Recently, the Bank of England and the OECD predicted that the UK will enter a recession in 2023. This doesn’t spell good news for British shares. Nonetheless, I’ve identified two of the best stocks to buy for my portfolio during this economic downturn.

1. Hotel Chocolat

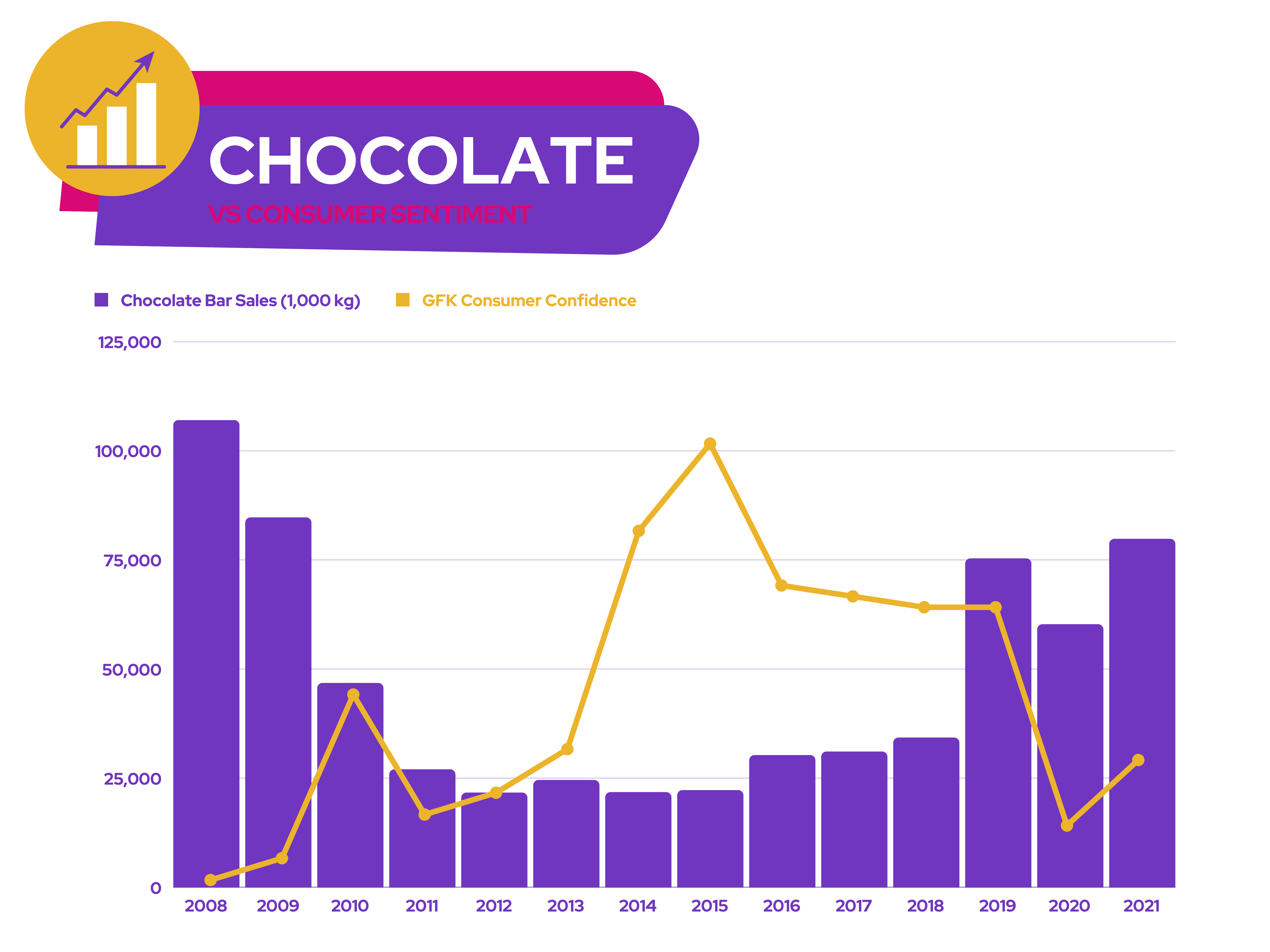

Customers tend to purchase more chocolate when consumer confidence declines, which is why Hotel Chocolat (LSE: HOTC) is one of my stocks to buy. Odd as it may seem, this inverted relationship can be attributed to the Lipstick Effect, where small-ticket indulgences have some level of protection during economic turmoil. Sometimes, this can even lead to increased sales volumes as customers trade down to buy more ‘affordable’ treats and gifts.

As such, I believe the British chocolate manufacturer is well positioned to capitalise on the current economic climate. This has been evident in its latest trading update.

Should you invest £1,000 in Rivian Automotive right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Rivian Automotive made the list?

| UK sales | Growth |

|---|---|

| FY22 vs FY21 | 35% |

| FY22 vs FY19 | 68% |

Having said that, there are caveats to buying the stock. For one, the brand’s recent exit from the US due to its inability to penetrate the market spooked investors. This was why the stock dropped over 40% in July. Consequently, management expects to make a loss in FY22 and forecasts lower growth in FY23.

Nevertheless, I think these factors are already priced into the current share price. The board remains optimistic about growth beyond FY23 and the chain is planning on growing its customer base while exercising strict capital discipline. With virtually no debt on its balance sheet and cash and equivalents worth approximately £67m, this could be possible if previous trends prove to be true. Berenberg has a ‘hold’ rating on the stock with a price target of £1.55, so I’ll only be dipping my toes in for now, but may buy more if its outlook improves.

