Warren Buffett is a huge proponent of index funds. He labels them “the most sensible equity investment” for most people, and has advocated for investing in the S&P 500. That being said, the UK’s FTSE 100 is a great option too. So, here’s where I decide which index I’ll be looking to invest in next year.

FTSE 100

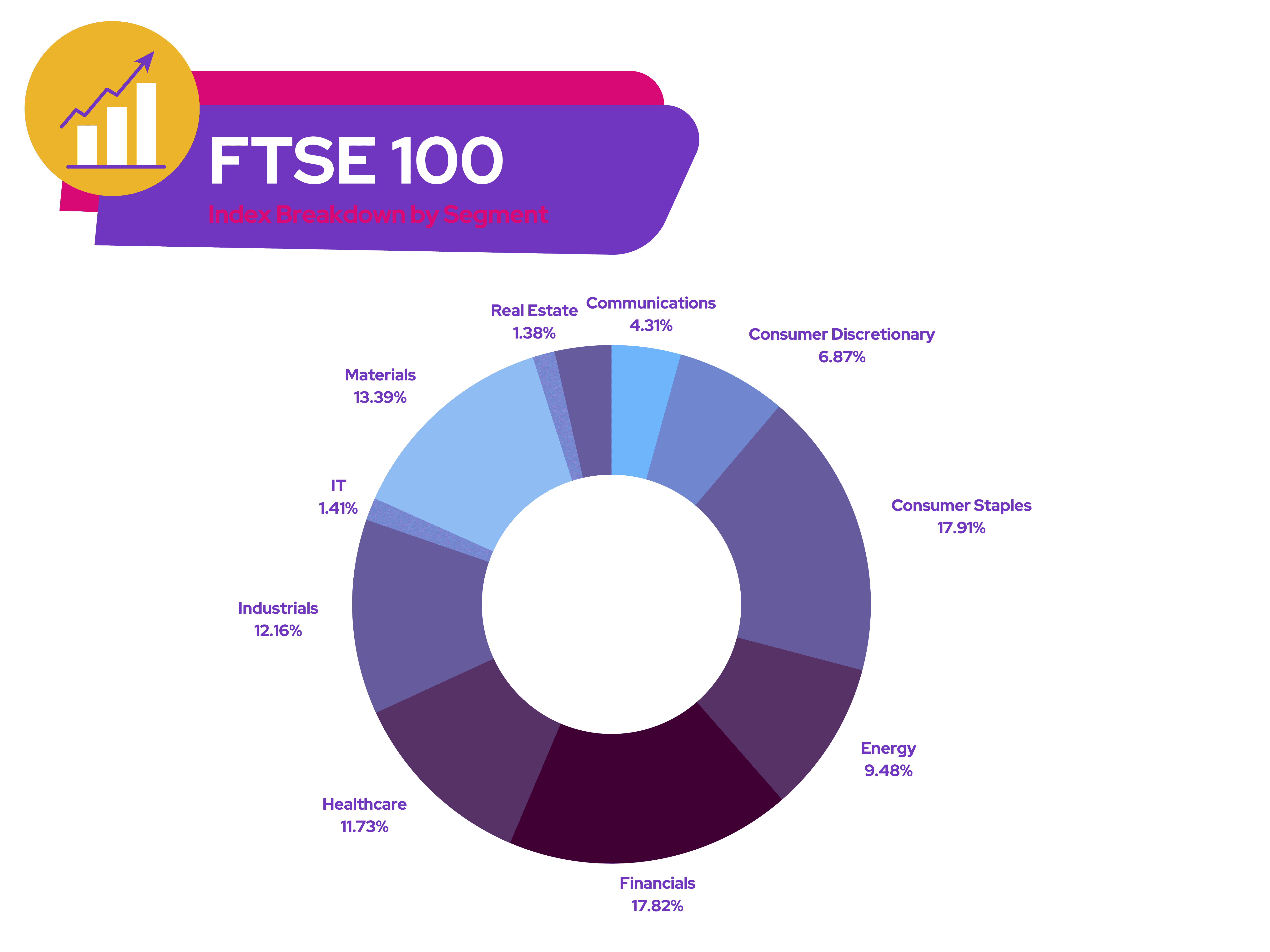

Britain’s main index has been fairly static this year, despite the headwinds of high inflation and interest rates. This is due to the more defensive nature of its shares. Hence, companies in sectors such as consumer staples, oil and financials have seen their share prices holding up amid a looming global recession.

Nonetheless, a global recession could present a buying opportunity for me. This is because most of the index’s companies are cyclical in nature. For instance, firms in the mining industry will fall during an economic downturn, but will rebound when the global economy recovers.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

However, the defensive set up of the FTSE 100 is a double-edged sword. The index’s lack of tech and growth stocks has resulted in very slow growth over the past two decades. Despite that, the UK’s largest index is known for being a dividend mine with its average dividend yield of 3.7%. This attracts many dividend investors seeking passive income.

