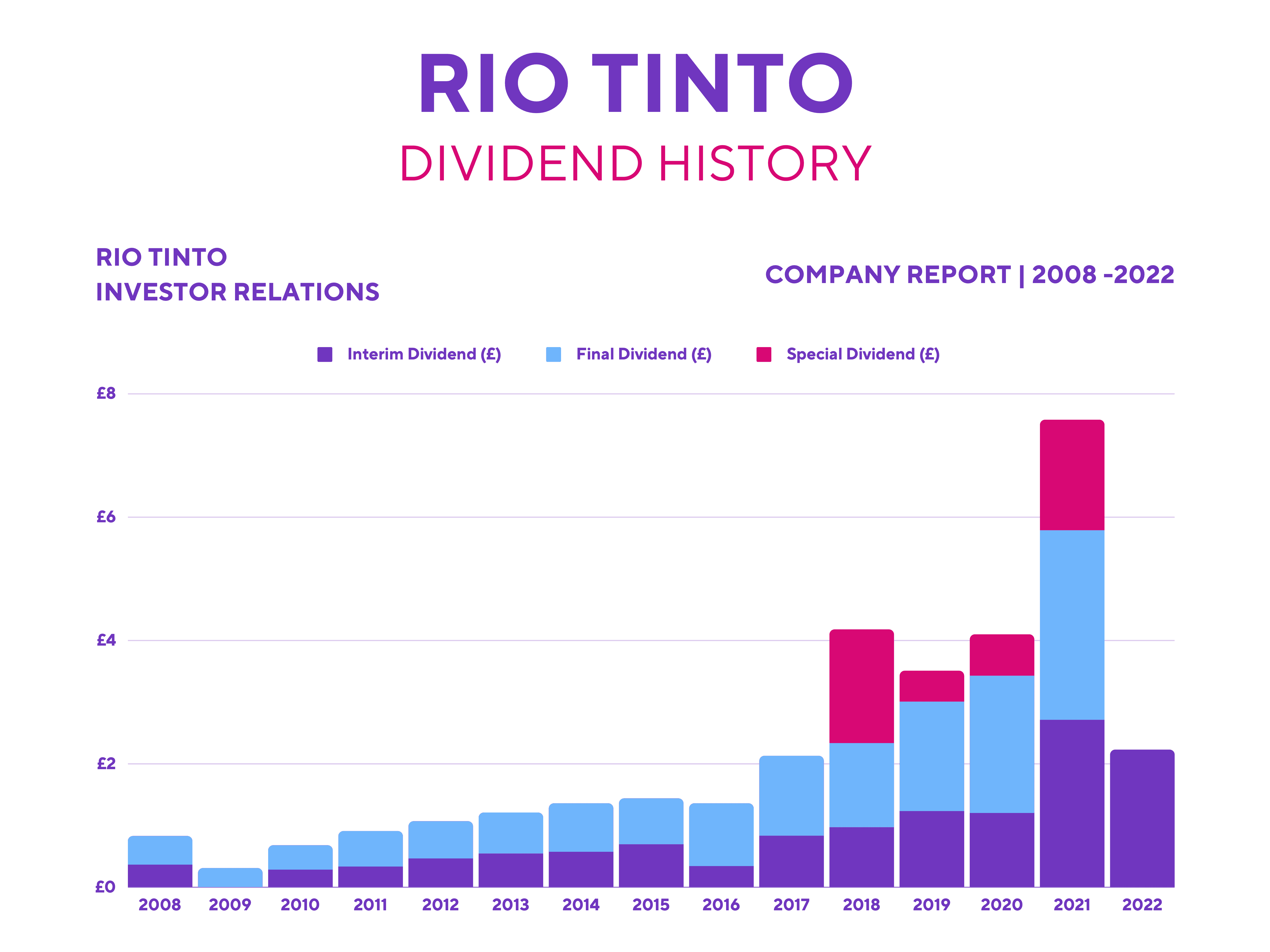

Like many mining companies, Rio Tinto (LSE: RIO) is a dividend aristocrat. The FTSE 100 firm has an excellent reputation of producing mega dividends. But with cash flow expected to decline in the short term, its high yield may not be sustainable.

Melting demand

Rio Tinto generates the bulk of its revenue from China and iron. As such, the reopenings and abrupt closures caused by the country’s zero-COVID policy has resulted in Rio’s share price being extremely volatile this year.

Nonetheless, its stock is still up 8% in 2022 so far. This is certainly commendable given the lower demand and prices for iron ore. However, demand for the metal is forecasted to remain muted for the near term. This is due to the ongoing property crisis in China, as banks continue to warn property developers not to overdevelop due to oversupply. As a result, investment in Chinese real estate has fallen by 8% so far this year, with property sales by floor area tanking 22%.

Should you invest £1,000 in Lloyds Banking Group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Lloyds Banking Group made the list?

The recessionary backdrop across the globe, particularly in Europe and the US, doesn’t provide Rio with any tailwinds either, as Purchasing Managers’ Index (PMI) numbers have shown several contractions over the past few months. Therefore, the prices of other metals on the metal producer’s portfolio, including copper, aluminium, and lithium, have also dropped.

Any special returns?

Rio Tinto’s top and bottoms lines are expected to get hit this year. Consequently, this could impact its current dividend yield of 9.8%. In fact, the FTSE 100 miner had already cut its most recent interim dividend in July.

Could this spell similar fortunes going into its final dividend? Most possibly. The company’s balance sheet remains strong with a debt-to-equity ratio of 20.3% and a dividend cover of 1.7. But declining free cash flow from lower sales is going to impact its financials if it continues to pay high dividends. For that reason, analysts are expecting its dividend to drop to by as much as 30%. There’s also unlikely to be a special pay out on top of the final dividend like last year.

Yielding future gains?

Will I invest in Rio Tinto shares? Well, the group certainly has an stellar track record of delivering high yields, especially in recent years. That being said, past performance is not necessarily an indicator for future performance.

On the one hand, a Chinese reopening could lead to a sharp reversal in iron ore demand and prices. This could drive Rio’s share price and dividend back up, given the economic stimulus. But on the flip side, China’s property crisis may linger for longer than expected which could leave Rio’s shares and dividend with downside risks.

After all, analysts are predicting a negative price-to-earnings growth (PEG) ratio of -0.2 for the stock if iron ore prices don’t rebound soon. Brokers from Berenberg, Barclays, and Deutsche have also echoed this sentiment. Accordingly, they’ve lowered their price targets for the stock to approximately £48.

Rio’s high yield could generate me a decent amount of passive income. But I think the path ahead regarding its growth is muddled with tremendous uncertainty. Thus, I won’t be investing in Rio Tinto despite its current yield.