2. Reckitt Benckiser

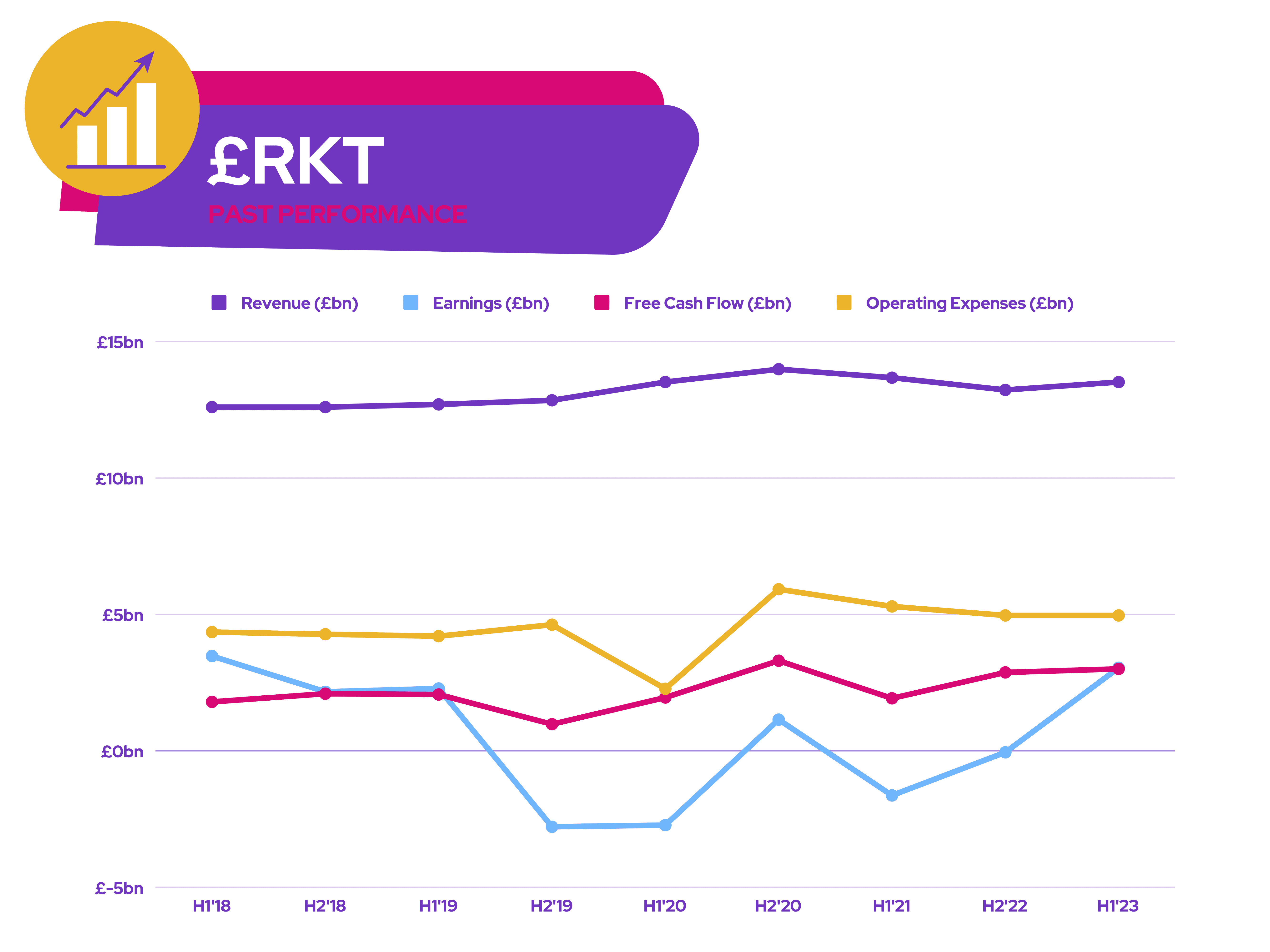

Next on my list is a less speculative stock, Reckitt Benckiser (LSE: RKT). The FTSE 100 firm has underperformed its index this year, but things could turn around soon, according to brokers at Deutsche.

Discretionary spending is expected to decline during a recession. Yet, demand for Reckitt products isn’t likely to wane due to the inelastic nature of its products. This has allowed the group to raise the prices of its products while growing its profit margins to 22.5%. Additionally, Reckitt earns the bulk of its revenue from outside the UK and Europe, allowing it to hedge against slower growth in the area. This is why Deutsche thinks Reckitt is a stock to buy.

Moreover, its baby formula product, Enfamil, is cited as a strong catalyst to provide earnings growth as analysts are expecting the company to capitalise on a period of rising US births. And with Reckitt aggressively gaining market share over leader Abbott, the product could be a huge money-maker.

Nonetheless, it’s worth noting that the conglomerate’s balance sheet isn’t the healthiest. Having quite a high debt-to-equity ratio (107%) isn’t ideal and is something to take note of. But given that its adjusted EBITDA covers its net debt by 2.4 times, I might be willing to take a risk and open a position. After all, Deutsche analysts rate the stock a ‘buy’ with a price target of £67.50.