that carry such huge amounts of debt.

Net debt at Rolls stood at £4bn as of September. The costs of servicing this are colossal and look set to climb further as interest rates rise. These big debts could also reduce what the company can spend on its growth projects as well as when (and at what levels) shareholder dividends will return.

These high debt levels are also concerning given the uncertain outlook for the aviation industry. Okay, the sector has recovered strongly in 2022. But can it continue to as consumer spending comes under pressure and the Covid-19 crisis in Asia drags on?

I’m hugely encouraged by ongoing news surrounding the company’s development of green technologies. But as an investment, Rolls still carries too much risk for my liking.