For much of the last decade, ‘Big Tech’ has been the place to be in the stock market. I really couldn’t go wrong owning the mega-cap technology stocks, as they all rose consistently. In 2020, for instance, the five ‘FAANG’ stocks, Facebook (now Meta), Apple, Amazon, Netflix, and Google (now Alphabet) rose 33%, 81%, 76%, 67%, and 31% respectively.

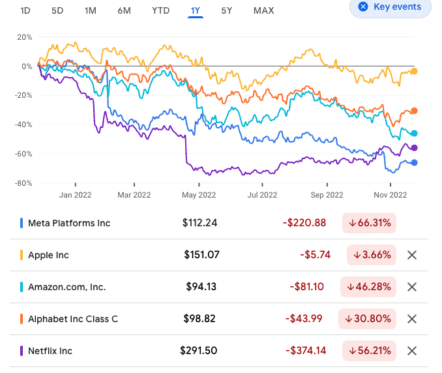

However, recently, the Big Tech trade has broken down in a big way. Not only have these stocks taken a big hit, but their performances have diverged massively. For example, Apple is down 15% year to date, while Meta is down nearly 70%.

So what should I do now? Is it game over for these stocks, or does this space still offer opportunities for a long-term investor like myself?

The world is becoming more digital

Taking a step back for a minute and looking at big picture trends in the world today, I’m still convinced this area of the market has a lot of investment potential. The world is becoming more digitalised every day. And this trend is only likely to accelerate going forward.

Looking ahead, a lot of the industries that the mega-cap tech companies operate in are projected to grow significantly over the next decade. Cloud computing, for example, is projected to grow by around 16% a year between now and 2030. Meanwhile, the e-commerce and mobile payments markets are expected to grow by around 11% and 35% respectively over this period.

Given this kind of market growth, I think it’s likely that revenues and earnings within the large-cap technology space will continue to rise over time.

I’m still buying Big Tech stocks for my portfolio

So I’m going to keep adding to the mega-cap tech stocks I own. My top pick at the moment is probably Microsoft. It has recurring revenues so it’s a little more defensive than some of the others. Meanwhile, it’s a major player in the cloud. I plan to buy some more shares soon.

I also like Alphabet today. It offers exposure to streaming, cloud, artificial intelligence (AI), self-driving cars, biotechnology and more, so I see a lot of potential. It also has a very reasonable valuation. I took the opportunity to buy more shares recently.

Amazon and Apple are the other two tech giants I own, and I plan to buy more as I grow my portfolio. The former offers exposure to e-commerce, cloud, self-driving cars and AI, while the latter offers exposure to smartphones, electronic payments, digital healthcare and more.

All of these companies have strong competitive advantages, powerful brands (Apple, Google, Amazon, and Microsoft are the four most valuable brands in the world, according to Kantar BrandZ), and strong balance sheets. In other words, they’re quality companies.

A long-term play

OK, these stocks have had an amazing run over the last decade, so a multi-year period of consolidation could lie ahead. There could even be further downside in the near term if interest rates keep rising.

I‘d be ok with that as I have a 10+ year time horizon. I’d be happy to accumulate at today’s prices for a few years and build up sizeable positions while prices are low.

I’m confident that in the long run, such stocks will go higher.