Burberry‘s (LSE: BRBY) latest half-year results resonated well with investors. Consequently, the Burberry share price hit its highest level this year at £21. Having said that, I’ll be giving my initial take on its earnings and whether its stock has hit a peak.

No signs of wearing off

Burberry’s H1 results were generally good. The FTSE 100 firm managed to beat analysts’ consensus and grew its top and bottom lines, despite lagging Chinese sales. And although overall comparable store sales only saw a 5% increase, revenue and margins saw double-digit increases thanks to a weaker pound that gave a £31m boost to the firm’s operating profit.

| Metrics | H1 2023 | H1 2022 | Change |

|---|---|---|---|

| Revenue | £1.35bn | £1.21bn | 11% |

| Adjusted operating income | £238m | £196m | 21% |

| Profit before tax (PBT) | £251m | £191m | 31% |

| Adjusted diluted earnings per share (EPS) | 44.3p | 33.5p | 32% |

| Free cash flow | £88m | £104m | -15% |

| Dividend per share | 16.5p | 11.6p | 42% |

Asia and America sales saw a drop of 4% and 3% respectively in H1. Nonetheless, other regions more than compensated for this with EMEIA seeing growth of 34%. Luxury brands globally have been able to pass on higher costs to their affluent customers who are less likely to be struggling in the cost-of-living crisis. Perhaps the Veblen effect — an abnormal consumer behaviour caused by the belief that higher prices mean higher quality or value — is a factor too.

Bagging higher numbers

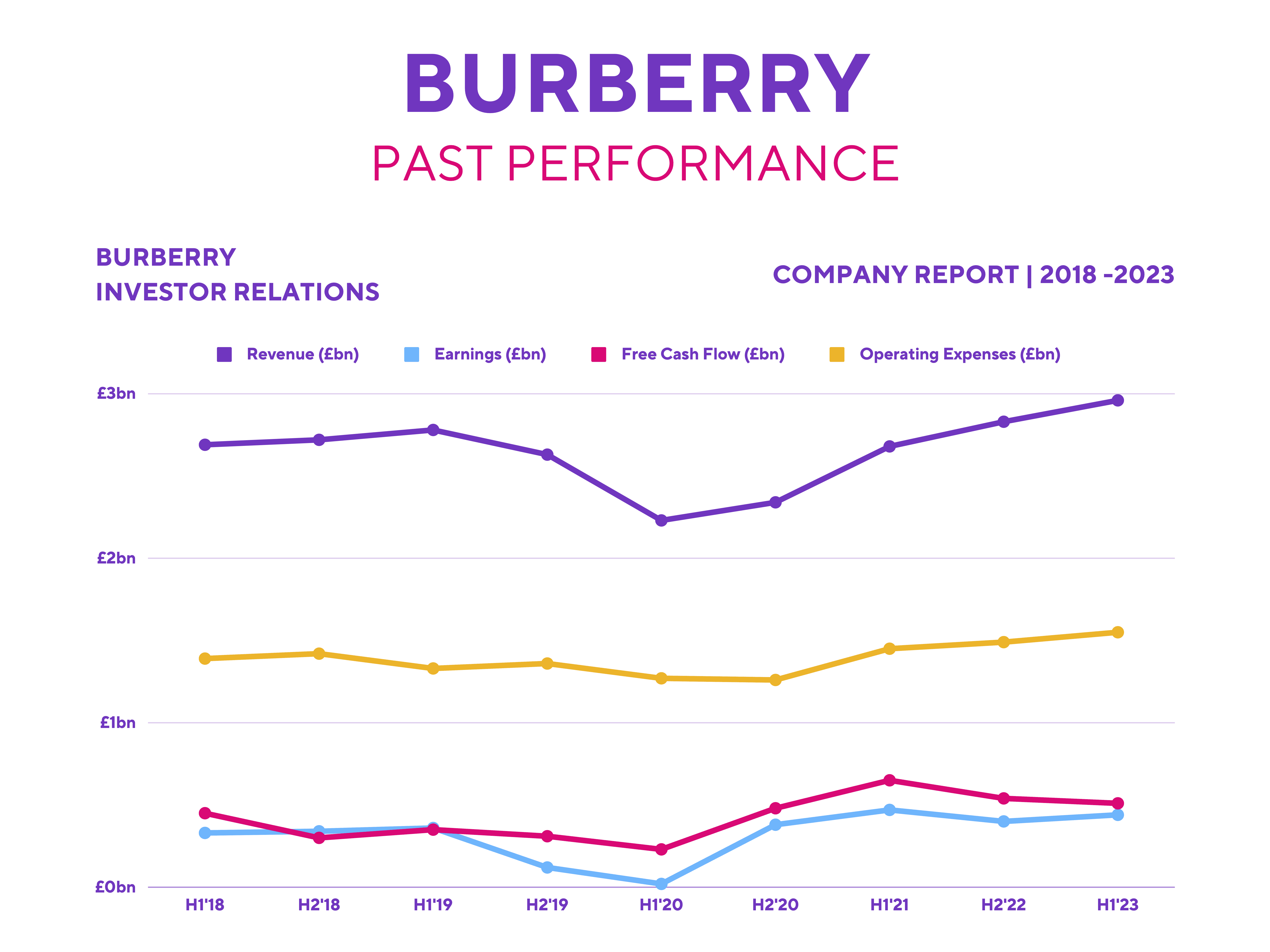

Investors were generally happy with the numbers produced and the share price rallied by 5%, building on an 8% gain over the last month. But what impressed me most was Burberry’s ambitions. It plans to grow its annual revenue from £2.8bn to £4bn next year, and £5bn thereafter.

CEO Jonathan Akeroyd also established a new medium-term target to grow profit margins and match its luxury peers at around 18%, with Burberry currently yielding 15%. These targets are heavily dependent on a number of factors playing out in the group’s favour:

- Chinese sales rebounding.

- Incoming CCO Daniel Lee successfully revitalising Burberry’s accessories to compete with upscale rivals.

- E-commerce expansion.

Should I invest?

Luxury brands tend to hold up well during recessionary periods due to the type of customers they cater to, and the British brand has been no exception. As such, investing in luxury stocks can be an excellent inflation hedge and defensive play at such times.

This defensive strategy feels even more secure when considering the health of Burberry’s balance sheet, and its decent dividend yield of 2.2%. The company has a healthy debt-to-equity ratio of 24.2%. With around £1bn worth of cash and equivalents, it can cover its debt (£374m) and dividends comfortably.

With that in mind, has the Burberry share price hit a ceiling then? Well, given that the stock currently trades at a price-to-earnings growth (PEG) ratio of 0.6, there’s definitely a case that it could be undervalued. However, brokers from RBC, Barclays, and Deutsche remain cautious. RBC cited a lack of confidence due to the “absence of meaningful gross margin support”, while Third Bridge analyst Alex Smith stated that Burberry “is more [negatively] exposed than other luxury brands”. So, analysts may have raised their target prices to an average of £21.06, but they still reiterated their ‘hold’ ratings.

Therefore, having bought shares at £18, I’ve since exited my position as Burberry shares have hit my price target. With the stock market rebounding, I reckon that there are other stocks that are able to generate a higher return for my portfolio.