Shares in Royal Mail owner IDS (LSE: IDS) have lost more than 50% of their value this year due to an array of issues. The firm’s latest half-year report doesn’t project a bright future either. Nonetheless, the stock could be a moneyspinner, despite the risks involved.

Driving in circles

The FTSE 250 firm’s latest results were an absolute bloodbath. Despite coming in slightly above analysts’ consensus, the numbers shared didn’t make for pretty viewing. The company’s top and bottom lines continue to suffer with further losses expected.

| Metrics | H1 2023 | H1 2022 | Change |

|---|---|---|---|

| Revenue | £5.84bn | £6.07bn | -4% |

| Operating income | -£163m | £311m | -152% |

| Profit before tax (PBT) | -£127m | £315m | -140% |

| Basic earnings per share (EPS) | -9.0p | 27.0p | -133% |

| Free cash flow | -£195m | £260m | -175% |

| Net debt | -£1.47bn | -£0.54bn | -172% |

With negotiations between management and union representatives still nowhere near resolved, I’m only expecting Royal Mail’s numbers to get worse. This is especially the case when workers are set to strike on crucial festive season days.

Additionally, a request from the board to stop delivering post on Saturdays has been rejected by the government, with an appeal still pending. This comes on the back of CEO Simon Thompson trying to cut costs and restructure the organisation.

As such, Royal Mail is now forecasting its full-year adjusted operating profit to come in at a loss of approximately -£400m. Therefore, IDS isn’t predicted to turn a profit in the near term as it’s now only targeting a return to profitability by FY25.

Delivering a silver lining

Doom and gloom aside though, there were a couple of silver linings. For one, its international division, GLS continues to perform. Although operating margins dropped due to inflationary pressures, revenue continued to see a healthy increase. More importantly, the business brought in positive cash flow and is expected to produce high single-digit revenue growth with an adjusted operating profit of around €390m this year.

| GLS Metrics | H1 2023 | H1 2022 | Change |

|---|---|---|---|

| Revenue | £2.20bn | £2.01bn | 10% |

| Operating income | £162m | £169m | -4% |

| Cash flow | £131m | £147m | -11% |

Furthermore, Royal Mail recently topped the poll of being the best parcel performer for the second year running. This shows that despite numerous strikes, Royal Mail’s customers remain somewhat satisfied. This gives the business a solid platform on which to recover given its loyal customer base.

According to Barclays, “a constructive resolution of the union dispute would ideally allow the company to set off on a path of a sustainable multi-year structural reform”. If this can be found sooner rather than later, this could then allow the FTSE 250 firm to begin returning towards profitability and potentially bring big rewards for shareholders.

Rough road ahead

Even so, the road ahead remains very tough for IDS. Inflation continues to dampen parcel demand and a resolution between Royal Mail and the union remains far off. As a result, the firm now enters into cash-preservation mode as it struggles to maintain its balance sheet going into a period of unprofitability.

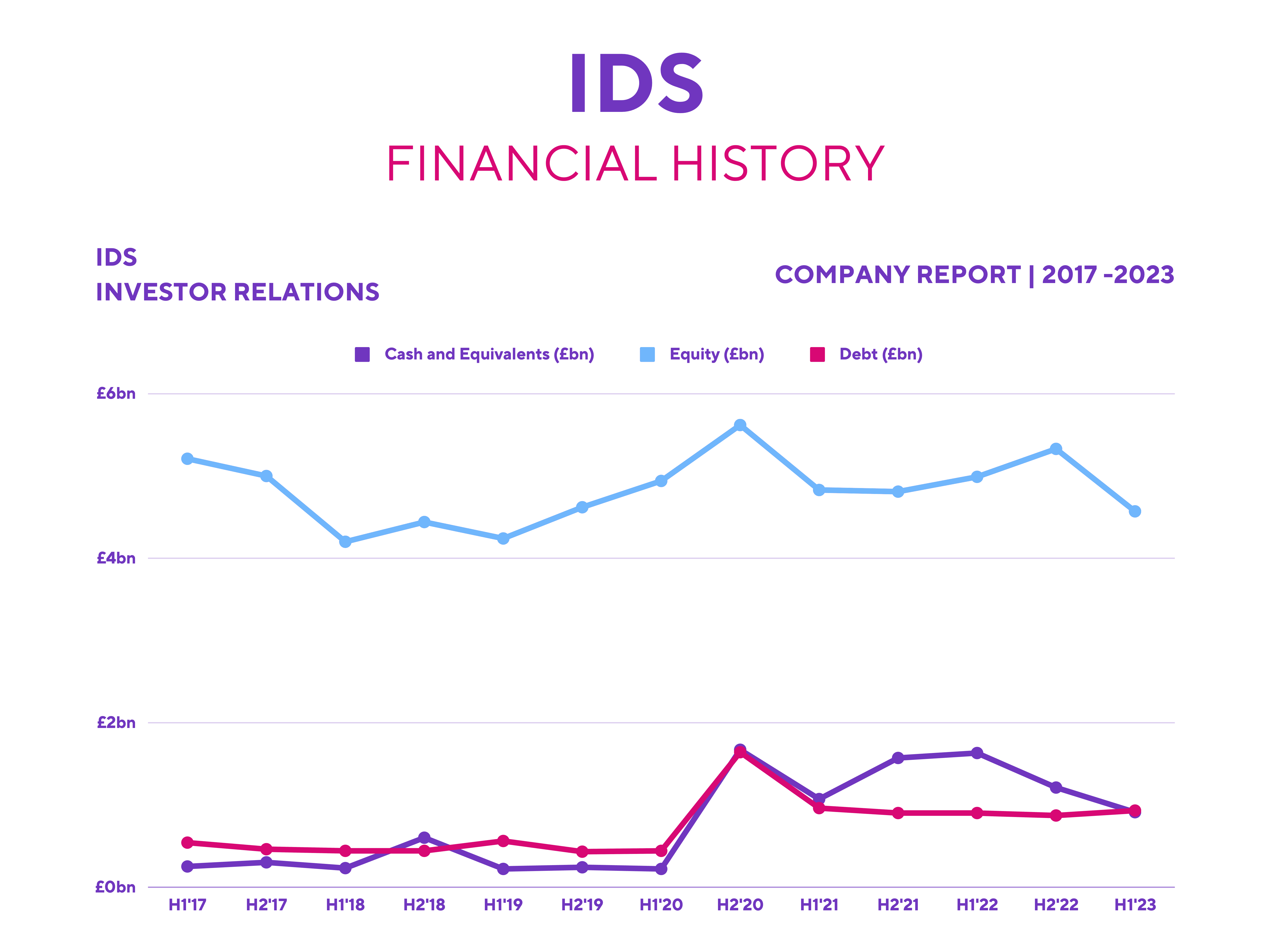

Even though IDS’s debt-to-equity ratio of 20.4% may seem healthy, it’s worth noting that its cash and equivalents (£910m) no longer cover its debt (£930m). With decelerating free cash flow expected, this is likely to get worse. Consequently, no dividend is to be expected for the foreseeable future.

Berenberg may have a ‘buy’ rating for stock with an astounding price target of £3.70, but brokers from Barclays and Deutsche rate it a ‘hold’ and ‘sell’, respectively, with an average price target of £1.85. For that reason, I’m not willing to gamble on such high risks, especially when I can invest my money in other companies with better fundamentals and growth prospects.