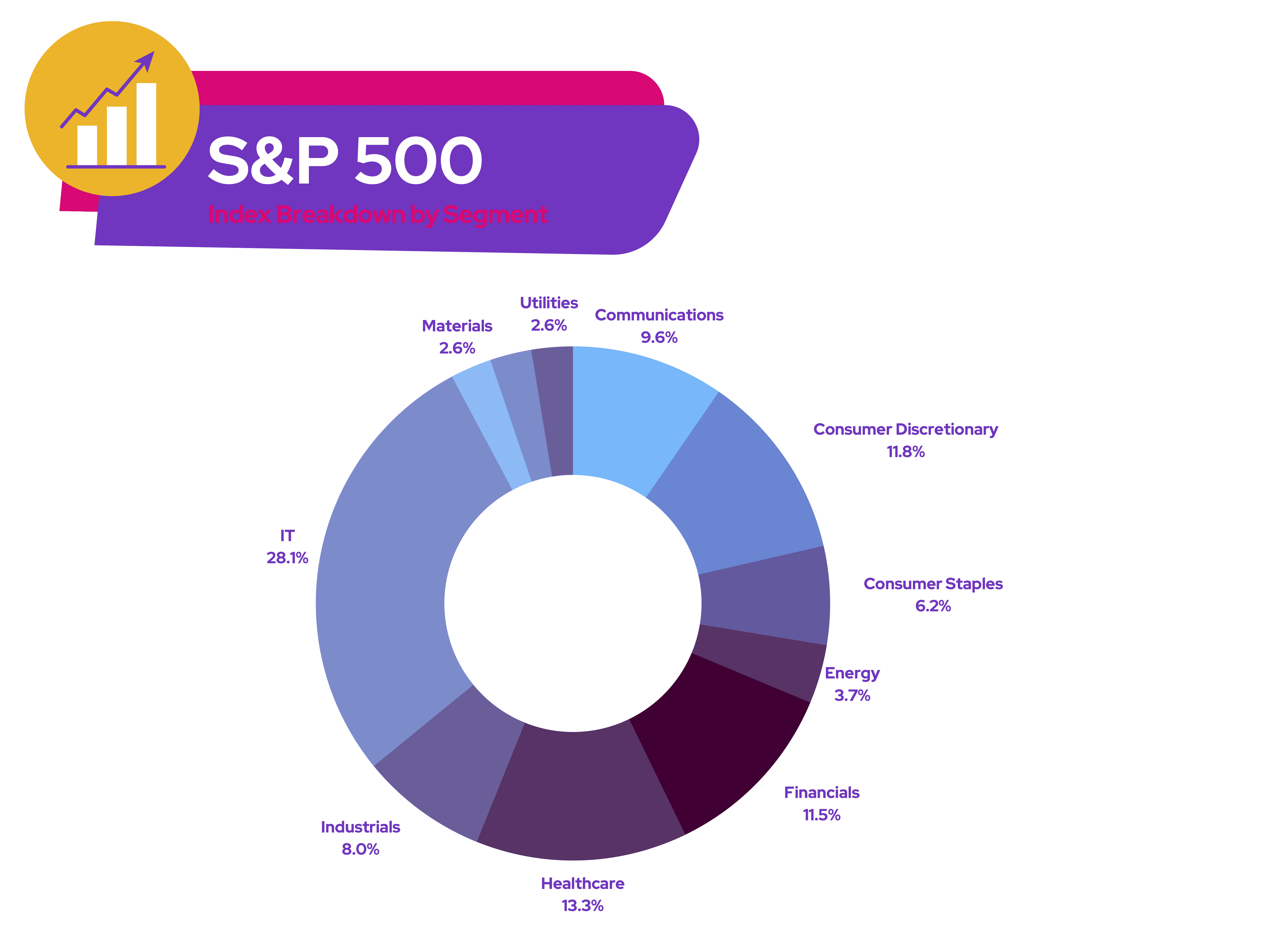

S&P 500

On the flip side, the S&P 500 has spent a large part of the year in bear market territory. This is a result of its larger exposure to tech and growth stocks. And unlike its British counterpart, most its earnings come domestically. Although international income this year has affected earnings negatively due to a strong US dollar.

