Marks and Spencer (LSE:MKS) stock has seen a recovery of 30% over the past month. Its latest results indicate a tough road ahead, but its shares may be good value with a price-to-earnings (P/E) ratio of 8. So are Marks and Spencer shares a good buy for my portfolio?

Marked up costs

For its first half, M&S didn’t do as badly as anticipated. Revenue and overall sales volumes saw healthy increases. And while its bottom line dropped rather substantially, this can be attributed to a number of factors.

| Metrics | H1 2023 | H1 2022 | Change |

|---|---|---|---|

| Statutory revenue | £5.56bn | £5.11bn | 9% |

| Profit before tax | £209m | £187m | 11% |

| Adjusted basic earnings per share (EPS) | 7.8p | 12.1p | -34% |

The company didn’t get similar tax relief to last year as a result of the pandemic winding down. And higher energy and labour costs ate into its margins. Additionally, M&S acquired its logistics provider, Gist, and capital expenditure rose 46%.

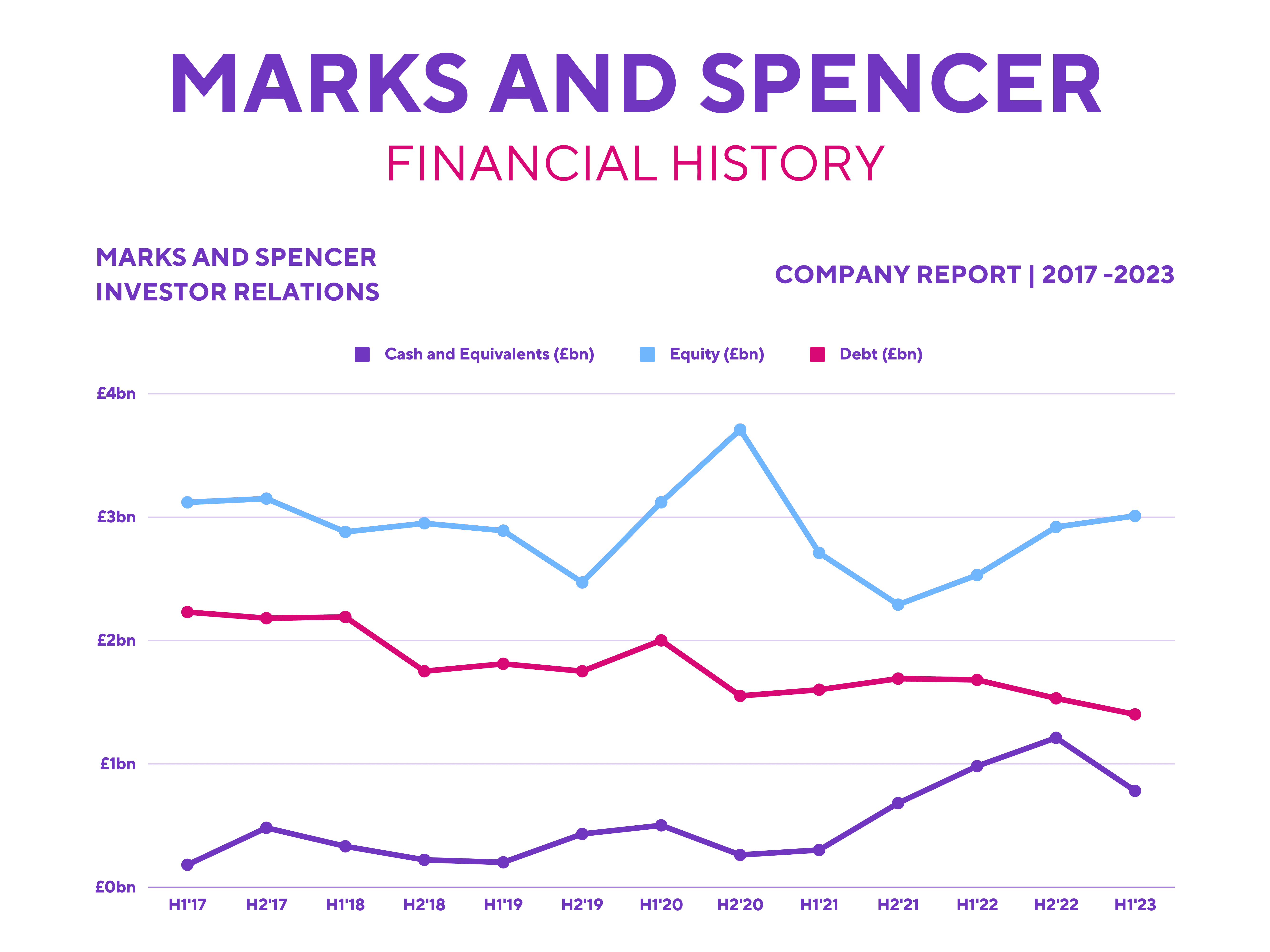

Its balance sheet continues to improve despite the tumultuous macroeconomic environment. While debt levels remain high at £1.4bn, it’s worth noting that the company has £1.63bn worth of liquidity, consisting of £783m in cash and equivalents, and an £850m revolving credit facility.

Making a mark

M&S is renowned for its slightly more expensive food offerings. As such, analysts and investors alike were expecting sales to plummet during the current cost-of-living crisis. However, the retailer bucked the trend and surprised them. This could be attributed to the combination of a belief in M&S’s strong value credentials, despite its prices, and the Veblen effect. That’s essentially abnormal consumer behaviour caused by the belief that higher prices mean higher quality or value.

For that reason, I was delighted to see the numbers Marks and Spencer shared. Both Food and Clothing & Home (C&H) sales volumes saw increases. And growth in like-for-like (LFL) sales outperformed the overall industry and many of its supermarket peers over the last six months.

| Metrics | LFL food sales growth |

|---|---|

| Marks and Spencer | 6.8% |

| Tesco | 3.2% |

| Sainsbury’s | -0.8% |

Aside from that, the firm also saw footfall to its stores rising along with transaction frequencies. As a result, the FTSE 250 firm’s C&H segment gained 50bps of market share on the back of strong volume growth. And with a number of exciting new clothing lines, valuable food items, and more affordable gifts launching, the jump in the share price is understandable.

| Metrics | H1 2023 | H1 2022 | Change |

|---|---|---|---|

| UK footfall per week | 14.6m | 13.2m | 11% |

| UK transactions per week | 10.5m | 9m | 17% |

Sparkly Christmas

Many retailers have been warning of a slow Christmas this year, but M&S reported the opposite. In fact, co-CEO Katie Bickerstaffe cited its customers spending more this year due to their more affluent backgrounds.

Management still warned investors of a stormy FY24, as high inflation is expected to continue biting into the firm’s bottom line and to impact consumer spending. Yet I believe inflation may have peaked, based on energy prices levelling off and commodity prices tumbling. Therefore, I think M&S’s bottom line could get a boost in FY24 instead, which should be further helped by the Gist acquisition and the £150m in cost savings the board has planned.

Are Marks and Spencer shares a buy for me then? Well, Barclays recently reiterated its ‘overweight’ rating for the stock with an average price target of £1.55, a 24% upside from current levels. So, despite having bought a substantial number of shares at £1, and already being up 20%, I’m still planning to buy more shares and definitely not selling. This is due to M&S’s robust performance and what I see as a bright long-term future.