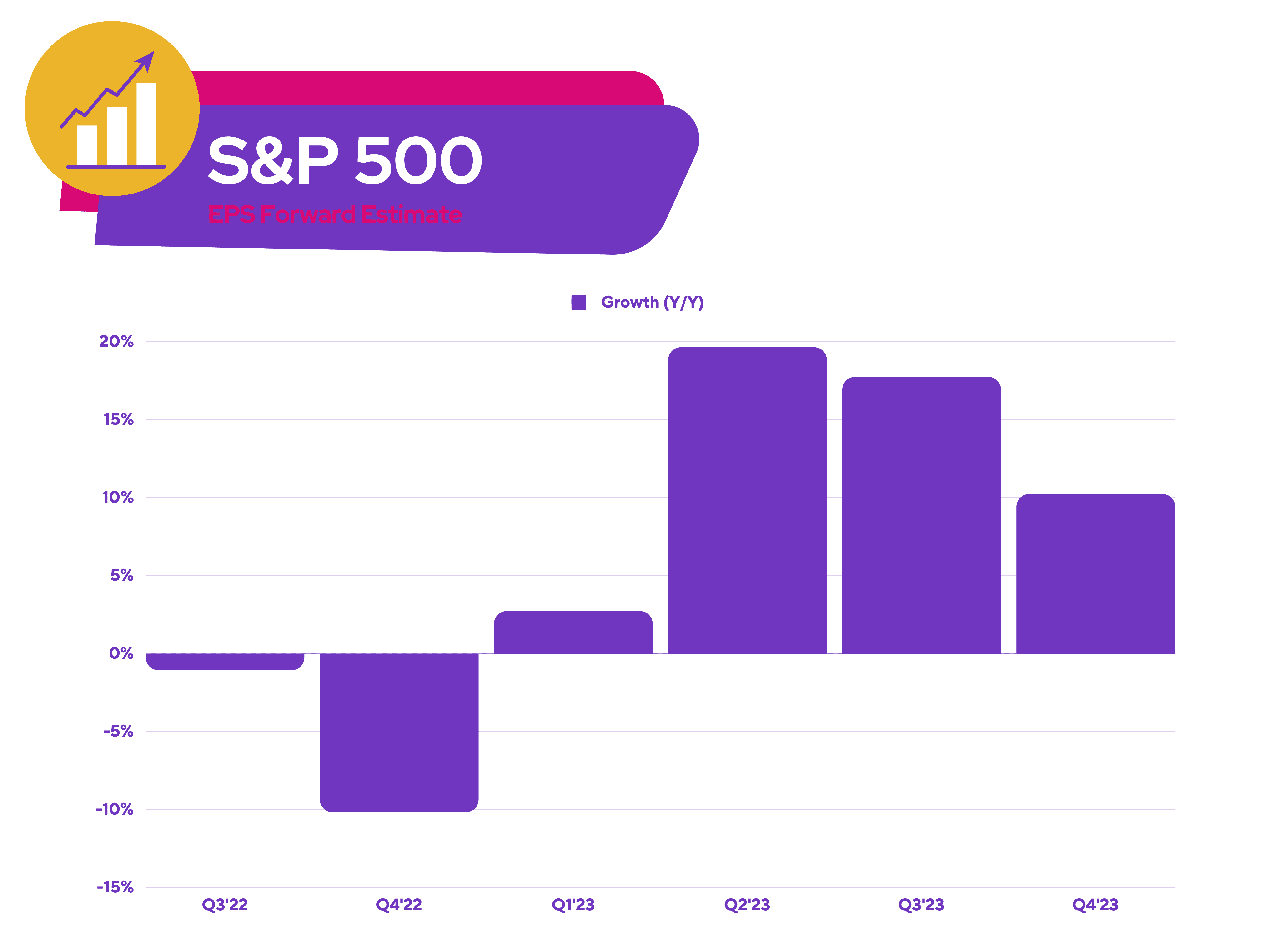

Nevertheless, several analysts believe the US index may have hit a bottom. Historically, the S&P has a tendency to find a bottom before a recession and when earnings estimates decline.

Additionally, inflation seems to have peaked. The last four Consumer Price Index (CPI) releases have seen declines. Moreover, the latest comments from Federal Reserve members indicate that they may be slowing the pace of rate hikes sooner rather than later. This has led many analysts to assume that rate hikes could stop at a lower rate than previously anticipated.

If this proves to be true, it could see the S&P 500 generating a higher return than the FTSE 100 in the upcoming year. Bullish analysts such as Barry Bannister from Stifel are now forecasting the US index to rise by as much as 17% in the first quarter of 2023.

Which will I buy?

In a pool of index funds, it’s important to pay for one that charges minimal management fees so that I can capitalise on as much gains as possible. These include popular Exchange Traded Funds (ETFs), such as Vanguard’s S&P 500 ETF and FTSE 100 ETF.

Ultimately though, I’m planning to buy both FTSE 100 and S&P 500 ETFs, because I believe in diversifying my portfolio. This allows me to gain exposure to both growth and blue-chip names while capitalising on reasonable dividend yields. Nevertheless, most of my money will still be invested in individual value and growth stocks such as Alphabet and PayPal, as I’m inclined to take more risk for higher growth.